Frontier Communications 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

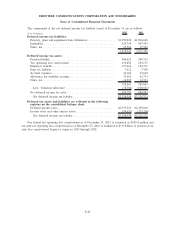

fair value as of the measurement date. The measurement date used to determine pension and other

postretirement benefit measures for the pension plan and the postretirement benefit plan is December 31.

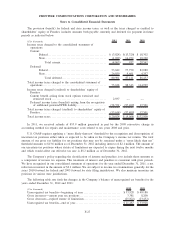

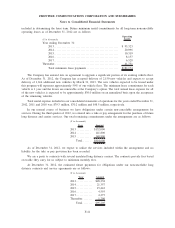

Pension Benefits

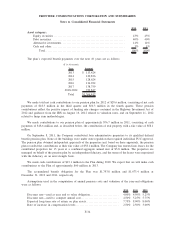

The following tables set forth the pension plan’s projected benefit obligations and fair values of plan assets

as of December 31, 2012 and 2011 and the components of total periodic pension benefit cost for the years

ended December 31, 2012, 2011 and 2010:

($ in thousands) 2012 2011

Change in projected benefit obligation (PBO)

PBO at beginning of year . . . ......................................... $1,799,313 $1,644,657

Service cost ......................................................... 43,688 38,879

Interest cost ......................................................... 78,027 84,228

Actuarial loss ........................................................ 196,304 160,390

Benefits paid ........................................................ (172,601) (128,841)

PBO at end of year .................................................. $1,944,731 $1,799,313

Change in plan assets

Fair value of plan assets at beginning of year . . ....................... $1,257,990 $1,290,274

Actual return on plan assets . ......................................... 139,679 19,883

Employer contributions, net of transfers ............................... 28,598 76,674

Benefits paid ........................................................ (172,601) (128,841)

Fair value of plan assets at end of year ............................... $1,253,666 $1,257,990

Funded status ........................................................ $ (691,065) $ (541,323)

Amounts recognized in the consolidated balance sheet

Current liabilities . . .................................................. $ (60,386) $ —

Pension and other postretirement benefits.............................. $ (630,679) $ (541,323)

Accumulated other comprehensive loss ................................ $ 697,874 $ 575,163

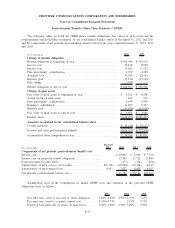

($ in thousands)

Expected in

2013 2012 2011 2010

Components of total periodic pension benefit cost

Service cost . ...................................... $ 43,688 $ 38,879 $ 21,169

Interest cost on projected benefit obligation ......... 78,027 84,228 67,735

Expected return on plan assets . . ................... (95,777) (100,558) (69,831)

Amortization of prior service cost/(credit) . .......... $ 8 (199) (199) (199)

Amortization of unrecognized loss .................. 40,287 29,890 15,364 27,393

Net periodic pension benefit cost ................... 55,629 37,714 46,267

Special termination charge ......................... — — 69

Total periodic pension benefit cost.................. $ 55,629 $ 37,714 $ 46,336

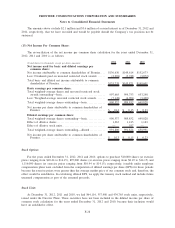

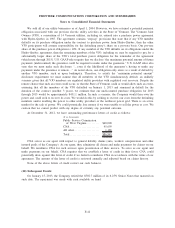

We capitalized $15.8 million, $10.2 million and $8.3 million of pension and OPEB expense into the cost

of our capital expenditures during the years ended December 31, 2012, 2011 and 2010, respectively, as the

costs relate to our engineering and plant construction activities.

Based on current assumptions and plan asset values, we estimate that our 2013 pension and OPEB

expenses will be approximately $100 million to $110 million before amounts capitalized into the cost of capital

expenditures.

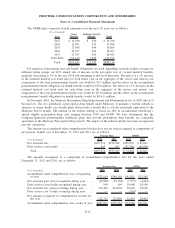

The plan’s weighted average asset allocations at December 31, 2012 and 2011 by asset category are as

follows:

F-33

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements