GameStop 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

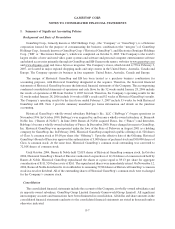

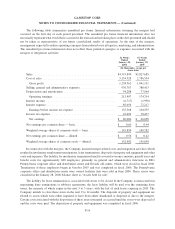

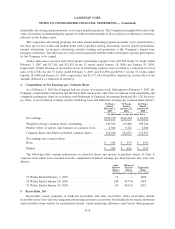

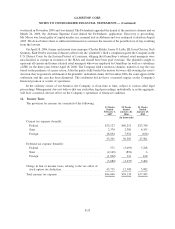

The following table summarizes unaudited pro forma financial information assuming the mergers had

occurred on the first day of each period presented. The unaudited pro forma financial information does not

necessarily represent what would have occurred if the transaction had taken place on the date presented and should

not be taken as representative of our future consolidated results of operations. At the time of the mergers,

management expected to realize operating synergies from reduced costs in logistics, marketing, and administration.

The unaudited pro forma information does not reflect these potential synergies or expenses associated with the

mergers or integration activities:

52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

(In thousands, except per

share data)

Sales ................................................... $4,393,890 $3,827,685

Cost of sales ............................................. 3,154,928 2,786,554

Gross profit ............................................ 1,238,962 1,041,131

Selling, general and administrative expenses ...................... 930,767 788,413

Depreciation and amortization ................................ 94,288 77,964

Operating earnings ....................................... 213,907 174,754

Interest income ........................................... (6,717) (1,998)

Interest expense ........................................... 85,056 72,217

Earnings before income tax expense .......................... 135,568 104,535

Income tax expense ........................................ 49,482 38,477

Net earnings ........................................... $ 86,086 $ 66,058

Net earnings per common share — basic......................... $ 0.60 $ 0.44

Weighted average shares of common stock — basic ................ 143,850 149,782

Net earnings per common share — diluted ....................... $ 0.56 $ 0.42

Weighted average shares of common stock — diluted ............... 152,982 156,050

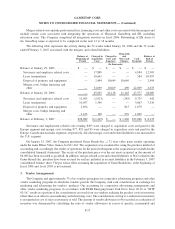

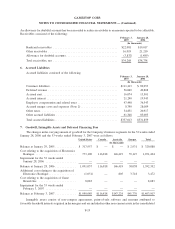

In connection with the mergers, the Company incurred merger-related costs and integration activities which

resulted in involuntary employment terminations, lease terminations, disposals of property and equipment and other

costs and expenses. The liability for involuntary termination benefits covered severance amounts, payroll taxes and

benefit costs for approximately 680 employees, primarily in general and administrative functions in EB’s

Pennsylvania corporate office and distribution center and Nevada call center, which were closed in fiscal 2006.

Termination of these employees began in October 2005 and was completed in fiscal 2006. The Pennsylvania

corporate office and distribution center were owned facilities that were sold in June 2006. These assets were

classified in the January 28, 2006 balance sheet as “Assets held for sale.”

The liability for lease terminations is associated with stores to be closed. If the Company is unsuccessful in

negotiating lease terminations or sublease agreements, the lease liability will be paid over the remaining lease

terms, the majority of which expire in the next 3 to 5 years, with the last of such leases expiring in 2015. The

Company intends to close these stores in the next 9 to 12 months. The disposals of property and equipment are

related to assets which were either impaired or have been either abandoned or disposed of due to the mergers.

Certain costs associated with the disposition of these assets remained as accrued until the assets were disposed of

and the costs were paid. The disposition of property and equipment was completed in fiscal 2006.

F-16

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)