Energizer 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

EPS CAGR of at least 12% is achieved, with smaller percentages vesting if the Company achieves an EPS CAGR between 5%

and 12%. In addition, the terms of the performance awards provide that the awards vest upon death, disability and in some

instances upon change of control and potential pro rata vesting for retirement based on age and service requirements. The total

performance award expected to vest is being amortized over the vesting period.

In December 2012, the Company granted RSE awards to a group of key employees which included approximately 188,300

shares that vest ratably over four years or upon death or change of control. At the same time, the Company granted two RSE

awards to a group of key executives. One grant includes approximately 94,100 shares and vests, in most cases, on the third

anniversary of the date of grant or upon death or change of control. The second grant includes approximately 205,600 shares,

which vests on the date that the Company publicly releases its earnings for its 2015 fiscal year, contingent upon achievement of

performance targets with respect to adjusted cumulative earnings before interest taxes depreciation and amortization (EBITDA)

and adjusted return on invested capital, weighted equally, and subject to adjustment based on relative total shareholder return

during the three year performance period based on a relevant group of industrial and consumer goods companies. In addition,

the terms of the performance awards provide that the awards vest upon death and in some instances upon change of control and

potential pro rata vesting for retirement based on age and service requirements. The total performance awards expected to vest

will be amortized over the vesting period. The closing stock price on the date of the grant used to determine the award

estimated fair value was $81.45. The awards that are contingent upon achievement of performance targets have a 7% fair value

premium to the closing stock price on the date of the grant based on a simulation of outcomes under the relative total

shareholders' return metric required by the Accounting Standards Codification ("ASC") section 718.

In November 2013, which is fiscal 2014, the Company granted RSE awards to a group of key employees which included

approximately 179,800 shares that vest ratably over four years or upon death or change of control. At the same time, the

Company granted two RSE awards to a group of key executives. One grant includes approximately 39,800 shares and vests, in

most cases, on the third anniversary of the date of grant or upon death or change of control. The second grant includes

approximately 238,600 shares, which vests on the date that the Company publicly releases its earnings for its 2016 fiscal year,

contingent upon achievement of performance targets with respect to adjusted cumulative earnings before interest taxes

depreciation and amortization (EBITDA) and adjusted return on invested capital, weighted equally, and subject to adjustment

based on relative total shareholder return during the three year performance period based on a relevant group of industrial and

consumer goods companies. In addition, the terms of the performance awards provide that the awards vest upon death and in

some instances upon change of control and potential pro rata vesting for retirement based on age and service requirements. The

total performance awards expected to vest will be amortized over the vesting period. The closing stock price on the date of the

grant used to determine the award estimated fair value was $101.56. The awards that are contingent upon achievement of

performance targets will have a fair value premium added or subtracted to the closing stock price on the date of the grant based

on a simulation of outcomes under the relative total shareholders' return metric required by the Accounting Standards

Codification ("ASC") section 718.

The Company records estimated expense for the performance based grants based on target achievement of performance metrics

for the three year period for each respective program unless evidence exists that achievement above or below target for the

applicable performance metric is more likely to occur. The estimated fair value of the award is determined using the closing

share price of the Company's common stock on the date of the grant.

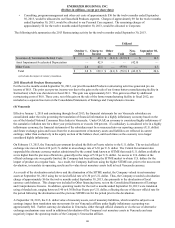

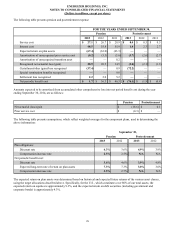

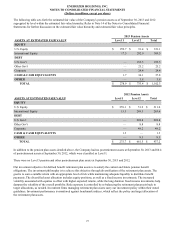

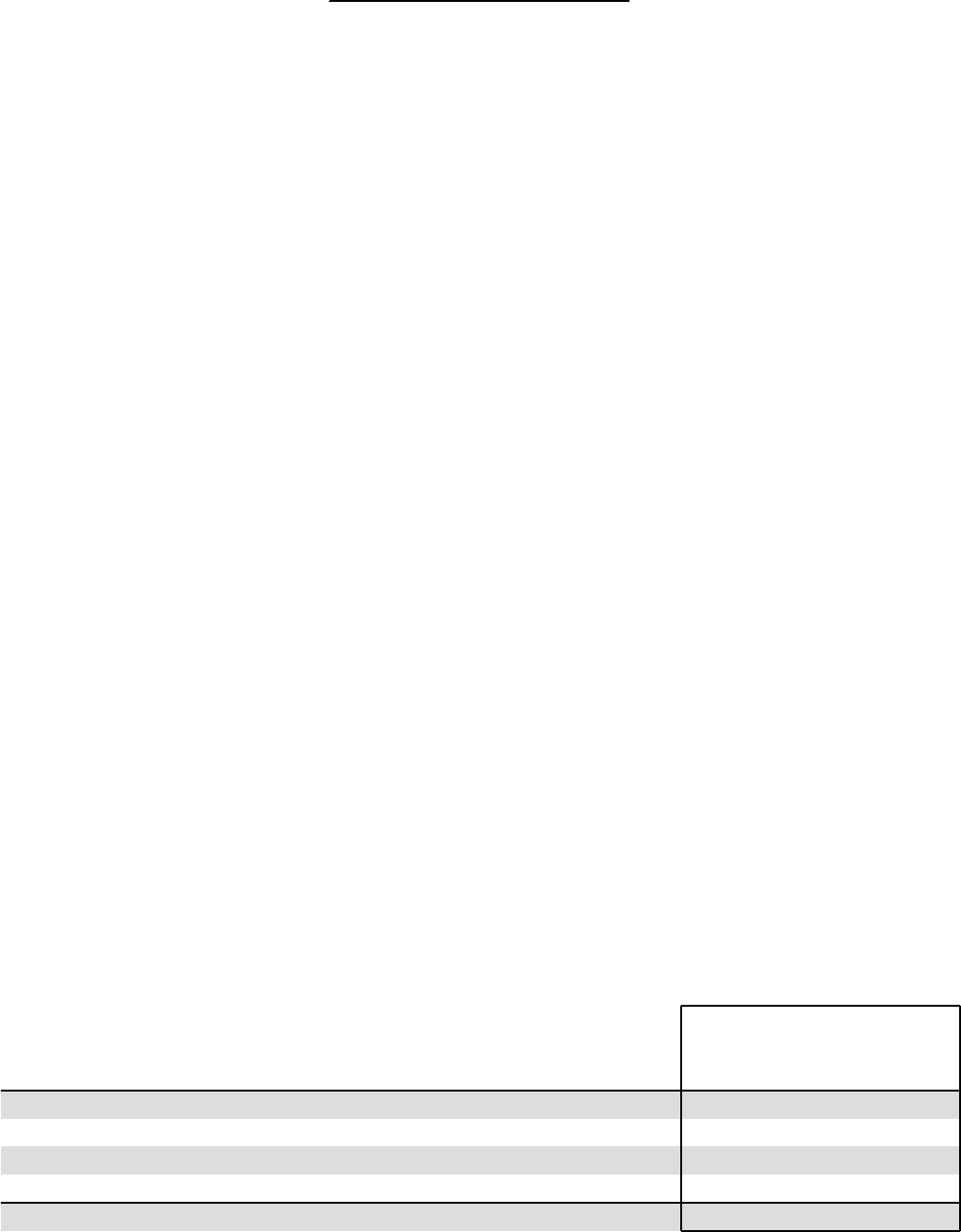

The following table summarizes RSE activity during the current fiscal year (shares in millions):

Shares

Weighted-Average

Grant Date

Estimated Fair

Value

Nonvested RSE at October 1, 2012 1.96 $70.38

Granted 0.50 84.33

Vested (0.62) 67.92

Canceled (0.20) 69.10

Nonvested RSE at September 30, 2013 1.64 $75.75

As of September 30, 2013, there was an estimated $47.8 of total unrecognized compensation costs related to RSE granted to

date, which will be recognized over a weighted-average period of approximately 1.1 years. The amount recognized may vary as

72