Frontier Communications 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

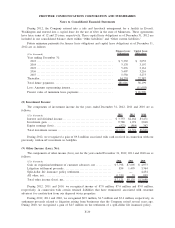

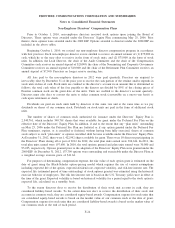

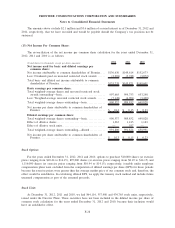

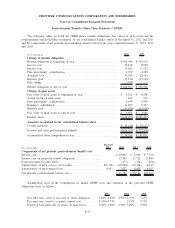

The significant items reclassified from each component of accumulated other comprehensive income (loss)

for the years ended December 31, 2012, 2011 and 2010 are as follows:

Details about Accumulated Other

Comprehensive Loss Components 2012 2011 2010

Affected Line Item in the

Statement Where Net

Income is Presented

($ in thousands) Amount Reclassified from

Accumulated Other Comprehensive Loss(a)

Amortization of Pension Cost

Items(b)

Prior-service costs............... $ 199 $ 199 $ 199

Actuarial gains/(losses) .......... (29,890) (15,364) (27,393)

(29,691) (15,165) (27,194) Income before income taxes

Tax impact . . ................... 11,282 5,763 10,334 Income tax (expense) benefit

$(18,409) $ (9,402) $(16,860) Net income

Amortization of Postretirement

Cost Items(b)

Prior-service costs............... $ 10,068 $ 10,198 $ 8,158

Actuarial gains/(losses) .......... (7,537) (4,424) (4,919)

2,531 5,774 3,239 Income before income taxes

Tax impact . . ................... (962) (2,194) (1,230) Income tax (expense) benefit

$ 1,569 $ 3,580 $ 2,009 Net income

(a) Amounts in parentheses indicate losses.

(b) These accumulated other comprehensive loss components are included in the computation of net periodic

pension cost (see Note 17—Retirement Plans for additional details).

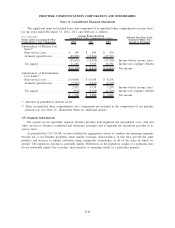

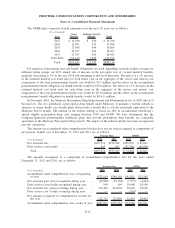

(15) Segment Information:

We operate in one reportable segment. Frontier provides both regulated and unregulated voice, data and

video services to business, residential and wholesale customers and is typically the incumbent provider in its

service areas.

As permitted by U.S. GAAP, we have utilized the aggregation criteria to combine our operating segments

because all of our Frontier properties share similar economic characteristics, in that they provide the same

products and services to similar customers using comparable technologies in all of the states in which we

operate. The regulatory structure is generally similar. Differences in the regulatory regime of a particular state

do not materially impact the economic characteristics or operating results of a particular property.

F-30

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements