Frontier Communications 2012 Annual Report Download - page 52

Download and view the complete annual report

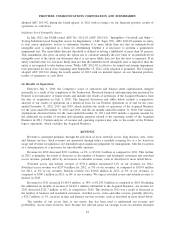

Please find page 52 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our average cash balances were $705.6 million, $275.0 million and $304.7 million for 2012, 2011 and

2010, respectively. Our average total restricted cash balance was $105.9 million and $170.5 million for 2012

and 2011, respectively.

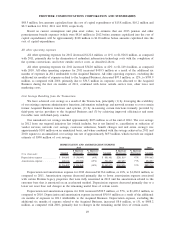

Losses on Early Extinguishment of Debt

During 2012, we recognized losses of $90.4 million on the early extinguishment of debt, including $69.0

million in connection with a $500.0 million debt tender offer for the Notes, a loss of $2.1 million for $78.1

million in total open market repurchases of our 6.25% Senior Notes due 2013 and a loss of $19.3 million for

open market repurchases of $75.7 million of the April 2015 Notes and $59.3 million of the 2017 Notes.

Other Income, net

Other income, net for 2012 decreased $2.0 million to $7.1 million, as compared with 2011.

Other income, net for 2011 decreased $4.6 million to $9.1 million, as compared with 2010, primarily due

to a gain of $4.5 million on a split-dollar life insurance policy settlement recognized in the second quarter

of 2010.

Interest Expense

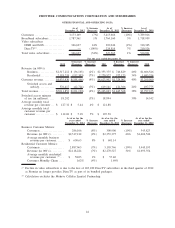

Interest expense for 2012 increased $22.8 million, or 3%, to $688.0 million, as compared with 2011,

primarily due to the registered debt offerings of $1,350 million in total of senior unsecured notes, resulting in

higher average debt levels, partially offset by debt repayments of $757.0 million and lower capitalized interest

in 2012. Our composite average borrowing rate as of December 31, 2012 was 7.85%

Interest expense for 2011 increased $143.4 million, or 27%, to $665.2 million, as compared with 2010,

primarily due to higher average debt levels during 2011. Interest expense for 2011 and 2010 included $284.4

million and $143.2 million, respectively, associated with the assumed debt from the Transaction. Our composite

average borrowing rate as of December 31, 2011 and 2010 was 7.92% and 8.04%, respectively.

Our average debt outstanding was $8,563.5 million, $8,299.8 million and $6,950.9 million for 2012, 2011

and 2010, respectively. Our debt levels have risen from 2010 levels primarily due to the $3.5 billion of debt

that was assumed by Frontier upon consummation of the Transaction, and from 2011 levels primarily due to the

$1.4 billion in registered debt offerings in 2012, as discussed above.

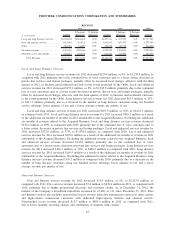

Income Tax Expense

Income tax expense for 2012 decreased $12.7 million, or 14%, to $75.6 million, as compared with 2011.

The variance is primarily due to lower pretax income in 2012, along with the impact of the reversal of

uncertain tax positions for $12.3 million, partially offset by a net increase in deferred tax balances.

The effective tax rate for 2012 was 33.0% as compared with 35.9% for 2011 and 42.5% for 2010.

Income tax expense for 2011 decreased $26.7 million, or 23%, to $88.3 million, as compared with 2010,

primarily due to lower pretax income, the reduction of deferred tax balances based on the application of

enacted state tax statutes for $6.8 million and the net reversal of a reserve for uncertain tax positions for $9.9

million, partially offset by the impact of a $10.8 million charge resulting from the enactment on May 25, 2011

of the Michigan Corporate Income Tax that eliminated certain future tax deductions. During 2010, Frontier

reduced certain deferred tax assets of $11.3 million related to Transaction costs which were not tax deductible.

These costs were incurred to facilitate the Transaction and as such were capitalized for tax purposes.

The amount of our uncertain tax positions whose statute of limitations are expected to expire during the

next twelve months and which would affect our effective tax rate is $5.2 million as of December 31, 2012.

We paid $4.7 million in cash taxes during 2012, as compared to receiving refunds (net of cash taxes paid)

of $33.1 million in cash taxes during 2011. Our 2012 cash taxes paid reflects the continued impact of bonus

depreciation in accordance with the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation

Act of 2010. In 2011, we received refunds of $53.9 million generated in part by the 2009 retroactive change in

51

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES