Energizer 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

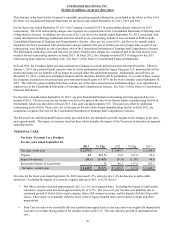

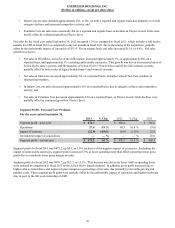

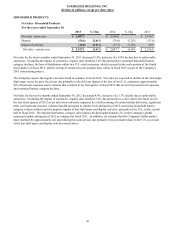

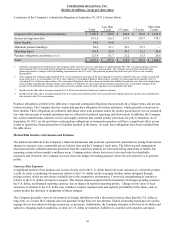

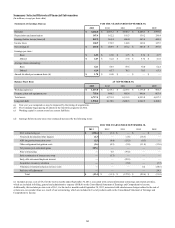

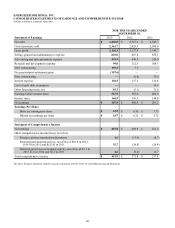

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

have a material effect on our total capital and operating expenditures, consolidated earnings or competitive position. However,

current environmental spending estimates could be modified as a result of changes in our plans or our understanding of

underlying facts, changes in legal requirements, including any requirements related to global climate change, or other factors.

Inflation

Management recognizes that inflationary pressures may have an adverse effect on the Company through higher material, labor

and transportation costs, asset replacement costs and related depreciation, and health care and other costs. In general, the

Company has been able to offset or minimize inflation effects through a variety of methods including pricing actions, cost

reductions and productivity improvements. We can provide no assurance that such mitigation will be available in the future.

Legal and other contingencies

The Company and its subsidiaries are parties to a number of legal proceedings in various jurisdictions arising out of the

operations of the Company's businesses. Many of these legal matters are in preliminary stages and involve complex issues of

law and fact, and may proceed for protracted periods of time. The amount of liability, if any, from these proceedings cannot be

determined with certainty. However, based upon present information, the Company believes that its liability, if any, arising

from such pending legal proceedings, asserted legal claims and known potential legal claims which are likely to be asserted, are

not reasonably likely to be material to the Company's financial position, results of operations, or cash flows, taking into account

established accruals for estimated liabilities.

Critical Accounting Policies

The methods, estimates, and judgments the Company uses in applying its most critical accounting policies have a significant

impact on the results the Company reports in its consolidated financial statements. Specific areas, among others, requiring the

application of management's estimates and judgment include assumptions pertaining to accruals for consumer and trade-

promotion programs, pension and postretirement benefit costs, share-based compensation, future cash flows associated with

impairment testing of goodwill and other long-lived assets, credit worthiness of customers, uncertain tax positions, the

reinvestment of undistributed foreign earnings, tax valuation allowances, and legal and environmental matters. On an ongoing

basis, the Company evaluates its estimates, but actual results could differ materially from those estimates.

The Company's most critical accounting policies are: revenue recognition; pension and other postretirement benefits, share-

based compensation, the valuation of long-lived assets including property, plant and equipment, income taxes including

uncertain tax positions and the carrying value of intangible assets and the related impairment testing of goodwill and other

indefinite-lived intangible assets. The Company's critical accounting policies have been reviewed with the Audit Committee of

the Board of Directors. A summary of the Company's significant accounting policies is contained in Note 2 of the Notes to

Consolidated Financial Statements. This listing is not intended to be a comprehensive list of all of the Company's accounting

policies.

• Revenue Recognition The Company derives revenues from the sale of its products. Revenue is recognized when title,

ownership and risk of loss pass to the customer. When discounts are offered to customers for early payment, an

estimate of the discounts is recorded as a reduction of net sales in the same period as the sale. Standard sales terms are

final and, except for seasonal sun care returns, which are discussed in detail in the next paragraph, returns or

exchanges are not permitted unless a special exception is made; reserves are established and recorded in cases where

the right of return exists for a particular sale.

Under certain circumstances, we allow customers to return sun care products that have not been sold by the end of the

sun care season, which is normal practice in the sun care industry. We record sales at the time the title, ownership and

risk of loss pass to the customer. The terms of these sales vary but, in all instances, the following conditions are met:

the sales arrangement is evidenced by purchase orders submitted by customers; the selling price is fixed or

determinable; title to the product has transferred; there is an obligation to pay at a specified date without any

additional conditions or actions required by the Company; and collection is reasonably assured. Simultaneous with the

sale, we reduce sales and cost of sales, and reserve amounts on our consolidated balance sheet for anticipated returns

based upon an estimated return level, in accordance with GAAP. Customers are required to pay for the sun care

product purchased during the season under the required terms. We generally receive returns of U.S. sun care products

from September through January following the summer sun care season. We estimate the level of sun care returns

using a variety of inputs including historical experience, consumption trends during the sun care season and inventory

positions at key retailers as the sun care season progresses. We monitor shipment activity and inventory levels at key

retailers during the season in an effort to more accurately estimate potential returns. This allows the Company to

manage shipment activity to our customers, especially in the latter stages of the sun care season, to reduce the

47