Frontier Communications 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Strengthened Balance Sheet and Financial Profile

Effective February 16, 2012, our Board of Directors set the annual cash dividend at $0.40 per share. The

Board reduced the dividend from $0.75 per share to $0.40 per share in order to strengthen our balance

sheet and improve operational and financial flexibility.

During 2012, we raised $1.4 billion in three registered debt offerings. We used part of the proceeds to

retire and repurchase an aggregate principal amount of $757.0 million of debt during the year. As a

result, we have excess proceeds from those offerings that are included in cash and cash equivalents as of

the end of the year, which will be used to repurchase or retire existing indebtedness or for general

corporate purposes. Additionally, on January 15, 2013, we retired $502.7 million of our 6.25% Senior

Notes due 2013 with cash on hand.

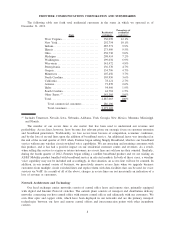

For the year ended December 31, 2012, we generated revenue of $5.0 billion, including customer

revenue of $4.4 billion and regulatory revenue of $0.6 billion, and net cash provided from operating

activities of $1.6 billion. We have a well-balanced debt maturity schedule and we have available

liquidity of over $2.1 billion as of December 31, 2012, comprised of cash and available credit on our

$750 million revolving credit facility.

Our average monthly total revenue per customer in 2012 improved by $5.44, or 4%, to $127.32, as

compared to the prior year. Residential customer monthly churn was further reduced in 2012 to 1.62% from

1.69% in 2011. We added 60,900 direct broadcast satellite (DBS) video subscribers during 2012 with our video

product offered through DISH Network (DISH). We lost 203,100 DirecTV video subscribers in the third

quarter of 2012 when Frontier chose to not offer DirecTV as part of its bundled packages.

We believe that our local engagement strategy enhances customer loyalty. On January 10, 2013, we

strategically realigned our regional reporting structure from six regions to four regions. In addition, we

decentralized certain functions, such as sales and marketing, enabling us to further strengthen our local

engagement strategy, which we believe will deepen our relationships with customers and ultimately improve

customer retention and average revenue per customer. We also realigned certain corporate support functions in

order to achieve improved customer service. This realignment will enable our local leaders to specifically target

sales and marketing efforts to the communities they serve.

Communications Services

We tripled the size of the Company in July 2010 when we acquired the defined assets and liabilities of the

local exchange business and related landline activities of Verizon in Arizona, Idaho, Illinois, Indiana, Michigan,

Nevada, North Carolina, Ohio, Oregon, South Carolina, Washington, West Virginia and Wisconsin and in

portions of California bordering Arizona, Nevada and Oregon (collectively, the Acquired Territories), including

Internet access and long distance services and broadband video provided to designated customers in the

Acquired Territories (which we refer to as the Acquired Business). We financed the purchase of the Acquired

Business (the Transaction) with a distribution of $5.2 billion of common stock to Verizon shareholders (678.5

million shares) and the assumption of $3.5 billion of debt.

As of December 31, 2012, we are the nation’s fourth largest Incumbent Local Exchange Carrier (ILEC),

with 3.2 million customers, 1.8 million broadband connections and 14,700 employees. We operate as an ILEC

in 27 states.

We conduct business with both business and residential customers, and we provide the “last mile” of

telecommunications services to customers in these markets. During 2012, our customer revenue was $4,435.4

million, including business revenue of $2,317.2 million and residential revenue of $2,118.2 million. At

December 31, 2012, we had 1,787,600 broadband subscribers and 346,600 video customers. Our services and

products include:

•data and Internet services

– wireline broadband services

– data transmission services (e.g., DS1, DS3, Ethernet, dedicated Internet Protocol)

– wireless broadband services

3

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES