Frontier Communications 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amount by which the carrying amount of the assets exceeds the estimated fair value. Also, we periodically

reassess the useful lives of our tangible and intangible assets to determine whether any changes are required. In

2012 and 2011, we had no “critical estimates” related to asset impairments.

Intangibles

Our indefinite lived intangibles consist of goodwill and trade name, which resulted from the purchase of

ILEC properties. We test for impairment of these assets annually, or more frequently, as circumstances warrant.

We test for goodwill impairment at the “operating segment” level, as that term is defined in U.S. GAAP.

Effective with the third quarter of 2011, the Company reorganized into six operating segments in order to

leverage the full benefits of its local engagement model. The six operating segments consist of the following

regions: Central, Midwest, National, Northeast, Southeast and West. Our operating segments are aggregated

into one reportable segment since they have similar economic characteristics. In conjunction with the

reorganization of our operating segments during the third quarter of 2011, we reassigned goodwill to our

reporting units using a relative fair value allocation approach. This structure is consistent with how our Chief

Operating Decision Makers (CEO, CFO, President and COO) review our results on a daily, weekly and

monthly basis. After making the change in our operating segments, we reviewed our goodwill impairment test

by comparing the EBITDA multiples for each reporting unit to their carrying values noting that no impairment

indicator was present. No potential impairment was indicated and no further analysis was deemed necessary.

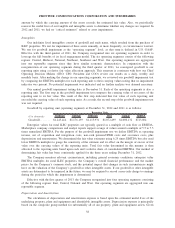

Our annual goodwill impairment testing date is December 31. Each of the operating segments is also a

reporting unit. The first step in the goodwill impairment test compares the carrying value of net assets of the

reporting unit to its fair value. The result of this first step indicated that fair value of each reporting unit

exceeded the carrying value of such reporting units. As a result, the second step of the goodwill impairment test

was not required.

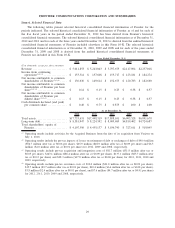

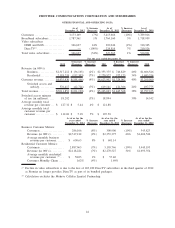

Goodwill by reporting unit (operating segment) at December 31, 2012 and 2011 is as follows:

($ in thousands) Northeast National Southeast West Central Midwest

Reporting Units

Goodwill ........ $1,245,414 $1,176,139 $1,113,931 $1,072,499 $1,006,132 $723,604

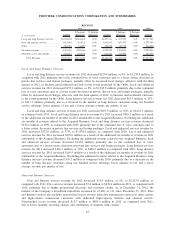

Enterprise values for rural ILEC properties are typically quoted as a multiple of cash flow or EBITDA.

Marketplace company comparisons and analyst reports support a range of values around a multiple of 5.5 to 7.5

times annualized EBITDA. For the purpose of the goodwill impairment test we define EBITDA as operating

income, net of acquisition and integration costs, non-cash pension/OPEB costs and severance costs, plus

depreciation and amortization. We determined the fair value estimates using 6.25 times EBITDA but also used

lower EBITDA multiples to gauge the sensitivity of the estimate and its effect on the margin of excess of fair

value over the carrying values of the reporting units. Total fair value determined in this manner is then

allocated to the reporting units based upon each unit’s relative share of consolidated EBITDA. Our method of

determining fair value has been consistently applied for the three years ending December 31, 2012.

The Company monitors relevant circumstances, including general economic conditions, enterprise value

EBITDA multiples for rural ILEC properties, the Company’s overall financial performance and the market

prices for the Company’s common stock, and the potential impact that changes in such circumstances might

have on the valuation of the Company’s goodwill or other intangible assets. If our goodwill or other intangible

assets are determined to be impaired in the future, we may be required to record a non-cash charge to earnings

during the period in which the impairment is determined.

Effective with the first quarter of 2013, the Company reorganized into four operating segments consisting

of the following regions: East, Central, National and West. Our operating segments are aggregated into one

reportable segment.

Depreciation and Amortization

The calculation of depreciation and amortization expense is based upon the estimated useful lives of the

underlying property, plant and equipment and identifiable intangible assets. Depreciation expense is principally

based on the composite group method for substantially all of our property, plant and equipment assets. Given

38

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES