Frontier Communications 2012 Annual Report Download - page 72

Download and view the complete annual report

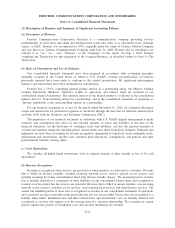

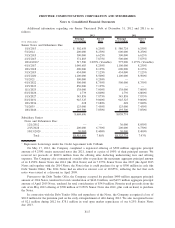

Please find page 72 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As required by law, the Company collects various taxes from its customers and subsequently remits these

taxes to governmental authorities. Substantially all of these taxes are recorded through the consolidated balance

sheet and presented on a net basis in our consolidated statements of operations. We also collect Universal

Service Fund (USF) surcharges from customers (primarily federal USF) that we have recorded on a gross basis

in our consolidated statements of operations and included within “Revenue” and “Other operating expenses” of

$119.7 million, $104.5 million and $73.8 million for the years ended December 31, 2012, 2011 and 2010,

respectively.

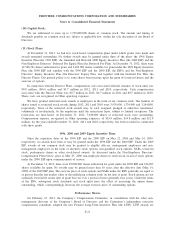

(e) Property, Plant and Equipment:

Property, plant and equipment are stated at original cost, including capitalized interest, or fair market value

as of the date of acquisition for our acquired properties. Maintenance and repairs are charged to operating

expenses as incurred. The gross book value of routine property, plant and equipment retired is charged against

accumulated depreciation.

(f) Goodwill and Other Intangibles:

Intangibles represent the excess of purchase price over the fair value of identifiable tangible net assets

acquired. We undertake studies to determine the fair values of assets and liabilities acquired and allocate

purchase prices to assets and liabilities, including property, plant and equipment, goodwill and other

identifiable intangibles. We annually (during the fourth quarter) or more frequently, if appropriate, examine the

carrying value of our goodwill and trade name to determine whether there are any impairment losses. We test

for goodwill impairment at the “operating segment” level, as that term is defined in U.S. GAAP. During the

third quarter of 2011, the Company reorganized into six operating segments in order to leverage the full

benefits of its local engagement model. Our operating segments consist of the following regions: Central,

Midwest, National, Northeast, Southeast and West. Our operating segments are aggregated into one reportable

segment. In conjunction with the reorganization of our operating segments effective with the third quarter of

2011, we reassigned goodwill to our reporting units using a relative fair value allocation approach.

The Company amortizes finite lived intangible assets over their estimated useful lives and reviews such

intangible assets at least annually to assess whether any potential impairment exists and whether factors exist

that would necessitate a change in useful life and a different amortization period.

(g) Impairment of Long-Lived Assets and Long-Lived Assets to Be Disposed Of:

We review long-lived assets to be held and used and long-lived assets to be disposed of for impairment

whenever events or changes in circumstances indicate that the carrying amount of such assets may not be

recoverable. Recoverability of assets to be held and used is measured by comparing the carrying amount of the

asset to the future undiscounted net cash flows expected to be generated by the asset. Recoverability of assets

held for sale is measured by comparing the carrying amount of the assets to their estimated fair market value. If

any assets are considered to be impaired, the impairment is measured by the amount by which the carrying

amount of the assets exceeds the estimated fair value. Also, we periodically assess the useful lives of our

tangible assets to determine whether any changes are required.

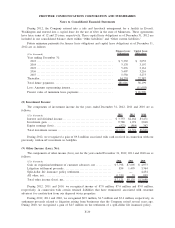

(h) Investments:

Investments in entities that we do not control, but where we have the ability to exercise significant

influence over operating and financial policies, are accounted for using the equity method of accounting.

(i) Income Taxes and Deferred Income Taxes:

We file a consolidated federal income tax return. We utilize the asset and liability method of accounting

for income taxes. Under the asset and liability method, deferred income taxes are recorded for the tax effect of

F-11

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements