GameStop 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the

reporting period. In preparing these financial statements, management has made its best estimates and judgments of

certain amounts included in the financial statements, giving due consideration to materiality. Changes in the

estimates and assumptions used by management could have significant impact on the Company’s financial results.

Actual results could differ from those estimates.

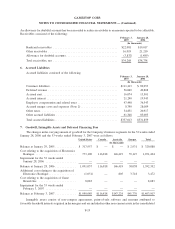

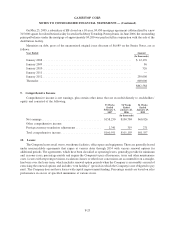

Fair Values of Financial Instruments

The carrying values of cash and cash equivalents, accounts receivable, accounts payable and the note payable

to Barnes & Noble reported in the accompanying consolidated balance sheets approximate fair value due to the

short-term maturities of these assets and liabilities. The fair values of the Company’s senior notes payable and

senior floating rate notes payable in the accompanying consolidated balance sheets are estimated based on recent

quotes from brokers. As of February 3, 2007, the senior notes payable and senior floating rate notes payable had a

carrying value of $593.3 million and $250.0 million, respectively, and a fair value of $640.5 million and

$260.6 million, respectively. As of January 28, 2006, the carrying values of the senior notes payable and the

senior floating rate notes payable approximated the fair values due to the recent issuance of these notes in

connection with the mergers. Foreign Currency Contracts are recorded at fair market value.

Guarantees

The Company remains contingently liable for the BC Sports Collectibles store leases assigned to Sports

Collectibles Acquisition Corporation (“SCAC”). SCAC is owned by the family of James J. Kim, Chairman of EB at

the time and currently one of the Company’s directors. If SCAC were to default on these lease obligations, the

Company would be liable to the landlords for up to $133 in minimum rent and landlord charges as of February 3,

2007. Mr. Kim has entered into an indemnification agreement with EB with respect to these leases, therefore no

accrual was recorded for this contingent obligation.

The Company had bank guarantees relating to international store leases totaling $4,142 as of February 3, 2007.

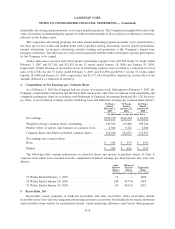

Vendor Concentration

The Company’s largest vendors worldwide are Microsoft Corp., Sony Computer Entertainment of America,

Nintendo of America, Inc. and Electronic Arts, Inc., which accounted for 14%, 13%, 11% and 10%, respectively, of

the Company’s new product purchases in fiscal 2006. In fiscal 2005, the Company’s largest vendors, as measured in

the U.S. only due to the timing of the mergers, were Sony, Microsoft and Electronic Arts, which accounted for 18%,

13% and 11%, respectively, of the Company’s new product purchases. In fiscal 2004, Company’s largest

U.S. vendors were Electronic Arts, Nintendo and Microsoft, which accounted for 14%, 13% and 12%, respectively,

of the Company’s new product purchases.

Classifications

The Company includes purchasing, receiving and distribution costs in selling, general and administrative

expenses, rather than cost of goods sold, in the statement of operations. For the 53 weeks ended February 3, 2007

and the 52 weeks ended January 28, 2006 and January 29, 2005, these purchasing, receiving and distribution costs

amounted to $22,284, $20,583 and $9,203, respectively.

The Company includes processing fees associated with purchases made by check and credit cards in cost of

sales, rather than selling, general and administrative expenses, in the statement of operations. For the 53 weeks

ended February 3, 2007 and the 52 weeks ended January 28, 2006 and January 29, 2005, these processing fees

amounted to $40,877, $20,905 and $12,014, respectively.

F-13

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)