Energizer 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

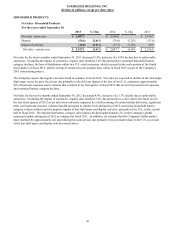

• Infant Care net sales declined approximately $11, or 6%, on both a reported and organic basis due primarily to overall

category declines and increased competitive activity, and

• Feminine Care net sales were essentially flat on a reported and organic basis as declines in Playtex Gentle Glide were

mostly offset by continued growth in Playtex Sport.

Net sales for the fiscal year ended September 30, 2012 increased 1.2% as compared to fiscal 2011, which includes a full twelve

months for ASR in fiscal 2012 as compared to only ten months in fiscal 2011 due to the timing of the acquisition, partially

offset by the unfavorable impact of currencies of $31.4. On an organic basis, net sales increased $15.0, or 0.6%. Net sales

growth was due to:

• Net sales in Wet Shave, inclusive of the ASR impact, increased approximately 3%, or approximately $50, on a

reported basis, and approximately 5% excluding unfavorable currencies. This growth was driven by increased sales of

Schick Hydro men's systems, and the launches of Schick Hydro 5 Power Select and Hydro Silk women's systems,

partially offset by lower sales of legacy branded men's and women's systems,

• Net sales in Skin Care increased approximately $5, on a reported basis, on higher sales of Sun Care products in

international markets,

• In Infant Care, net sales decreased approximately $18 on a reported basis, due to category softness and competitive

activity, and

• Net sales in Feminine Care decreased approximately $10 on a reported basis, as Playtex Gentle Glide declines were

partially offset by continued growth in Playtex Sport.

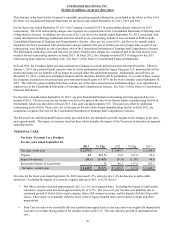

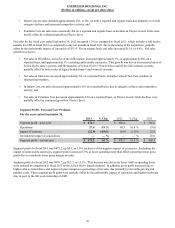

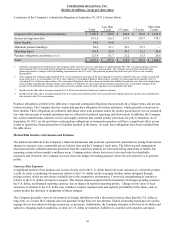

Segment Profit - Personal Care Products

For the years ended September 30,

2013 % Chg 2012 % Chg 2011

Segment profit - prior year $ 470.7 $ 408.4 $ 366.6

Operations 27.4 5.9 % 68.3 16.8 % (9.0)

Impact of currency (22.9)(4.9)% (6.0) (1.5)% 22.8

Incremental impact of acquisitions ——% — — % 28.0

Segment profit - current year $ 475.2 1.0 % $ 470.7 15.3 % $ 408.4

Segment profit for fiscal 2013 was $475.2, up $4.5, or 1.0%, inclusive of the negative impact of currencies. Excluding the

impact of unfavorable currencies, segment profit increased 5.9% as lower spending more than offset somewhat lower gross

profit due to a modestly lower gross margin on sales.

Segment profit for fiscal 2012 was $470.7, up $62.3, or 15.3%. This increase was driven by lower A&P as spending levels

were reduced in comparison to fiscal 2011 as the Schick Hydro launch matured. In addition, gross profit increased due to

higher sales as noted above and improved gross margin as a percentage of net sales due primarily to favorable pricing and

product costs. These segment profit gains were partially offset by the unfavorable impact of currencies and higher overheads

due, in part, to the full year ownership of ASR.

39