Energizer 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

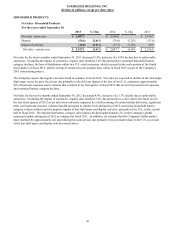

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

• Net cash flow from operating activities was $750.0, up $118.4 or 19% as compared to fiscal 2012 despite significant

cash restructuring costs in fiscal 2013 due primarily to the improvement in managed working capital, and

• Cash payments of dividends totaling $105.6 to common shareholders, as fiscal 2013 was the first full year of quarterly

dividends for Energizer.

2013 Developments

Restructuring Initiatives

In November 2012, the Company’s Board of Directors authorized an enterprise-wide restructuring, which included the

following objectives:

• Reduce global workforce by more than 10%, or approximately 1,500 colleagues;

• Rationalize and streamline operations facilities in the Household Products Division;

• Consolidate general and administrative functional support across the organization;

• Streamline the Household Products Division product portfolio to enable increased focus on our core battery and

portable lighting businesses;

• Streamline the marketing organization within our Household Products Division;

• Optimize our go-to-market strategies and organization structures within our international markets;

• Reduce overhead spending, including changes to benefit programs and other targeted spending reductions; and

• Create a center-led purchase function to drive procurement savings.

The Company estimates that total gross savings from this program will be $225, and will be fully realized in fiscal 2015. In

addition, the Company estimates total pre-tax restructuring and related costs needed to execute this program will be near $250.

During fiscal 2013, significant progress has been made against all of the aforementioned objectives.

For the twelve months ended September 30, 2013, the Company estimates that gross restructuring savings were approximately

$103. In addition, headcount reductions have totaled approximately 1,400 to date. The Company estimates that an additional

$80 to $100 of gross savings will be realized during fiscal 2014, which would bring the gross total project savings to near $200

by the end of fiscal 2014. The overall project is ahead of schedule and the total gross savings estimate remains $225.

For the twelve months ended September 30, 2013, the Company recorded pre-tax expense of $139.3 for the 2013 Restructuring

plan including:

• Non-cash asset impairment charges of $19.3 and accelerated depreciation charges of $23.6 for the twelve months

ended September 30, 2013 related primarily to completed and upcoming plant closures,

• Severance and related benefit costs of $49.3 for the twelve months ended September 30, 2013, associated with staffing

reductions that have been identified to date, and

• Consulting, program management and other charges associated with the restructuring of $47.1 for the twelve months

ended September 30, 2013.

In addition, the Company recorded approximately $5 for certain information technology enablement costs (included in SG&A

on the Consolidated Statement of Earnings and Comprehensive Income) and approximately $6 of obsolescence charges related

to the exit of certain non-core product lines (included in cost of products sold in the Consolidated Statement of Earnings and

Comprehensive Income). The information technology and non-core inventory obsolescence charges are considered part of the

total project costs incurred for our restructuring initiative.

Pension and Post-Retirement Benefit Changes

In the first fiscal quarter of 2013, the Company approved and communicated changes to its U.S. pension plan, which is the most

significant of the Company's pension obligations. Effective January 1, 2014, the pension benefit earned to date by active

participants under the legacy Energizer U.S. pension plans will be frozen and future service benefits will no longer be accrued

under this retirement program. As a result of this plan change, the Company recorded a pre-tax curtailment gain of $37.4 in the

first fiscal quarter of 2013.

In July 2013, the Company finalized and communicated a decision to discontinue certain post-retirement benefits. The

communication was provided to all eligible participants of the impacted plans in late July 2013. The communication advised the

impacted participants that the Company would discontinue all benefits associated with the impacted plans effective December

31, 2013. As a result of this action, the Company recorded a gain of approximately $70 in the fourth fiscal quarter of 2013.

33