Frontier Communications 2012 Annual Report Download - page 44

Download and view the complete annual report

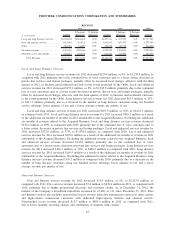

Please find page 44 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and broadband penetration. Traditionally, we lose access lines because of competition, economic conditions,

and by the loss of second lines upon the addition of broadband service. An additional factor was introduced at

the end of the second quarter of 2012 when Frontier began selling Simply Broadband, which is our broadband

service without any wireline circuit switched voice capabilities. We are attracting and retaining customers with

this product, and it has had a positive impact on our residential customer counts and revenues. As a result,

when selling this service to acquire or retain customers, no access lines are sold nor are they counted. Similarly,

during the fourth quarter of 2012, Frontier began selling a satellite broadband product and we are trialing an

AT&T Mobility product bundled with broadband service in selected markets. In both of these cases, a wireline

voice capability may not be included and accordingly, in that situation, an access line will not be counted. In

addition, in our normal course of business, we proactively remove access lines when we upgrade business

customers from multiple circuit switched lines and replace them with data facilities that can be used for voice

services via VoIP. As a result of all of the above, changes in access lines are not necessarily an indication of a

loss of revenue or customers.

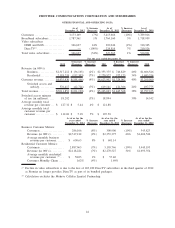

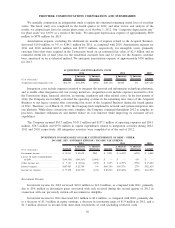

During 2012, we lost 240,500 customers, as compared to a loss of 375,400 customers in 2011. We believe

the improved customer retention in 2012 as compared to 2011 is principally due to our investments in our

network, our local engagement strategy, improved customer service and the introduction of our Simply

Broadband product. Also, during 2012, the average monthly total customer revenue per customer increased

$5.18, or 5%, over 2011. We lost 216,700 residential customers and 23,800 business customers during the year

ended December 31, 2012, or 7% on an annual basis, as compared to 341,400 residential customers and 33,900

business customers lost during the year ended December 31, 2011, or 10% on an annual basis. Average

monthly residential revenue per customer increased $0.63 to $58.03 during 2012 as compared to 2011. This

increase is due to the additional monthly subscriber line charges to our residential customers which were

implemented in the third quarter of 2012, as permitted by the Order, increased penetration of products and

rationalized product pricing. Economic conditions and/or increasing competition could make it more difficult to

sell our bundled service offerings, and cause us to increase our promotions and/or lower our prices for our

products and services, which would adversely affect our revenue, profitability and cash flows.

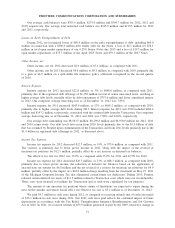

During the year ended December 31, 2012, the Company added 23,400 net broadband subscribers. During

2011, the Company added 45,200 net broadband subscribers. We believe that the lower customer activations

were due to the final systems conversion during 2012 and the delayed roll-out of marketing promotions in the

second half of 2012. The Company plans to significantly expand broadband availability and speed over the next

several years. We expect to continue to increase broadband subscribers in 2013.

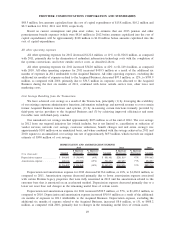

As stated above, while the number of access lines is one metric to gauge certain revenue trends, it is not

necessarily the best or only measure to evaluate our business. Management believes that customer counts and

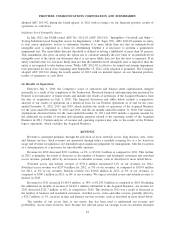

understanding different components of revenue is most important. For this reason, presented in the table titled

“Other Financial and Operating Data” below is an analysis that presents customer counts, average monthly

revenue, products per customer and churn. It also categorizes revenue into customer revenue (business and

residential) and regulatory revenue (switched access and subsidy revenue). Despite the 7% decline in residential

customers and the 8% decline in business customers during 2012, customer revenue (all revenue except

switched access and subsidy revenue) declined in 2012 by only 4 percent as compared to the prior year. The

decline in customers was partially offset by increased penetration of additional products sold to both business

and residential customers, which has increased our average monthly revenue per customer. A substantial further

loss of customers, combined with increased competition and the other factors discussed herein, may cause our

revenue, profitability and cash flows to decrease in 2013.

43

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES