Frontier Communications 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.sale of its May 2012 offering of $500.0 million of 9.250% Senior Notes due 2021, plus cash on hand, to

purchase the Notes.

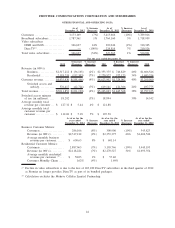

The repurchases in the Debt Tender Offer for the Notes resulted in a loss on the early extinguishment of

debt of $69.0 million, which we recognized in the second quarter of 2012. We also recognized losses of $2.1

million during the second quarter of 2012 for $78.1 million in total open market repurchases of our 6.25%

Senior Notes due 2013.

On October 1, 2012, the Company accepted for purchase $75.7 million and $59.3 million aggregate

principal amount of the April 2015 Notes and its 8.250% Senior Notes due 2017 (the 2017 Notes), respectively,

in open market repurchases for total consideration of $154.7 million. The repurchases resulted in a loss on the

early retirement of debt of $19.3 million that was recognized in the fourth quarter of 2012.

In 2011, we retired an aggregate principal amount of $552.4 million of debt, consisting of $551.4 million

of senior unsecured debt and $1.0 million of rural utilities service loan contracts. In 2010, we retired an

aggregate principal amount of $7.2 million of debt, consisting of $2.8 million of senior unsecured debt and $4.4

million of rural utilities service loan contracts.

We may from time to time make additional repurchases of our debt in the open market, through tender

offers, exchanges of debt securities, by exercising rights to call or in privately negotiated transactions. We may

also refinance existing debt or exchange existing debt for newly issued debt obligations.

Bank Financing

The Company has a credit agreement (the Credit Agreement) with CoBank, ACB, as administrative agent,

lead arranger and a lender, and the other lenders party thereto for a $575.0 million senior unsecured term loan

facility with a final maturity of October 14, 2016. The entire facility was drawn upon execution of the Credit

Agreement in October 2011. Repayment of the outstanding principal balance is made in quarterly installments

in the amount of $14,375,000, which commenced on March 31, 2012, with the remaining outstanding principal

balance to be repaid on the final maturity date. Borrowings under the Credit Agreement bear interest based on

the margins over the Base Rate (as defined in the Credit Agreement) or LIBOR, at the election of the

Company. Interest rate margins under the facility (ranging from 0.875% to 2.875% for Base Rate borrowings

and 1.875% to 3.875% for LIBOR borrowings) are subject to adjustments based on the Total Leverage Ratio of

the Company, as such term is defined in the Credit Agreement. The current pricing on this facility is LIBOR

plus 2.875%. The maximum permitted leverage ratio, as defined in the Credit Agreement, is 4.5 times. The

proceeds of the facility were used to repay in full the remaining outstanding principal on three debt facilities

(Frontier’s $200 million Rural Telephone Financing Cooperative term loan maturing October 24, 2011, its $143

million CoBank term loan maturing December 31, 2012, and its $130 million CoBank term loan maturing

December 31, 2013) and the remaining proceeds were used for general corporate purposes.

The Credit Agreement contains customary representations and warranties, affirmative and negative

covenants, including a restriction on the Company’s ability to declare dividends if an event of default has

occurred or will result therefrom, a financial covenant that requires compliance with a leverage ratio, and

customary events of default. Upon proper notice, the Company may, in whole or in part, repay the facility

without premium or penalty, but subject to breakage fees on LIBOR loans, if applicable. Amounts pre-paid may

not be re-borrowed.

Transaction Financing

On April 12, 2010, in anticipation of the Transaction, the Verizon subsidiary then holding the assets of the

Acquired Business completed a private offering of $3.2 billion aggregate principal amount of senior notes. The

gross proceeds of the offering, plus $125.5 million (the Transaction Escrow) contributed by Frontier, were

deposited into an escrow account. Immediately prior to the Transaction, the proceeds of the notes offering (less

the initial purchasers’ discount) were released from the escrow account and used to make a special cash

payment to Verizon, as contemplated by the Transaction, with amounts in excess of the special cash payment

and the initial purchasers’ discount received by the Company ($53.0 million). In addition, the $125.5 million

Transaction Escrow was returned to the Company.

34

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES