Frontier Communications 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$68.5 million, less amounts capitalized into the cost of capital expenditures of $15.8 million, $10.2 million and

$8.3 million for 2012, 2011 and 2010, respectively.

Based on current assumptions and plan asset values, we estimate that our 2013 pension and other

postretirement benefit expenses (which were $81.6 million in 2012 before amounts capitalized into the cost of

capital expenditures) will be approximately $100 million to $110 million before amounts capitalized into the

cost of capital expenditures.

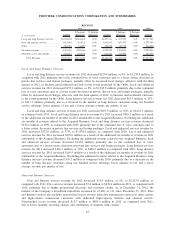

All other operating expenses

All other operating expenses for 2012 decreased $122.6 million, or 11%, to $1,026.8 million, as compared

with 2011, primarily due to the elimination of redundant information technology costs with the completion of

the systems conversions, and lower outside service costs, as described above.

All other operating expenses for 2011 increased $342.0 million, or 42%, to $1,149.4 million, as compared

with 2010. All other operating expenses for 2011 increased $439.5 million as a result of the additional six

months of expenses in 2011 attributable to the Acquired Business. All other operating expenses, excluding the

additional six months of expenses related to the Acquired Business, decreased $97.5 million, or 12%, to $709.9

million, as compared with 2010, primarily due to $36.5 million in corporate costs allocated to the Acquired

Business during the first six months of 2011, combined with lower outside service fees, other taxes and

marketing costs.

Cost Savings Resulting from the Transaction

We have achieved cost savings as a result of the Transaction, principally (1) by leveraging the scalability

of our existing corporate administrative functions, information technology and network systems to cover certain

former Acquired Business functions and systems, (2) by in-sourcing certain functions formerly provided by

third-party service providers to the Acquired Business and (3) by achieving improved efficiencies and more

favorable rates with third-party vendors.

Our annualized cost savings reached approximately $653 million as of the end of 2012. The cost savings

in 2012 from our targeted initiatives list (which includes, but is not limited to, cancellation or reduction of

vendor services, network cost savings, contractor reductions, benefit changes and real estate savings) was

approximately $101 million on an annualized basis, and when combined with the savings achieved in 2011 and

2010, equates to an annualized cost savings run rate of approximately $653 million, which exceeds our original

estimate of $500 million of cost savings.

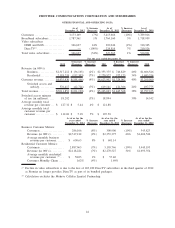

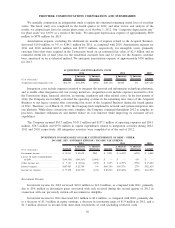

DEPRECIATION AND AMORTIZATION EXPENSE

($ in thousands) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2012 2011 2010

Depreciation expense . . . . . . . ...... $ 844,641 $ (36,840) (4%) $ 881,481 $281,819 47% $599,662

Amortization expense . . . . . . . ...... 422,166 (99,528) (19%) 521,694 227,637 77% 294,057

$1,266,807 $(136,368) (10%) $1,403,175 $509,456 57% $893,719

Depreciation and amortization expense for 2012 decreased $136.4 million, or 10%, to $1,266.8 million, as

compared to 2011. Amortization expense decreased primarily due to lower amortization expense associated

with certain Frontier legacy properties that were fully amortized in 2012 and the amortization related to the

customer base that is amortized on an accelerated method. Depreciation expense decreased primarily due to a

lower net asset base and changes in the remaining useful lives of certain assets.

Depreciation and amortization expense for 2011 increased $509.5 million, or 57%, to $1,403.2 million, as

compared to 2010. Depreciation and amortization expense increased $510.9 million as a result of the additional

six months of expenses in 2011 attributable to the Acquired Business. Depreciation expense, excluding the

additional six months of expense related to the Acquired Business, increased $8.6 million, or 1%, to $608.2

million, as compared with 2010, primarily due to changes in the remaining useful lives of certain assets.

49

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES