Frontier Communications 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

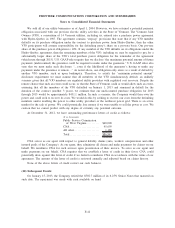

401(k) Savings Plans

We sponsor employee retirement savings plans under section 401(k) of the Internal Revenue Code. The

plans cover substantially all full-time employees. Under certain plans, we provide matching contributions.

Employer contributions were $23.0 million, $22.2 million and $14.9 million for 2012, 2011 and 2010,

respectively. The amounts for 2011 and 2010 include employer contributions of $15.9 million and $10.6

million, respectively, for certain former employees of the Acquired Business under three separate plans.

(18) Fair Value of Financial Instruments:

Fair value is defined under U.S. GAAP as the exit price associated with the sale of an asset or transfer of a

liability in an orderly transaction between market participants at the measurement date. Valuation techniques

used to measure fair value under U.S. GAAP must maximize the use of observable inputs and minimize the use

of unobservable inputs. In addition, U.S. GAAP establishes a three-tier fair value hierarchy, which prioritizes

the inputs used in measuring fair value.

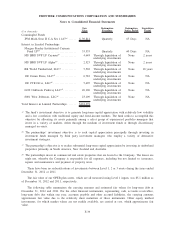

The three input levels in the hierarchy of fair value measurements are defined by the FASB generally as

follows:

Input

Level Description of Input

Level 1 Observable inputs such as quoted prices in active markets for identical assets.

Level 2 Inputs other than quoted prices in active markets that are either directly or indirectly observable.

Level 3 Unobservable inputs in which little or no market data exists.

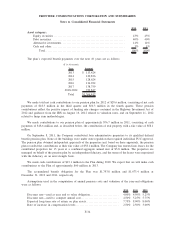

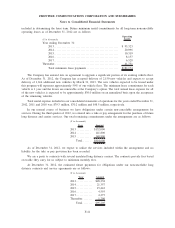

The following tables represent the Company’s pension plan assets measured at fair value on a recurring

basis as of December 31, 2012 and 2011:

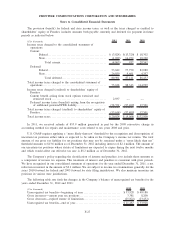

($ in thousands) Total Level 1 Level 2 Level 3

Fair Value Measurements at December 31, 2012

Cash and Cash Equivalents ...................... $ 42,391 $ — $ 42,391 $ —

U.S. Government Obligations .................... 14,166 — 14,166 —

Corporate and Other Obligations . . . .............. 246,024 — 246,024 —

Common Stock . ................................ 133,631 133,631 — —

Commingled Funds.............................. 345,532 — 305,718 39,814

Interest in Registered Investment Companies ..... 366,336 99,161 267,175 —

Interest in Limited Partnerships .................. 101,678 — — 101,678

Insurance Contracts ............................. 799 — 799 —

Other. .......................................... 96 — 96 —

Total investments, at fair value .................. $1,250,653 $232,792 $876,369 $141,492

Interest and Dividends Receivable. . .............. 3,252

Due from Broker for Securities Sold ............. 3,788

Receivable Associated with Insurance Contract . . . 7,610

Due to Broker for Securities Purchased .......... (11,637)

Total Plan Assets, at Fair Value . . . .............. $1,253,666

F-37

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements