GameStop 2006 Annual Report Download - page 50

Download and view the complete annual report

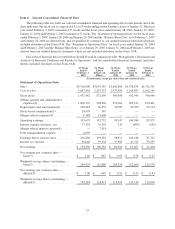

Please find page 50 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gross profit increased by $599.4 million, or 68.7%, from $872.0 million in fiscal 2005 to $1,471.4 million in

fiscal 2006. Gross profit as a percentage of sales decreased from 28.2% in fiscal 2005 to 27.7% in fiscal 2006. This

decrease was primarily due to the increase in hardware sales as a percentage of total sales. New hardware sales carry

a lower overall gross profit compared to other sales categories. The increase in hardware sales was driven by new

product launches in fiscal 2006. The gross profit on new hardware increased from 6.1% of sales in fiscal 2005 to

7.2% in fiscal 2006 due to an emphasis on selling product replacement plans along with hardware platforms. Gross

profit as a percentage of sales on new software remained comparable at 21.4% in fiscal 2005 and 21.2% in fiscal

2006. Gross profit as a percentage of sales on other products decreased from 35.8% in fiscal 2005 to 34.4% in fiscal

2006 due to a shift in sales to lower margin products within the other product categories. Gross profit as a percentage

of sales on used video game products increased from 47.4% in fiscal 2005 to 49.5% in fiscal 2006 due to increased

efforts to monitor margin rates and the application of GameStop’s merchandising algorithms to EB’s used video

game category for all of fiscal 2006 compared to only the period following the mergers in fiscal 2005.

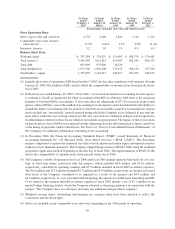

Selling, general and administrative expenses increased by $401.1 million, or 67.0%, from $599.0 million in

fiscal 2005 to $1,000.1 million in fiscal 2006. The increase was primarily attributable to the mergers, the increase in

the number of stores in operation, and the related increases in store, distribution and corporate office operating

expenses as well as expenses from the 53rd week included in fiscal 2006. Selling, general and administrative

expenses as a percentage of sales decreased from 19.4% in fiscal 2005 to 18.8% in fiscal 2006. The decrease in

selling, general and administrative expenses as a percentage of sales was primarily due to synergies obtained from

the mergers, including the shut-down of EB’s corporate headquarters and distribution center. Foreign currency

transaction gains and (losses) are included in selling, general and administrative expenses and amounted to

($1.0) million in fiscal 2006, compared to $2.6 million in fiscal 2005.

Depreciation and amortization expense increased from $66.4 million in fiscal 2005 to $109.9 million in fiscal

2006. This increase of $43.5 million was due primarily to the mergers, with the remaining increase due to capital

expenditures for 421 new GameStop stores and the Company’s new corporate headquarters and distribution facility.

Depreciation and amortization expense will increase from fiscal 2006 to fiscal 2007 due to continued capital

expenditures for new stores and management information systems.

Beginning January 29, 2006, the Company adopted the provisions of SFAS 123(R) using the modified

prospective application method. Under this method, the Company records stock-based compensation expense based

on the estimated grant-date fair value previously presented in the pro forma footnote disclosures for all options

granted prior to, but not vested as of, the adoption date. In addition, the Company records compensation expense for

the share-based awards granted after the adoption date in accordance with SFAS 123(R). As a result of the adoption,

the Company recognized $21.0 million in stock-based compensation expense for fiscal 2006. In accordance with

SFAS 123(R), prior periods have not been restated.

The Company’s results of operations for fiscal 2006 and fiscal 2005 include expenses believed to be of a one-

time or short-term nature associated with the mergers, which included $6.8 million and $13.6 million, respectively,

considered in operating earnings and $7.5 million included in fiscal 2005 in interest expenses. The $6.8 million and

$13.6 million included $1.9 million and $9.0 million, respectively, in charges associated with assets of the Company

considered to be impaired as a result of the mergers and $4.9 million and $4.6 million, respectively, in costs

associated with integrating the operations of Historical GameStop and EB. Costs related to the mergers included in

interest expense in fiscal 2005 include a fee of $7.1 million for an unused bridge financing facility which the

Company obtained as financing insurance in connection with the mergers. The Company does not anticipate

incurring any additional merger-related expenses.

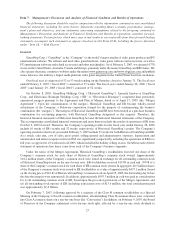

Interest income resulting from the investment of excess cash balances increased from $5.1 million in fiscal

2005 to $11.3 million in fiscal 2006 due to interest earned on invested assets. Interest expense increased from

$30.4 million in fiscal 2005 to $84.7 million in fiscal 2006 primarily due to the first full year of interest incurred on

the senior notes payable and the senior floating rate notes payable and the interest incurred on the note payable to

Barnes & Noble in connection with the repurchase of Historical GameStop’s Class B common stock in fiscal 2004.

Debt extinguishment expense of $6.1 million was incurred in fiscal 2006 for the loss associated with the Company’s

repurchase of $50.0 million of its senior notes payable and $50.0 million of its senior floating rate notes payable.

35