Energizer 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

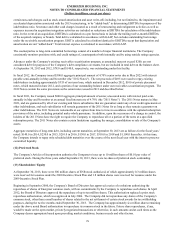

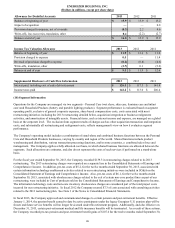

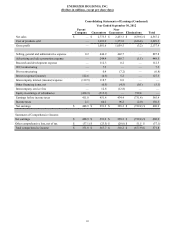

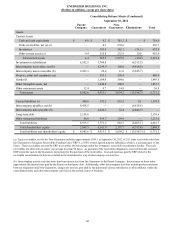

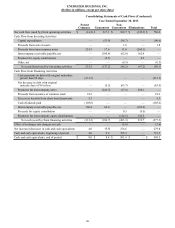

(19) Quarterly Financial Information – (Unaudited)

The results of any single quarter are not necessarily indicative of the Company’s results for the full year. Net earnings of the

Company are impacted in the first quarter by the additional battery product sales volume associated with the December holiday

season. Data are computed independently for each of the periods presented. As a result, the sum of the amounts for the quarter

may not equal the total for the year.

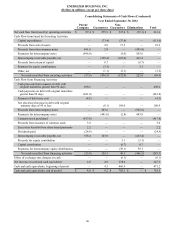

Fiscal 2013 First Second Third Fourth

Net sales $ 1,192.5 $ 1,095.9 $ 1,111.5 $ 1,066.1

Gross profit 561.6 530.7 510.4 501.6

Net earnings 129.8 84.9 87.2 105.1

Earnings per share:

Basic $ 2.10 $ 1.37 $ 1.40 $ 1.69

Diluted $ 2.07 $ 1.35 $ 1.38 $ 1.66

Items increasing/(decreasing) net earnings:

2013 restructuring (1) $ (30.7)$ (24.8)$ (19.1)$ (23.3)

Net pension/post-retirement gains 23.5 — — 44.0

ASR integration/transaction costs (0.6)(0.4)(0.1)(0.5)

Other realignment/integration (0.1)(0.2) 0.1 (0.8)

Venezuela devaluation/other impacts 0.4 (6.3)(0.2)(0.2)

Adjustments to valuation allowances and prior years tax

accruals — 3.0 7.2 (1.9)

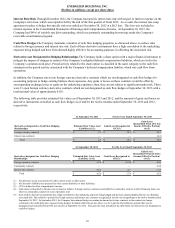

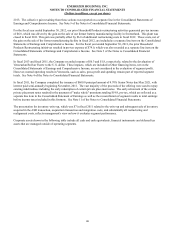

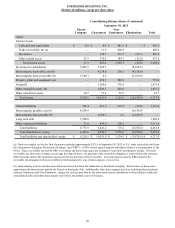

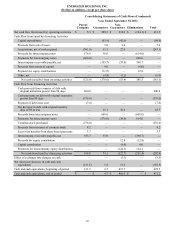

Fiscal 2012 First Second Third Fourth

Net sales $ 1,198.1 $ 1,101.8 $ 1,124.1 $ 1,143.2

Gross profit 564.5 517.2 528.8 527.4

Net earnings 143.8 77.9 70.2 117.0

Earnings per share:

Basic $ 2.17 $ 1.19 $ 1.08 $ 1.86

Diluted $ 2.15 $ 1.17 $ 1.06 $ 1.84

Items increasing/(decreasing) net earnings:

2013 restructuring $ — $ — $ — $ (4.6)

Prior restructuring 7.6 (1.2)(0.4)(0.3)

ASR integration/transaction costs (0.9)(1.5)(1.5)(1.3)

Other realignment/integration — (0.2)(0.2)(0.1)

Early termination of interest rate swap — — (1.1)—

Litigation provision — — (8.5) 8.5

Adjustments to valuation allowances and prior years tax

accruals — — 4.2 2.8

(1) Includes net of tax costs of $3.4 for the twelve months ended September 30, 2013, associated with certain information technology and related activities,

which are included in SG&A on the Consolidated Statement of Earnings and Comprehensive Income. Additionally, this includes net of tax costs of $3.8, for

the twelve months ended September 30, 2013, associated with obsolescence charges related to the exit of certain non-core product lines as a result of our

restructuring, which are included in cost of products sold on the Consolidated Statement of Earnings and Comprehensive Income.

89