Frontier Communications 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.on the respective line items in net income in circumstances when U.S. GAAP requires the item being

reclassified in its entirety to net income. This new guidance is to be applied prospectively. The Company

adopted ASU 2013-02 during the fourth quarter of 2012 with no impact on our financial position, results of

operations or cash flows.

Indefinite-Lived Intangible Assets

In July 2012, the FASB issued ASU No. 2012-02 (ASU 2012-02), “Intangibles—Goodwill and

Other–Testing Indefinite-Lived Intangible Assets for Impairment,” (ASC Topic 350). ASU 2012-02 permits an

entity to first assess qualitative factors to determine whether it is more likely than not that an indefinite-lived

intangible asset is impaired as a basis for determining whether it is necessary to perform a quantitative

impairment test. The more-likely-than-not threshold is defined as having a likelihood of more than 50 percent.

This amendment also gives an entity the option not to calculate annually the fair value of an indefinite-lived

intangible asset if the entity can determine that it is not more likely than not that the asset is impaired. If an

entity concludes that it is not more likely than not that the indefinite-lived intangible asset is impaired, then the

entity is not required to take further action. While ASU 2012-02 is effective for annual and interim impairment

tests performed for fiscal years beginning after September 15, 2012, early adoption is permitted. The Company

adopted ASU 2012-02 during the fourth quarter of 2012 with no material impact on our financial position,

results of operations or cash flows.

(3) The Transaction:

On July 1, 2010, Frontier acquired the defined assets and liabilities of the local exchange business and

related landline activities of Verizon Communications Inc. (Verizon) in Arizona, Idaho, Illinois, Indiana,

Michigan, Nevada, North Carolina, Ohio, Oregon, South Carolina, Washington, West Virginia and Wisconsin

and in portions of California bordering Arizona, Nevada and Oregon (collectively, the Acquired Territories),

including Internet access and long distance services and broadband video provided to designated customers in

the Acquired Territories (the Acquired Business). Frontier was considered the acquirer of the Acquired

Business for accounting purposes.

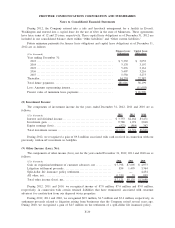

We accounted for our acquisition of 4.0 million access lines from Verizon (the Transaction) using the

guidance included in ASC Topic 805. We incurred $81.7 million, $143.1 million and $137.1 million of

acquisition and integration related costs in connection with the Transaction during the years ended December

31, 2012, 2011 and 2010, respectively. Such costs are required to be expensed as incurred and are reflected in

“Acquisition and integration costs” in our consolidated statements of operations.

The allocation of the purchase price of the Acquired Business was based on the fair value of assets

acquired and liabilities assumed as of July 1, 2010, the effective date of the Transaction. Our assessment of fair

value was final as of June 30, 2011.

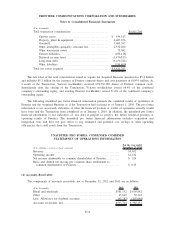

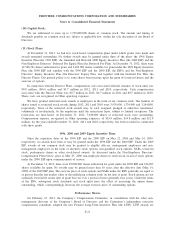

The final allocation of the purchase price presented below represents the effect of recording the final fair

value of assets acquired, liabilities assumed and related deferred income taxes as of the date of the Transaction,

based on the total transaction consideration of $5.4 billion.

F-13

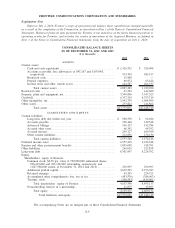

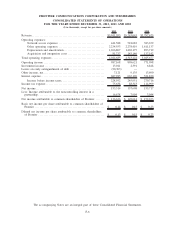

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements