Energizer 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

under the Stayfree, Carefree and o.b. brands. The acquisition of the Stayfree pad, Carefree liner and o.b. tampon brands, in

October 2013, should more than double the Company's reported sales of feminine care products as compared to fiscal 2013,

adding improved scale in the category in North America, and providing opportunities to cross-promote and innovate across a

wider spectrum in feminine hygiene.

In infant care, we market a broad range of products including bottles, cups, and mealtime products under the Playtex brand

name. We also offer a line of pacifiers, including the Ortho-Pro and Binky pacifiers. We believe our Playtex Diaper Genie

brand of diaper disposal systems leads the U.S. diaper pail category. The Diaper Genie brand consists of the diaper pail unit and

refill liners. The refill liners individually seal diapers in an odor-proof plastic film. We extended this technology, including the

pail and oder-proof plastic film refills to the pet care category with the introduction of Litter Genie in late fiscal 2012, a product

designed to provide a more convenient and effective way for cat owners to dispose of litter.

Energizer's Household Products division manufactures and markets one of the most extensive product portfolios in household

batteries, specialty batteries and portable lighting. Energizer is the successor to over 100 years of expertise in the battery and

portable lighting products industries. Its brand names Energizer and Eveready have worldwide recognition for quality and

dependability, and are marketed and sold around the world.

In household batteries, we offer batteries using carbon zinc, alkaline, rechargeable and lithium technologies. These products are

marketed and sold in the price, premium and performance segments. This allows us to penetrate a broad range of the market

and meet most consumer needs. We distribute our portfolio of household and specialty batteries and portable lighting products

through a global distribution network, which also provides a platform for the distribution of our personal care products.

Unless we indicate otherwise, we base the information concerning our industry contained or incorporated by reference herein

on our general knowledge of and expectations concerning the industry. Our market position, market share and industry market

size is based on our estimates using our internal data and estimates based on data from various industry sources, our internal

research and adjustments and assumptions that we believe to be reasonable. We have not independently verified data from

industry sources and cannot guarantee their accuracy or completeness. In addition, we believe that data regarding the industry,

market size and our market position and market share within such industry provide general insights but are inherently

imprecise. Further, our estimates and assumptions involve risks and uncertainties and are subject to change based on various

factors, including those discussed in the “Risk Factors” section of this Annual Report on Form 10-K. These and other factors

could cause results to differ materially from those expressed in the estimates and assumptions.

We use Energizer, Schick, Wilkinson Sword, Playtex, Edge, Skintimate, Personna, and the Energizer, Schick, Wilkinson Sword,

Playtex, Edge, Skintimate, Stayfree, Carefree and o.b. logos as our trademarks or those of our subsidiaries. Product names appearing

throughout in italics are trademarks of Energizer Holdings, Inc. or its subsidiaries. This Annual Report also may refer to brand

names, trademarks, service marks and trade names of other companies and organizations, and these brand names, trademarks,

service marks and trade names are the property of their respective owners.

Fiscal 2013 Summary

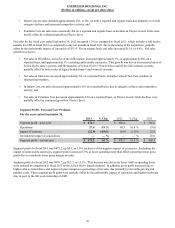

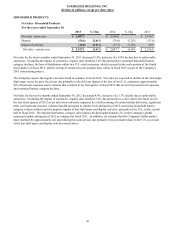

In fiscal 2013, the Company reported net earnings of $407.0 and earnings per diluted share of $6.47 (adjusted net earnings of

$438.0 and adjusted net earnings per diluted share of $6.96 as shown in the reconciliation below, both of which are non-GAAP

measures).

Following is a summary of key fiscal year 2013 results. All comparisons are to fiscal 2012, unless otherwise noted.

• Net earnings per diluted share of $6.47, up 4.0%; adjusted net earnings per diluted share of $6.96, up 12.3% (as shown

in the below reconciliation),

• Net sales down 2.2% (1.1% organically, as shown in the below reconciliation) due primarily to continued category

declines in Household Products (down 2.6% organically) and extensive competitive activity in Personal Care

(essentially flat organically),

• Gross margin up 30 basis points as a percent of net sales on a reported basis, and up 80 basis points excluding the

unfavorable impact of currencies,

• SG&A down $62.8 and down 90 basis points as a percent of net sales,

• Improved average managed working capital, as defined, as a percent of net sales, which declined to 18.1% for fiscal

2013 as compared to 21.4% in fiscal 2012 and as compared to 22.9% in fiscal 2011. See "Liquidity and Capital

Resources - Operating Activities" for definition of managed working capital,

32