GameStop 2006 Annual Report Download - page 52

Download and view the complete annual report

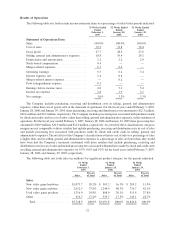

Please find page 52 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.percentage of sales decreased from 20.2% in fiscal 2004 to 19.4% in fiscal 2005. The decrease in selling, general

and administrative expenses as a percentage of sales was primarily due to combining the full year results of

Historical GameStop’s operations with the 16 weeks of EB’s operations, including the fourth quarter of the fiscal

year. The fourth quarter of the fiscal year typically experiences high leveraging of selling, general and admin-

istrative expenses due to the holiday selling season. Foreign currency transaction gains and (losses) are included in

selling, general and administrative expenses and amounted to $2.6 million in fiscal 2005, compared to an

immaterial amount of loss in fiscal 2004.

Depreciation and amortization expense increased from $36.8 million in fiscal 2004 to $66.4 million in fiscal

2005. This increase of $29.6 million was due primarily to depreciation of EB’s assets of $22.4 million after the

mergers, with the remaining increase due to capital expenditures for 296 new GameStop stores and management

information systems and the commencement in the third quarter of fiscal 2005 of full operations in the Company’s

new distribution facility.

The Company’s results of operations for fiscal 2005 include expenses believed to be of a one-time or short-

term nature associated with the mergers, which included $13.6 million included in operating earnings and

$7.5 million included in interest expenses. The $13.6 million included $9.0 million in one-time charges associated

with assets of the Company considered to be impaired because they were redundant as a result of the mergers. The

$7.5 million of merger-related interest expense resulted primarily from a commitment fee of $7.1 million for bridge

financing as a contingency in the event that we were unable to issue the senior notes and senior floating rate notes

prior to the consummation of the mergers.

Interest income resulting from the investment of excess cash balances increased from $1.9 million in fiscal

2004 to $5.1 million in fiscal 2005 due to an increase in the average yield on the investments, interest of $0.8 million

earned on the investment of the $941.5 million in proceeds of the offering of the senior notes and the senior floating

rate notes from the issuance date on September 28, 2005 until the date of the mergers on October 8, 2005 and

interest income earned by EB after the mergers on its invested assets. Interest expense increased from $2.2 million

in fiscal 2004 to $30.4 million in fiscal 2005 primarily due to the interest incurred on the $650 million senior notes

payable and the $300 million senior floating rate notes payable and the interest incurred on the note payable to

Barnes & Noble in connection with the repurchase of Historical GameStop’s Class B common stock in fiscal 2004.

Income tax expense increased by $21.1 million, from $38.0 million in fiscal 2004 to $59.1 million in fiscal

2005. The Company’s effective tax rate decreased from 38.4% in fiscal 2004 to 37.0% in fiscal 2005 due to expenses

related to the mergers and corporate restructuring. See Note 12 of “Notes to Consolidated Financial Statements” of

the Company for additional information regarding income taxes.

The factors described above led to an increase in operating earnings of $93.6 million, from $99.1 million in

fiscal 2004 to $192.7 million in fiscal 2005 and an increase in net earnings of $39.9 million, or 65.5%, from

$60.9 million in fiscal 2004 to $100.8 million in fiscal 2005.

Liquidity and Capital Resources

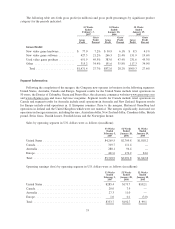

During fiscal 2006, cash provided by operations was $423.5 million, compared to cash provided by operations

of $291.4 million in fiscal 2005 and cash provided by operations of $146.0 million in fiscal 2004. The increase in

cash provided by operations of $132.1 million from fiscal 2005 to fiscal 2006 resulted from an increase in net

income of $57.5 million, primarily due to the addition of EB’s results of operations since the mergers and the

53rd week included in fiscal 2006; an increase in depreciation and amortization of $43.5 million due primarily to the

mergers; an increase in the growth in accounts payable and accrued liabilities, net of growth in merchandise

inventories and the provision for inventory reserves of $47.9 million caused by growth of the Company and efforts

to manage working capital; an increase in the cash provided by prepaid taxes of $43.6 million offset by the change in

the effect of the tax benefit realized from the exercise of stock options of $56.0 million; and an increase in the non-

cash adjustment for stock-based compensation expense due to the implementation of FAS 123(R) in fiscal 2006 of

$20.6 million, all of which were offset by a net decrease in prepaid expenses and other current assets of $41.0 million

due primarily to the store growth and the timing of rent payments at the end of the fiscal 2006.

37