Frontier Communications 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

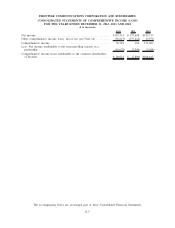

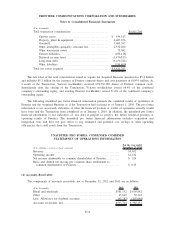

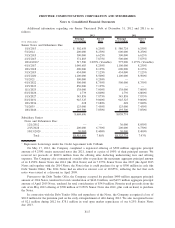

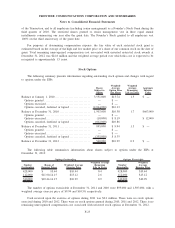

An analysis of the activity in the allowance for doubtful accounts for the years ended December 31, 2012,

2011 and 2010 is as follows:

($ in thousands)

Balance at

beginning of

Period

Charged to

Other Revenue

Charged to

Switched and

Nonswitched Revenue Deductions

Balance at

end of

Period

Additions

2010 ............................ $ 30,171 $55,161 $14,873 $ (26,634) $ 73,571

2011 ............................ 73,571 93,721 16,403 (76,647) 107,048

2012 ............................ 107,048 74,332 14,396 (102,509) 93,267

We maintain an allowance for bad debts based on our estimate of our ability to collect accounts

receivable. The increase to the allowance is recorded as a reduction to revenue.

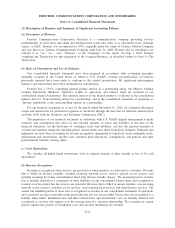

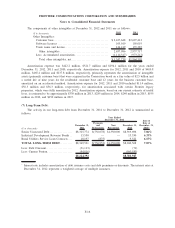

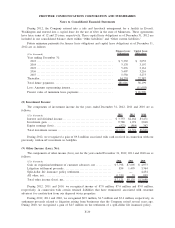

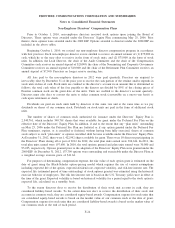

(5) Property, Plant and Equipment:

The components of property, plant and equipment at December 31, 2012 and 2011 are as follows:

($ in thousands)

Estimated

Useful Lives 2012 2011

Land ...................................................... N/A $ 126,483 $ 128,855

Buildings and leasehold improvements . . . ................... 41 years 1,052,650 1,050,555

General support ............................................ 5 to 17 years 988,707 914,777

Central office/electronic circuit equipment ................... 5 to 11 years 4,965,099 4,582,296

Poles ...................................................... 49 years 507,922 471,561

Cable and wire............................................. 15 to 30 years 6,038,835 5,727,310

Conduit.................................................... 60 years 354,777 342,868

Other ...................................................... 12 to 30 years 44,802 35,534

Construction work in progress . . ............................ 274,488 384,380

Property, plant and equipment . . ............................ 14,353,763 13,638,136

Less: Accumulated depreciation . ............................ (6,848,867) (6,090,613)

Property, plant and equipment, net .......................... $ 7,504,896 $ 7,547,523

Depreciation expense is principally based on the composite group method. Depreciation expense was

$844.6 million, $881.5 million and $599.7 million for the years ended December 31, 2012, 2011 and 2010,

respectively. As a result of an independent study of the estimated remaining useful lives of our plant assets, we

adopted new estimated remaining useful lives for certain plant assets as of October 1, 2012, with an immaterial

impact to depreciation expense.

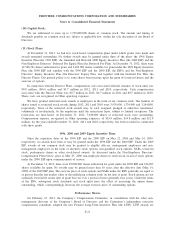

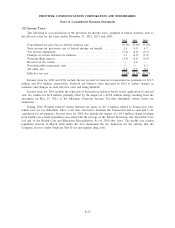

(6) Goodwill and Other Intangibles:

The components of goodwill by the reporting units in effect at December 31, 2012 and 2011 are as

follows:

($ in thousands)

Northeast. . .............................................................. $1,245,414

National. . . .............................................................. 1,176,139

Southeast. . .............................................................. 1,113,931

West .................................................................... 1,072,499

Central .................................................................. 1,006,132

Midwest. . . .............................................................. 723,604

Total Goodwill. ..................................................... $6,337,719

F-15

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements