Frontier Communications 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the varying estimated useful lives of our property, plant and equipment assets, the Company utilizes multiple

asset categories with separately determined composite lives and individual depreciation rates for each asset

category.

Within the composite group method, we group individual assets, including cable and wire, into asset

categories utilizing homogeneous characteristics, where such assets (i) are principally used in the same manner

throughout the company, (ii) are subject to similar operating conditions and (iii) have similar estimated useful

lives. Examples of the asset categories we utilize include aerial cable-copper, aerial cable-fiber, aerial cable-

station connections, underground cable-copper and underground cable-fiber. As a result of continuing changes

in technology, an independent study is conducted annually to update the estimated remaining useful lives of all

individual asset categories. The annual study includes models that consider actual usage, replacement history

and certain assumptions about technology evolution to estimate the remaining useful lives of our asset base by

asset category. The latest study was completed in the fourth quarter of 2012 and after review and analysis of

the results, we adopted new estimated remaining useful lives for certain plant assets as of October 1, 2012, with

an immaterial impact to depreciation expense. Our composite depreciation rate for plant assets was 6.65% as a

result of this study. There have been no significant changes to the ranges of estimated useful lives for the

individual asset categories, including the cable and wire asset groups, during the three years ended December

31, 2012.

Our finite lived intangibles include intangible assets related to the customer base acquired in the

Transaction that were recorded at an estimated fair value of $2.5 billion with an estimated useful life of nine

years for the residential customer list, as distinguished from the 12 years used for the business customer list.

For both classes of assets, the “sum of the years digits” method is used to amortize the intangible assets, which

tracks more closely with the projected revenue stream of each asset class. Our Frontier legacy customer list

intangible assets did not distinguish between business and residential classes and the amortization period was

five years on the straight-line method. We periodically reassess the useful life of our intangible assets to

determine whether any changes to those lives are required.

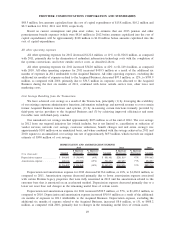

We anticipate depreciation expense of approximately $850 million to $870 million and amortization

expense of approximately $330 million for 2013.

Pension and Other Postretirement Benefits

Our estimates of pension expense, other postretirement benefits including retiree medical benefits and

related liabilities are “critical accounting estimates.” In connection with the completion of the Transaction on

July 1, 2010, certain employees were transferred from various Verizon pension plans into 12 pension plans that

were then merged with the Frontier Communications Pension Plan (the Plan) effective August 31, 2010. The

asset transfers from Verizon to the Plan have been completed. We sponsor a noncontributory defined benefit

pension plan covering a significant number of our current and former Frontier legacy employees and other

postretirement benefit plans that provide medical, dental, life insurance and other benefits for covered retired

employees and their beneficiaries and covered dependents. All of the employees who are still accruing pension

benefits are employees represented by unions. The accounting results for pension and other postretirement

benefit costs and obligations are dependent upon various actuarial assumptions applied in the determination of

such amounts. These actuarial assumptions include the following: discount rates, expected long-term rate of

return on plan assets, future compensation increases, employee turnover, healthcare cost trend rates, expected

retirement age, optional form of benefit and mortality. We review these assumptions for changes annually with

our independent actuaries. We consider our discount rate and expected long-term rate of return on plan assets to

be our most critical assumptions.

The discount rate is used to value, on a present value basis, our pension and other postretirement benefit

obligations (OPEB) as of the balance sheet date. The same rate is also used in the interest cost component of

the pension and postretirement benefit cost determination for the following year. The measurement date used in

the selection of our discount rate is the balance sheet date. Our discount rate assumption is determined annually

with assistance from our actuaries based on the pattern of expected future benefit payments and the prevailing

rates available on long-term, high quality corporate bonds that approximate the benefit obligation.

39

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES