GameStop 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

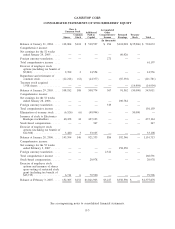

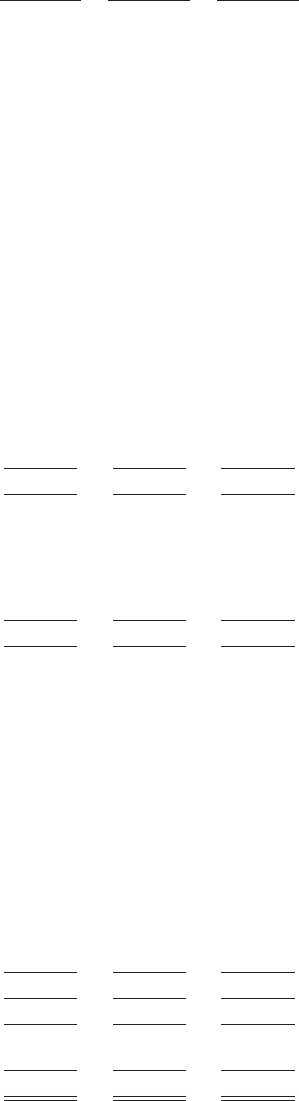

GAMESTOP CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

53 Weeks

Ended

February 3,

2007

52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

(In thousands)

Cash flows from operating activities:

Net earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 158,250 $ 100,784 $ 60,926

Adjustments to reconcile net earnings to net cash flows provided by operating

activities:

Depreciation and amortization (including amounts in cost of sales) . . . . . . 110,176 66,659 37,019

Provision for inventory reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50,779 25,103 17,808

Amortization and retirement of deferred financing fees . . . . . . . . . . . . . . . 4,595 1,229 432

Amortization and retirement of original issue discount on senior notes . . . . 1,523 316 —

Stock-based compensation expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,978 347 —

Deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,080) (3,675) 5,402

Loss on disposal and impairment of property and equipment . . . . . . . . . . . 4,261 11,648 382

Increase in deferred rent and other long-term liabilities . . . . . . . . . . . . . . . 9,702 3,669 5,349

Increase in liability to landlords for tenant allowances, net . . . . . . . . . . . . 1,602 202 1,644

Minority interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (96)

Decrease in value of foreign exchange contracts. . . . . . . . . . . . . . . . . . . . (4,450) (2,421) —

Changes in operating assets and liabilities, net of business acquired

Receivables, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,866 (9,995) (267)

Merchandise inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (118,417) (91,363) (10,578)

Prepaid expenses and other current assets . . . . . . . . . . . . . . . . . . . . . . (21,543) 19,484 (4,060)

Prepaid taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52,663 9,069 9,072

Excess tax benefit realized from exercise of stock options . . . . . . . . . . . (43,707) 12,308 5,082

Accounts payable and accrued liabilities . . . . . . . . . . . . . . . . . . . . . . . 197,306 148,054 17,872

Net cash flows provided by operating activities . . . . . . . . . . . . . . . . . . 423,504 291,418 145,987

Cash flows from investing activities:

Purchase of property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (133,930) (110,696) (98,305)

Merger with Electronics Boutique, net of cash acquired . . . . . . . . . . . . . . . . — (886,116) —

Acquisitions, net of cash acquired (including purchase of Game Brands

Inc.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11,303) — (62)

Sale of assets held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,297 — —

Net cash flows used in investing activities . . . . . . . . . . . . . . . . . . . . . . . . . (125,936) (996,812) (98,367)

Cash flows from financing activities:

Issuance of senior notes payable relating to Electronics Boutique merger, net

of discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 641,472 —

Issuance of senior floating rate notes payable relating to Electronics Boutique

merger . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 300,000 —

Repurchase of notes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (100,000) — —

Purchase of treasury shares through repurchase program. . . . . . . . . . . . . . . . — — (14,994)

Repurchase of common stock from Barnes & Noble . . . . . . . . . . . . . . . . . . — — (111,781)

Issuance of debt relating to the repurchase of common stock from Barnes &

Noble . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 74,020

Repayment of debt relating to the repurchase of common stock from

Barnes & Noble . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (12,173) (12,173) (37,500)

Repayment of other debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,441) (956) —

Proceeds from exercise of stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . 33,861 20,800 9,474

Excess tax benefit realized from exercise of stock options . . . . . . . . . . . . . . 43,707 — —

Net increase in other noncurrent assets and deferred financing fees . . . . . . . . (2,609) (13,466) (825)

Net cash flows provided by (used in) financing activities . . . . . . . . . . . . . . . (46,655) 935,677 (81,606)

Exchange rate effect on cash and cash equivalents . . . . . . . . . . . . . . . . . . . . (103) 318 73

Net increase (decrease) in cash and cash equivalents . . . . . . . . . . . . . . . . . . 250,810 230,601 (33,913)

Cash and cash equivalents at beginning of period . . . . . . . . . . . . . . . . . . . . . . 401,593 170,992 204,905

Cash and cash equivalents at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . $ 652,403 $ 401,593 $ 170,992

See accompanying notes to consolidated financial statements.

F-6