GameStop 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

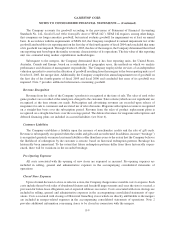

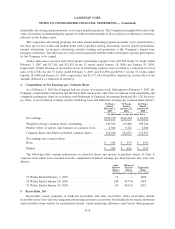

Merger-related costs include professional fees, financing costs and other costs associated with the mergers and

include certain costs associated with integrating the operations of Historical GameStop and EB, including

relocation costs. The Company completed all integration activities in fiscal 2006. Rebranding of EB stores to

the GameStop name is expected to be completed in the next 12 to 18 months.

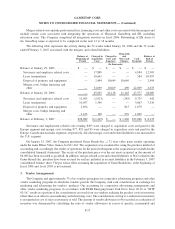

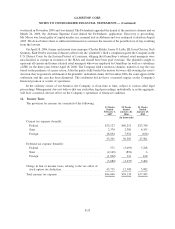

The following table represents the activity during the 52 weeks ended January 28, 2006 and the 53 weeks

ended February 3, 2007 associated with the mergers and related liabilities:

Balance at

Beginning of

Period

Charged to

Acquisition

Costs

Charged to

Costs and

Expenses

Write-Offs

and

Non-Cash

Charges

Cash

Payments

Balance at

End of

Period

(In thousands)

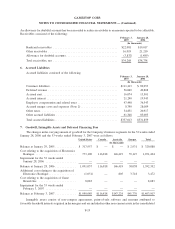

Balance at January 29, 2005 ............ $ — $ — $ — $ — $ — $ —

Severance and employee related costs . . . — 17,889 — — 4,984 12,905

Lease terminations ................. — 10,641 — — 584 10,057

Disposal of property and equipment . . . . — 2,494 10,649 10,649 — 2,494

Merger costs, bridge financing and

other .......................... — 34,669 10,469 496 42,009 2,633

Balance at January 28, 2006 ............ — 65,693 21,118 11,145 47,577 28,089

Severance and employee related costs . . . 12,905 (2,913) — (385) 9,735 642

Lease terminations ................. 10,057 1,346 — — 3,867 7,536

Disposal of property and equipment . . . . 2,494 — — 815 1,679 —

Merger costs, bridge financing and

other .......................... 2,633 148 — 976 1,805 —

Balance at February 3, 2007 ............ $28,089 $ (1,419) $ — $ 1,406 $17,086 $ 8,178

Severance and employment related costs totaling $493 were charged to acquisition costs and paid for the

Europe segment and merger costs totaling $77, $52 and $3 were charged to acquisition costs and paid for the

Europe, Canada and Australia segments, respectively. All other merger costs and related liabilities were incurred for

the U.S. segment.

On January 13, 2007, the Company purchased Game Brands Inc., a 72 store video game retailer operating

under the name Rhino Video Games, for $11,344. The acquisition was accounted for using the purchase method of

accounting and, accordingly, the results of operations for the period subsequent to the acquisition are included in the

consolidated financial statements. The excess of the purchase price over the net assets acquired, in the amount of

$8,083 has been recorded as goodwill. In addition, merger-related costs and related liabilities of $612 related to the

Game Brands Inc. purchase have been accrued for and are included in accrued liabilities in the February 3, 2007

consolidated balance sheet. The pro forma effect assuming the acquisition of Game Brands Inc. at the beginning of

fiscal 2006 and fiscal 2005 is not material.

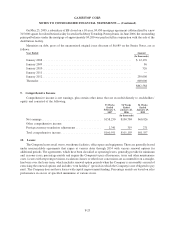

3. Vendor Arrangements

The Company and approximately 75 of its vendors participate in cooperative advertising programs and other

vendor marketing programs in which the vendors provide the Company with cash consideration in exchange for

marketing and advertising the vendors’ products. Our accounting for cooperative advertising arrangements and

other vendor marketing programs, in accordance with FASB Emerging Issues Task Force Issue 02-16 or “EITF

02-16,” results in a portion of the consideration received from our vendors reducing the product costs in inventory

rather than as an offset to our marketing and advertising costs. The consideration serving as a reduction in inventory

is recognized in cost of sales as inventory is sold. The amount of vendor allowances to be recorded as a reduction of

inventory was determined by calculating the ratio of vendor allowances in excess of specific, incremental and

F-17

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)