GameStop 2006 Annual Report Download - page 89

Download and view the complete annual report

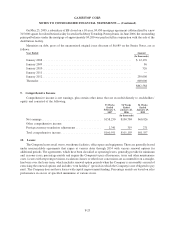

Please find page 89 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The availability under the Revolver is limited to a borrowing base which allows the Company to borrow up to

the lesser of (x) approximately 70% of eligible inventory and (y) 90% of the appraisal value of the inventory, in each

case plus 85% of eligible credit card receivables, net of certain reserves. Letters of credit reduce the amount

available to borrow by their face value. The Company’s ability to pay cash dividends, redeem options, and

repurchase shares is generally prohibited, except that if availability under the Revolver is or will be after any such

payment equal to or greater than 25% of the borrowing base the Company may repurchase its capital stock and pay

cash dividends. In addition, in the event that credit extensions under the Revolver at any time exceed 80% of the

lesser of the total commitment or the borrowing base, the Company will be subject to a fixed charge coverage ratio

covenant of 1.5:1.0.

The interest rate on the Revolver is variable and, at the Company’s option, is calculated by applying a margin

of (1) 0.0% to 0.25% above the higher of the prime rate of the administrative agent or the federal funds effective rate

plus 0.50% or (2) 1.25% to 1.75% above the LIBO rate. The applicable margin is determined quarterly as a function

of the Company’s consolidated leverage ratio. As of February 3, 2007 the applicable margin was 0.0% for prime rate

loans and 1.50% for LIBO rate loans. In addition, the Company is required to pay a commitment fee, currently

0.375% as of February 3, 2007, for any unused portion of the total commitment under the Revolver.

As of February 3, 2007, there were no borrowings outstanding under the Revolver and letters of credit

outstanding totaled $4,251.

On September 28, 2005, the Company, along with GameStop, Inc. (which was then a direct wholly-owned

subsidiary of Historical GameStop and is now, as a result of the mergers, an indirect wholly-owned subsidiary of the

Company) as co-issuer (together with the Company, the “Issuers”), completed the offering of U.S. $300,000

aggregate principal amount of Senior Floating Rate Notes due 2011 (the “Senior Floating Rate Notes”) and

U.S. $650,000 aggregate principal amount of Senior Notes due 2012 (the “Senior Notes” and, together with the

Senior Floating Rate Notes, the “Notes”). The Notes were issued under an indenture (the “Indenture”), dated

September 28, 2005, by and among the Issuers, the subsidiary guarantors party thereto, and Citibank, N.A., as

trustee (the “Trustee”). Concurrently with the consummation of the merger on October 8, 2005, EB and its direct

and indirect domestic wholly-owned subsidiaries (together, the “EB Guarantors”) became subsidiaries of the

Company and entered into a first supplemental indenture, dated October 8, 2005, by and among the Issuers, the EB

Guarantors and the Trustee, pursuant to which the EB Guarantors assumed all the obligations of a subsidiary

guarantor under the Notes and the Indenture. The net proceeds of the offering were used to pay the cash portion of

the merger consideration paid to the stockholders of EB in connection with the mergers.

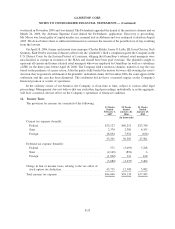

The Senior Floating Rate Notes bear interest at LIBOR plus 3.875%, mature on October 1, 2011 and were

priced at 100%. The rate of interest on the Senior Floating Rate Notes as of February 3, 2007 was 9.235% per

annum. The Senior Notes bear interest at 8.0% per annum, mature on October 1, 2012 and were priced at 98.688%,

resulting in a discount at the time of issue of $8,528. The discount is being amortized using the effective interest

method. As of February 3, 2007, the unamortized original issue discount was $6,689.

The Issuers pay interest on the Senior Floating Rate Notes quarterly, in arrears, every January 1, April 1, July 1

and October 1, to holders of record on the immediately preceding December 15, March 15, June 15 and

September 15, and at maturity. The Issuers pay interest on the Senior Notes semi-annually, in arrears, every

April 1 and October 1, to holders of record on the immediately preceding March 15 and September 15, and at

maturity.

The Indenture contains affirmative and negative covenants customary for such financings, including, among

other things, limitations on (1) the incurrence of additional debt, (2) restricted payments, (3) liens, (4) sale and

leaseback transactions and (5) asset sales. Events of default provided for in the Indenture include, among other

things, failure to pay interest or principal on the Notes, other breaches of covenants in the Indenture, and certain

events of bankruptcy and insolvency.

As of February 3, 2007, the Company was in compliance with all covenants associated with the Revolver and

the Indenture.

F-21

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)