GameStop 2006 Annual Report Download - page 79

Download and view the complete annual report

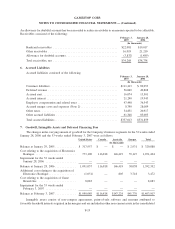

Please find page 79 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.generally did not enter into derivative instruments with respect to foreign currency risks, Electronics Boutique

routinely used forward exchange contracts and cross-currency swaps to manage currency risk and had a number of

open positions designated as hedge transactions as of the merger date. The Company discontinued hedge

accounting treatment for all derivative instruments acquired in connection with the mergers.

The Company follows the provisions of Statement of Financial Accounting Standards No. 133, Accounting for

Derivative Instruments and Hedging Activities (“SFAS 133”), as amended by Statement of Financial Accounting

Standards No. 138, Accounting for Certain Derivative Instruments and Certain Hedging Activities (“SFAS 138”).

SFAS 133 requires that all derivative instruments be recorded on the balance sheet at fair value. Changes in the fair

value of derivatives are recorded each period in current earnings or other comprehensive income, depending on

whether the derivative is designated as part of a hedge transaction, and if it is, depending on the type of hedge

transaction.

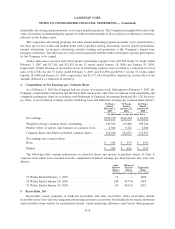

The Company uses forward exchange contracts, foreign currency options and cross-currency swaps, (together,

the “Foreign Currency Contracts”) to manage currency risk primarily related to intercompany loans denominated in

non-functional currencies and certain foreign currency assets and liabilities. These Foreign Currency Contracts are

not designated as hedges and, therefore, changes in the fair values of these derivatives are recognized in earnings,

thereby offsetting the current earnings effect of the re-measurement of related intercompany loans and foreign

currency assets and liabilities. The aggregate fair value of these Foreign Currency Contracts at February 3, 2007 was

a liability of $1,892, of which $2,540 is included in accrued liabilities, and $390 is included in other long-term

liabilities, with an offsetting amount of $1,038 included in other non-current assets in the accompanying

consolidated balance sheet. The aggregate fair value of these Foreign Currency Contracts at January 28, 2006

was a liability of $7,083, of which $6,513 is included in accrued liabilities and the remainder is included in other

long-term liabilities in the accompanying consolidated balance sheet. The Company had no forward exchange

contracts and currency swaps prior to October 8, 2005.

Net Earnings Per Common Share

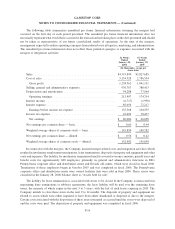

Net earnings per common share is presented in accordance with Statement of Financial Accounting Standards

No. 128, Earnings Per Share (“SFAS 128”). Basic earnings per common share is computed by dividing the net

income available to common stockholders by the weighted average number of common shares outstanding during

the period. Diluted earnings per common share is computed by dividing the net income available to common

stockholders by the weighted average number of common shares outstanding and potentially dilutive securities

outstanding during the period. Potentially dilutive securities include stock options and unvested restricted stock

outstanding during the period, using the treasury stock method. Potentially dilutive securities are excluded from the

computations of diluted earnings per share if their effect would be antidilutive. Note 4 provides additional

information regarding net earnings per common share.

Stock Options

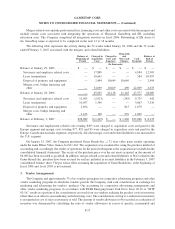

In December 2004, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standards No. 123 (Revised 2004), Share-Based Payment, (“SFAS 123(R)”). This Statement requires

companies to expense the estimated fair value of stock options and similar equity instruments issued to employees

in their financial statements. Previously, companies were required to calculate the estimated fair value of these

share-based payments and could elect to either include the estimated cost in earnings or disclose the pro forma effect

in the footnotes to their financial statements. We chose to disclose the pro forma effect for all periods through

January 28, 2006.

In March 2005, the SEC issued Staff Accounting Bulletin No. 107 (“SAB No. 107”) regarding the Staff’s

interpretation of SFAS 123(R). This interpretation provides the Staff’s views regarding interactions between

SFAS 123(R) and certain SEC rules and regulations and provides interpretations of the valuation of share-based

payments for public companies. Following the guidance prescribed in SAB No. 107, on January 29, 2006, the

F-11

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)