Frontier Communications 2012 Annual Report Download - page 73

Download and view the complete annual report

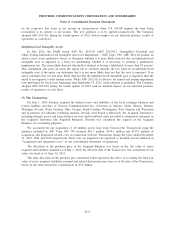

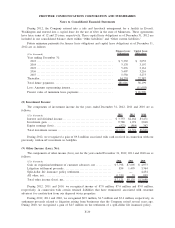

Please find page 73 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.temporary differences between the financial statement basis and the tax basis of assets and liabilities using tax

rates expected to be in effect when the temporary differences are expected to reverse.

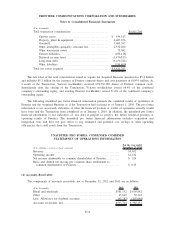

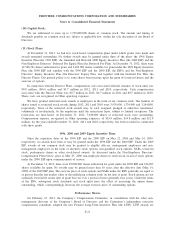

(j) Stock Plans:

We have various stock-based compensation plans. Awards under these plans are granted to eligible

officers, management employees, non-management employees and non-employee directors. Awards may be

made in the form of incentive stock options, non-qualified stock options, stock appreciation rights, restricted

stock, restricted stock units or other stock-based awards, including awards with performance, market and time-

vesting conditions. Our general policy is to issue shares from treasury upon the grant of restricted shares and

the exercise of options.

The compensation cost recognized is based on awards ultimately expected to vest. U.S. GAAP requires

forfeitures to be estimated and revised, if necessary, in subsequent periods if actual forfeitures differ from those

estimates.

(k) Net Income Per Common Share Attributable to Common Shareholders:

Basic net income per common share is computed using the weighted average number of common shares

outstanding during the period being reported on, excluding unvested restricted stock awards. The impact of

dividends paid on unvested restricted stock awards have been deducted in the determination of basic and

diluted net income attributable to common shareholders of Frontier. Except when the effect would be

antidilutive, diluted net income per common share reflects the dilutive effect of the assumed exercise of stock

options using the treasury stock method at the beginning of the period being reported on.

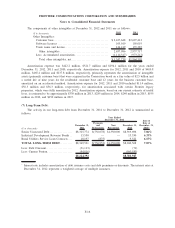

(2) Recent Accounting Literature:

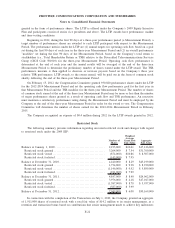

Fair Value Measurements

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update

(ASU) No. 2011-04 (ASU 2011-04), “Fair Value Measurements: Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (Accounting Standards Codification

(ASC) Topic 820). ASU 2011-04 changes the wording used to describe many of the requirements in U.S.

GAAP for measuring fair value and for disclosing information about fair value measurements to ensure

consistency between U.S. GAAP and IFRS. ASU 2011-04 also expands the disclosures for fair value

measurements that are estimated using significant unobservable (Level 3) inputs. This new guidance was to be

applied prospectively, and was effective for interim and annual periods beginning after December 15, 2011.

The Company adopted ASU 2011-04 in the first quarter of 2012 with no impact on our financial position,

results of operations or cash flows.

Presentation of Comprehensive Income

In June 2011, the FASB issued ASU No. 2011-05 (ASU 2011-05), “Comprehensive Income: Presentation

of Comprehensive Income,” (ASC Topic 220). ASU 2011-05 eliminates the option to report other

comprehensive income and its components in the statement of changes in equity. ASU 2011-05 requires

that all non-owner changes in stockholders’ equity be presented in either a single continuous statement of

comprehensive income or in two separate but consecutive statements. This new guidance was to be applied

retrospectively, and was effective for interim and annual periods beginning after December 15, 2011. The

Company adopted ASU 2011-05 in the first quarter of 2012 with no impact on our financial position, results of

operations or cash flows.

In February 2013, the FASB issued ASU No. 2013-02 (ASU 2013-02), “Comprehensive Income:

Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income,” (ASC Topic 220).

ASU 2013-02 requires disclosing the effect of reclassifications out of accumulated other comprehensive income

F-12

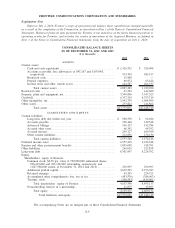

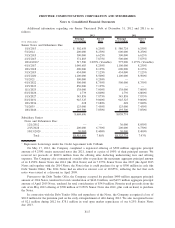

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements