Frontier Communications 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

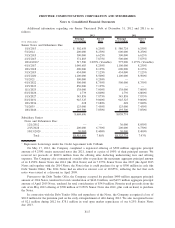

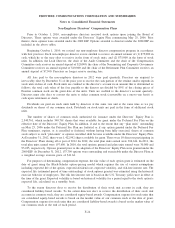

of the Transaction, and to all employees (including senior management) as a Founder’s Stock Grant during the

third quarter of 2010. The restricted shares granted to senior management vest in three equal annual

installments commencing one year after the grant date. The Founder’s Stock granted to all employees vest

100% on the third anniversary of the grant date.

For purposes of determining compensation expense, the fair value of each restricted stock grant is

estimated based on the average of the high and low market price of a share of our common stock on the date of

grant. Total remaining unrecognized compensation cost associated with unvested restricted stock awards at

December 31, 2012 was $24.8 million and the weighted average period over which this cost is expected to be

recognized is approximately 1.5 years.

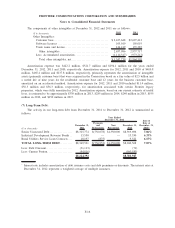

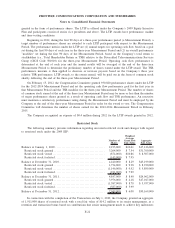

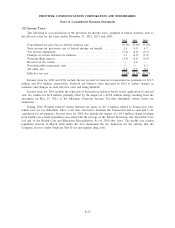

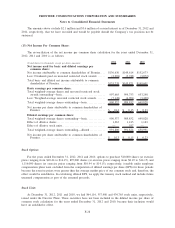

Stock Options

The following summary presents information regarding outstanding stock options and changes with regard

to options under the EIPs:

Shares

Subject to

Option

Weighted

Average

Option Price

Per Share

Weighted

Average

Remaining

Life in Years

Aggregate

Intrinsic

Value

Balance at January 1, 2010............................ 3,551,000 $13.74 1.5 $ —

Options granted .................................... — $ —

Options exercised................................... — $ —

Options canceled, forfeited or lapsed ................ (2,044,000) $16.13

Balance at December 31, 2010 ........................ 1,507,000 $10.50 1.7 $603,000

Options granted .................................... — $ —

Options exercised................................... (10,000) $ 8.19 $ 12,000

Options canceled, forfeited or lapsed ................ (602,000) $10.86

Balance at December 31, 2011 ........................ 895,000 $ 9.94 1.3 $ —

Options granted .................................... — $ —

Options exercised................................... — $ —

Options canceled, forfeited or lapsed ................ (355,000) $ 8.35

Balance at December 31, 2012 ........................ 540,000 $10.99 0.9 $ —

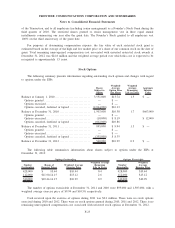

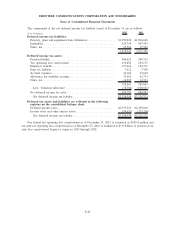

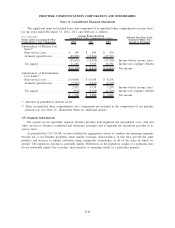

The following table summarizes information about shares subject to options under the EIPs at

December 31, 2012:

Number

Outstanding

Range of

Exercise Prices

Weighted Average

Exercise Price

Weighted Average

Remaining

Life in Years

Number

Exercisable

Weighted

Average

Exercise Price

Options Outstanding Options Exercisable

428,000 $ 10.44 $10.44 0.4 428,000 $10.44

112,000 $11.90-14.15 $13.12 2.6 112,000 $13.12

540,000 $10.44-14.15 $10.99 0.9 540,000 $10.99

The number of options exercisable at December 31, 2011 and 2010 were 895,000 and 1,507,000, with a

weighted average exercise price of $9.94 and $10.50, respectively.

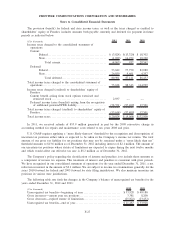

Cash received upon the exercise of options during 2011 was $0.1 million. There were no stock options

exercised during 2010 and 2012. There were no stock options granted during 2010, 2011 and 2012. There is no

remaining unrecognized compensation cost associated with unvested stock options at December 31, 2012.

F-23

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements