Frontier Communications 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

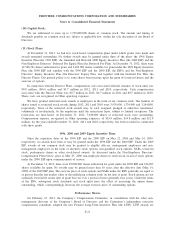

We also have a $40.0 million unsecured letter of credit facility, as amended. The terms of the letter of

credit facility are set forth in a Credit Agreement, dated as of September 8, 2010, among the Company, the

Lenders party thereto, and Deutsche Bank AG, New York Branch (the Bank), as Administrative Agent and

Issuing Bank (the Letter of Credit Agreement). An initial letter of credit for $190.0 million was issued to the

West Virginia Public Service Commission to guarantee certain of our capital investment commitments in West

Virginia in connection with the Transaction. The initial commitments under the Letter of Credit Agreement

expired on September 20, 2011, with the Bank exercising its option to extend $100.0 million of the

commitments to September 20, 2012. On September 11, 2012, the Company entered into an amendment to the

Letter of Credit Agreement to extend $40 million of the commitments to September 20, 2013. Two letters of

credit, one for $20 million expiring March 20, 2013 and the other for $20 million expiring September 20, 2013,

were issued on September 13, 2012. The Company is required to pay an annual facility fee on the available

commitment, regardless of usage. The covenants binding on the Company under the terms of the amended

Letter of Credit Agreement are substantially similar to those in the Company’s other credit facilities, including

limitations on liens, substantial asset sales and mergers, subject to customary exceptions and thresholds.

On April 12, 2010, in anticipation of the Transaction, the entity then holding the assets of the Acquired

Business completed a private offering for $3.2 billion aggregate principal amount of Senior Notes (the Senior

Notes). The gross proceeds of the offering, plus $125.5 million (the Transaction Escrow) contributed by

Frontier, were deposited into an escrow account. Immediately prior to the Transaction, the proceeds of the

notes offering (less the initial purchasers’ discount) were released from the escrow account and used to make a

special cash payment to Verizon, as contemplated by the Transaction, with amounts in excess of the special

cash payment and the initial purchasers’ discount received by the Company ($53.0 million). In addition, the

$125.5 million Transaction Escrow was returned to the Company.

Upon completion of the Transaction on July 1, 2010, we entered into a supplemental indenture with The

Bank of New York Mellon, as Trustee, pursuant to which we assumed the obligations under the Senior Notes.

The Senior Notes were recorded at their fair value on the date of acquisition, which was $3.2 billion.

As of December 31, 2012, we were in compliance with all of our debt and credit facility financial

covenants.

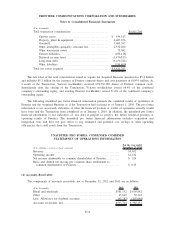

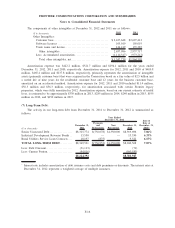

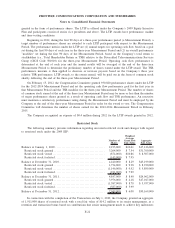

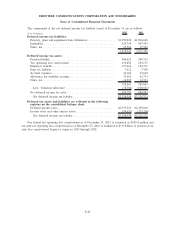

Our principal payments for the next five years are as follows as of December 31, 2012:

($ in thousands)

Principal

Payments

2013 ........................................................................... $ 560,550

2014 ........................................................................... $ 257,916

2015 ........................................................................... $ 732,746

2016 ........................................................................... $ 345,466

2017 ........................................................................... $1,041,186

Other Obligations

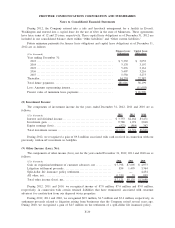

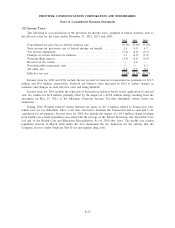

On September 8, 2011, the Company contributed four administrative properties to its qualified defined

benefit pension plan. None of the buildings were under state regulation that required individual PUC approval.

The pension plan obtained independent appraisals of the properties and, based on these appraisals, the pension

plan recorded the contributions at their fair value of $58.1 million. The Company has entered into leases for the

contributed properties for 15 years at a combined aggregate annual rent of $5.8 million. The properties are

managed on behalf of the pension plan by an independent fiduciary, and the terms of the leases were negotiated

with the fiduciary on an arm’s-length basis.

The contribution and leaseback of the properties was treated as a financing transaction and, accordingly,

the Company continues to depreciate the carrying value of the properties in its financial statements and no gain

or loss was recognized. An initial obligation of $58.1 million was recorded in our consolidated balance sheet

within “Other liabilities” for $57.5 million and within “Other current liabilities” for $0.6 million and is reduced

as lease payments are made to the pension plan.

F-19

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements