GameStop 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

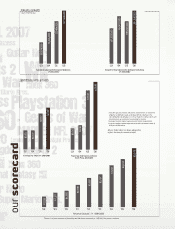

2006 was such a successful year for GameStop that we need

multiple headlines to communicate our performance: Sales

Exceeded $5 Billion and Grew by 72%, Net Earnings Increased by

57%, and Comparable Store Sales Growth Up 11.9%.

Sales rose on the strength of new video game software and next-

generation hardware consoles, and continued growth in the used

category. Net earnings for the year increased to $158.3 million,

including $4.3 million of merger-related expenses and $3.8

million of debt retirement costs. In addition, our diluted earnings

per share were $1.00, which includes $0.05 per share of merger-

related expenses and debt-retirement costs.

Last year we retired $122 million of debt, including $100 million

of notes related to the buyback initiative that we announced

in May of 2006. In February of 2007, the Board approved an

additional $150 million for note repurchases. To date, we have

repurchased and retired an additional $106 million in debt under

this program.

On February 7, 2007, the Class B shareholders approved the plan

to convert the Class B shares to Class A shares on a one-for-one

basis, while on February 9, 2007, the Board of Directors, in order

to make our stock more attractive to a wider range of investors,

authorized a two-for-one stock split in the form of a stock

dividend. GameStop’s stock price increased by 73% over the

course of the calendar year and closed at a split-adjusted price

of $27.55. Since year end with the combining of the A & B shares

and the stock split, the stock price has increased by just over

24% to $34.27 as of May 15, 2007.

In 2006 we opened 421 stores worldwide, with total capital

expenditures of $134 million, paid down $122 million in debt, and

still ended the year with a strong balance sheet and over $650

million in cash.

GameStop’s 2006 performance is a reection not only of the

success of our business model, but points to the increasing

importance of over 22,000 associates who know games, love

gaming, and every day serve our customers with a special

passion for the category.

A SUCCESSFUL MERGER

In October of 2005, we closed on a merger of the two leading

video game specialists in the industry: GameStop and EB Games.

In 2006, we successfully achieved the worldwide integration

of 2,351 EB stores with 2,026 GameStop stores. The signicant

synergies we envisioned were delivered on time and exceeded

our original forecasts. This massive undertaking is not only a

testament to the talent of our management team, but, through a

“Better Together” focus, resulted in best practices being applied

across all stores and in a stronger GameStop better able to serve

our customers.

THE GAMESTOP BUSINESS MODEL

What really makes GameStop unique is not only that we have

combined new and used product into a unied business model,

but that we have rened the concept to drive incremental new

sales, while also generating great value at lower price points on

used product.

The used business is a complex proposition. It is a “big thing” that

has been built by incorporating many “little things” through the

experience we have gained through over 10 years of rening the

model. We have built custom systems, created unique operating

metrics, trained our personnel to make the appropriate decisions

on used product and constructed a rst class refurbishing center

that recycles damaged product for resale. Being successful in

the used business means being even more successful in driving

new title sales, while at the same time giving our customers a

better deal.

THE CYCLE

There is no question in our mind that this group of emerging

consoles will create a completely new cycle: one that is deeper,

wider and longer than any before it.

From the power of emerging technology, where the Xbox 360

and the PS3 systems deliver “teraop” measured processing

power, to the impact of innovation with Nintendo’s Wii using

gyroscopic controllers, video gaming has entered an amazing

new cycle of expansive potential. Furthermore, we are

experiencing the benets of merging technologies: plug in the

360 or PS3 to a High Denition television and the gaming impact

is further energized; play DS Lite games with a friend through the

built in Wi-Fi connections, and a solo game becomes a shared

experience; hold a rock party with Guitar Hero, and instantly the

denition of a video game takes on a more expansive meaning.

Unique concepts, better graphics, better sound, better

connectivity – better everything is not too bold a statement for

the new generation of video game product.

Not only is the technology more powerful, it is more innovating

and engaging. The breakthrough Wii remote is putting “physical”

into game play, while making the experience less complex and

more fun. With new innovative game experiences hitting the

The breakthrough Wii remote is putting

“physical” into game play, while making the

experience less complex and more fun.