Frontier Communications 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to reduce our cash generated from operations. In addition, although we believe, based on information available

to us, that the financial institutions syndicated under our revolving credit facility would be able to fulfill their

commitments to us, this could change in the future. As of December 31, 2012, we had $560.5 million and

$257.9 million of debt maturing in 2013 and 2014, respectively, although $502.7 million of the 2013 maturing

debt was retired on January 15, 2013 with cash on hand.

In addition, the FCC and certain state regulatory commissions, in connection with granting their approvals

of the Transaction, specified certain capital expenditure and operating requirements for the Acquired Territories

for specified periods of time post-closing. These requirements focus primarily on certain capital investment

commitments to expand broadband availability to at least 85% of the households throughout the Acquired

Territories with minimum download speeds of 3 Mbps by the end of 2013 and 4 Mbps by the end of 2015.

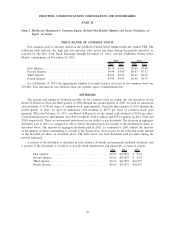

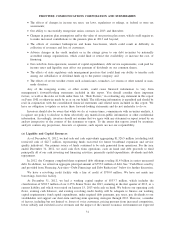

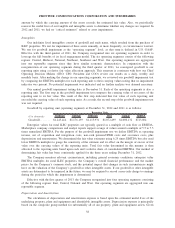

As of December 31, 2012 and 2011, we had expanded our broadband availability to the households

throughout the Company’s territories as follows:

(In excess of)

Frontier

Legacy

Acquired

Territories

Total

Company

Total

Company

2012 2011

1 Mbps . . . ................................................ 92% 86% 88% 83%

3 Mbps . . . ................................................ 80% 84% 83% 76%

4 Mbps . . . ................................................ 76% 78% 77% 66%

6 Mbps . . . ................................................ 66% 77% 74% 56%

12 Mbps . . ................................................ 42% 54% 51% NA

20 Mbps . . ................................................ 38% 41% 40% 28%

To satisfy all or part of certain capital investment commitments to three state regulatory commissions, we

placed an aggregate amount of $115.0 million in cash into escrow accounts and obtained a letter of credit for

$190.0 million in 2010. Another $72.4 million of cash in an escrow account (with a cash balance of $23.9

million and an associated liability of $0.2 million as of December 31, 2012) was acquired in connection with

the Transaction to be used for service quality initiatives in the state of West Virginia. As of December 31,

2012, $145.0 million had been released from escrow. As of December 31, 2012, the letter of credit had been

reduced to $40.0 million. The aggregate amount of these escrow accounts and the letter of credit will continue

to decrease over time as Frontier makes the required capital expenditures in the respective states.

In the third quarter of 2011, the Company contributed four administrative properties appraised at $58.1

million to its qualified defined benefit pension plan. The Company is leasing back the properties from its

pension plan for 15 years at a combined aggregate annual rent of $5.8 million. The properties are managed on

behalf of the pension plan by an independent fiduciary, and the terms of the leases were negotiated with the

fiduciary on an arm’s-length basis.

Cash Flows provided by Operating Activities

Cash flows provided by operating activities declined $20.2 million, or 1%, in 2012 as compared to 2011.

The decrease was primarily the result of large cash settlements of accounts payable due to the timing of vendor

payments during the first quarter of 2012. Our accounts payable balances at December 31, 2011 were unusually

high due to our systems conversion and broadband build activities in the second half of 2011.

We paid $4.7 million in net cash taxes during 2012, while cash refunds (net of cash taxes paid) for taxes

of $33.1 million were received in 2011, and cash paid for taxes was $19.9 million in 2010. Our 2012 cash taxes

reflect the continued impact of bonus depreciation under the Tax Relief, Unemployment Insurance

Reauthorization, and Job Creation Act of 2010. We expect that in 2013 our cash taxes will be approximately

$125 million to $150 million.

In connection with the Transaction, the Company undertook a variety of activities to integrate systems and

implement other initiatives. As a result of the Transaction, the Company incurred $81.7 million of costs related

to integration activities during 2012, as compared to $143.1 million and $137.1 million of acquisition and

integration costs in 2011 and 2010, respectively. All integration activities were completed as of the end of

2012.

32

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES