Energizer 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

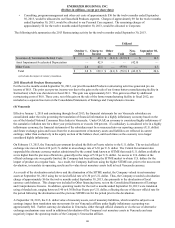

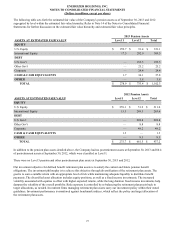

vesting for a portion of the awards depends on the achievement of the established performance targets. The weighted-average

estimated fair value for RSE granted in fiscal 2013, 2012 and 2011 was $84.3, $70.3, and $74.9, respectively. The estimated

fair value of RSE vested in fiscal 2013, 2012 and 2011 was $46.7, $29.3, and $25.3, respectively.

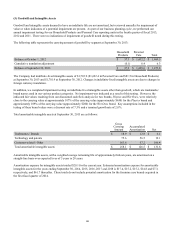

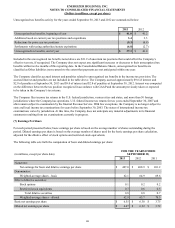

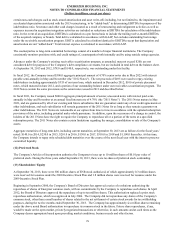

(9) Pension Plans and Other Postretirement Benefits

The Company has several defined benefit pension plans covering substantially all of its employees in the U.S. and certain

employees in other countries. The plans provide retirement benefits based, in certain circumstances, on years of service and on

earnings.

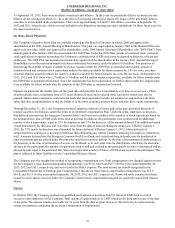

In the first quarter of fiscal 2013, the Company approved and communicated changes to its U.S. pension plan, which is the

most significant of the Company's pension obligations. Effective January 1, 2014, the pension benefit earned at that date by

active participants under the legacy Energizer U.S. pension plans will be frozen and future service benefits will no longer be

accrued under these retirement programs. For the twelve months ended September 30, 2013, the Company recorded a non-

cash, pre-tax curtailment gain of $37.4 as a result of this plan change.

In the fourth quarter of fiscal 2013, the Company finalized and communicated a decision to discontinue certain post-retirement

medical and life insurance benefits. The communication was provided to all eligible participants of the impacted plans and

advised that the Company would discontinue all benefits associated with the impacted plans effective December 31, 2013. As a

result of this action, the Company recorded a non-cash, pre-tax gain of $70.2 in the fourth fiscal quarter of 2013. The gains

represent the combined effect of the acceleration of a prior service cost credit and other gains and the elimination of the

majority of the post-retirement benefit liability.

The combined impact of the non-cash gains associated with the pension and other post-retirement benefit changes noted above,

which was $107.6 pre-tax, was reported on a separate line item in the Consolidated Statement of Earnings and Comprehensive

Income.

The Company also sponsors or participates in a number of other non-U.S. pension arrangements, including various retirement

and termination benefit plans, some of which are required by local law or coordinated with government-sponsored plans, which

are not significant in the aggregate and, therefore, are not included in the information presented in the following tables.

73