Frontier Communications 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

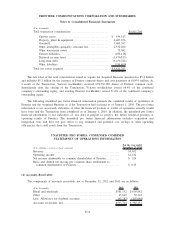

During 2012, the Company entered into a sale and leaseback arrangement for a facility in Everett,

Washington and entered into a capital lease for the use of fiber in the state of Minnesota. These agreements

have lease terms of 12 and 23 years, respectively. These capital lease obligations as of December 31, 2012 are

included in our consolidated balance sheet within “Other liabilities” and “Other current liabilities.”

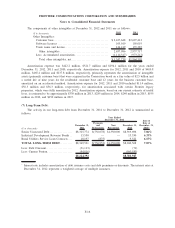

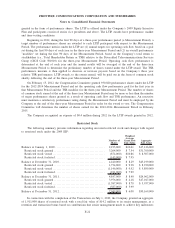

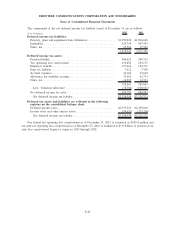

Future minimum payments for finance lease obligations and capital lease obligations as of December 31,

2012 are as follows:

($ in thousands)

Finance Lease

Obligations

Capital Lease

Obligations

Year ending December 31:

2013 ............................................................ $ 5,339 $ 3,055

2014 ............................................................ 5,170 3,107

2015 ............................................................ 5,276 3,161

2016 ............................................................ 5,407 3,216

2017 ............................................................ 5,550 3,273

Thereafter . . . ...................................................... 54,274 22,387

Total future payments . ............................................. $81,016 38,199

Less: Amounts representing interest ................................. (11,603)

Present value of minimum lease payments........................... $ 26,596

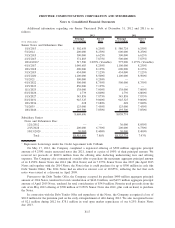

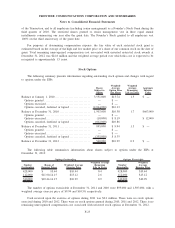

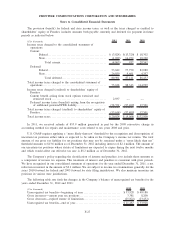

(8) Investment Income:

The components of investment income for the years ended December 31, 2012, 2011 and 2010 are as

follows:

($ in thousands) 2012 2011 2010

Interest and dividend income ....................................... $ 3,753 $2,184 $3,471

Investment gain. ................................................... 9,780 1,071 3,010

Equity earnings (loss) .............................................. (522) (864) 367

Total investment income . .......................................... $13,011 $2,391 $6,848

During 2012, we recognized a gain of $9.8 million associated with cash received in connection with our

previously written-off investment in Adelphia.

(9) Other Income (Loss), Net:

The components of other income (loss), net for the years ended December 31, 2012, 2011 and 2010 are as

follows:

($ in thousands) 2012 2011 2010

Gain on expiration/settlement of customer advances, net . . . ......... $ 7,798 $7,605 $ 4,973

Litigation settlement proceeds . .................................... 854 1,495 3,364

Split-dollar life insurance policy settlement ......................... — — 4,454

All other, net ..................................................... (1,531) 35 899

Total other income (loss), net. . .................................... $ 7,121 $9,135 $13,690

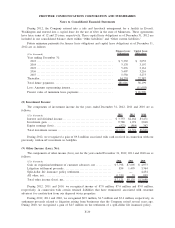

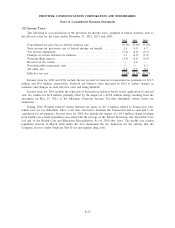

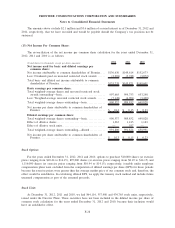

During 2012, 2011 and 2010, we recognized income of $7.8 million, $7.6 million and $5.0 million,

respectively, in connection with certain retained liabilities that have terminated, associated with customer

advances for construction from our disposed water properties.

During 2012, 2011 and 2010, we recognized $0.9 million, $1.5 million and $3.4 million, respectively, in

settlement proceeds related to litigation arising from businesses that the Company exited several years ago.

During 2010, we recognized a gain of $4.5 million on the settlement of a split-dollar life insurance policy.

F-20

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements