Frontier Communications 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

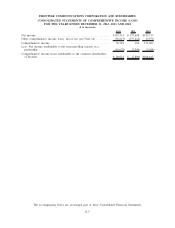

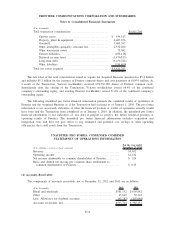

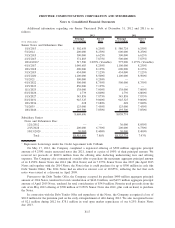

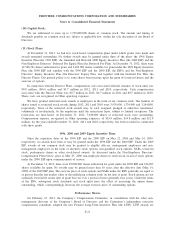

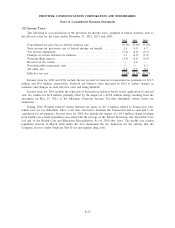

Additional information regarding our Senior Unsecured Debt at December 31, 2012 and 2011 is as

follows:

($ in thousands)

Principal

Outstanding

Interest

Rate

Principal

Outstanding

Interest

Rate

2012 2011

Senior Notes and Debentures Due:

1/15/2013 .......................... $ 502,658 6.250% $ 580,724 6.250%

5/1/2014 ........................... 200,000 8.250% 600,000 8.250%

3/15/2015 .......................... 300,000 6.625% 300,000 6.625%

4/15/2015 .......................... 374,803 7.875% 500,000 7.875%

10/14/2016* ........................ 517,500 3.095% (Variable) 575,000 3.175% (Variable)

4/15/2017 .......................... 1,040,685 8.250% 1,100,000 8.250%

10/1/2018 .......................... 600,000 8.125% 600,000 8.125%

3/15/2019 .......................... 434,000 7.125% 434,000 7.125%

4/15/2020 .......................... 1,100,000 8.500% 1,100,000 8.500%

7/1/2021 ........................... 500,000 9.250% — —

4/15/2022 .......................... 500,000 8.750% 500,000 8.750%

1/15/2023 .......................... 850,000 7.125% — —

11/1/2025 .......................... 138,000 7.000% 138,000 7.000%

8/15/2026 .......................... 1,739 6.800% 1,739 6.800%

1/15/2027 .......................... 345,858 7.875% 345,858 7.875%

8/15/2031 .......................... 945,325 9.000% 945,325 9.000%

10/1/2034 .......................... 628 7.680% 628 7.680%

7/1/2035 ........................... 125,000 7.450% 125,000 7.450%

10/1/2046 .......................... 193,500 7.050% 193,500 7.050%

8,669,696 8,039,774

Subsidiary Senior

Notes and Debentures Due:

12/1/2012 ........................ — — 36,000 8.050%

2/15/2028 ........................ 200,000 6.730% 200,000 6.730%

10/15/2029 . . . .................... 50,000 8.400% 50,000 8.400%

Total ........................ $8,919,696 7.86% $8,325,774 7.93%

*Represents borrowings under the Credit Agreement with CoBank.

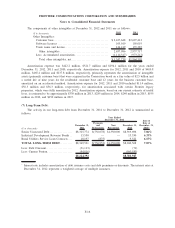

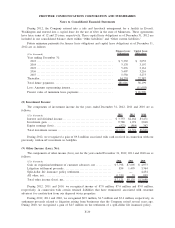

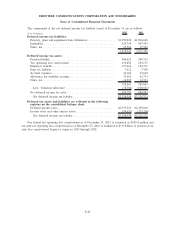

On May 17, 2012, the Company completed a registered offering of $500 million aggregate principal

amount of 9.250% senior unsecured notes due 2021, issued at a price of 100% of their principal amount. We

received net proceeds of $489.6 million from the offering after deducting underwriting fees and offering

expenses. The Company also commenced a tender offer to purchase the maximum aggregate principal amount

of its 8.250% Senior Notes due 2014 (the 2014 Notes) and its 7.875% Senior Notes due 2015 (the April 2015

Notes and together with the 2014 Notes, the Notes) that it could purchase for up to $500 million in cash (the

Debt Tender Offer). The 2014 Notes had an effective interest cost of 10.855%, reflecting the fact that such

notes were issued at a discount in April 2009.

Pursuant to the Debt Tender Offer, the Company accepted for purchase $400 million aggregate principal

amount of 2014 Notes, tendered for total consideration of $446.0 million, and $49.5 million aggregate principal

amount of April 2015 Notes, tendered for total consideration of $54.0 million. Frontier used proceeds from the

sale of its May 2012 offering of $500 million of 9.250% Senior Notes due 2021, plus cash on hand, to purchase

the Notes.

In connection with the Debt Tender Offer and repurchase of the Notes, the Company recognized a loss of

$69.0 million for the premium paid on the early extinguishment of debt during 2012. We also recognized losses

of $2.1 million during 2012 for $78.1 million in total open market repurchases of our 6.25% Senior Notes

due 2013.

F-17

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements