Energizer 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(5) Goodwill and Intangible Assets

Goodwill and intangible assets deemed to have an indefinite life are not amortized, but reviewed annually for impairment of

value or when indicators of a potential impairment are present. As part of our business planning cycle, we performed our

annual impairment testing for our Household Products and Personal Care reporting units in the fourth quarter of fiscal 2013,

2012 and 2011. There were no indications of impairment of goodwill noted during this testing.

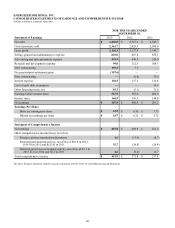

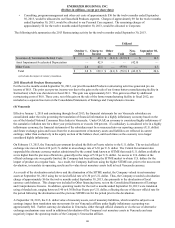

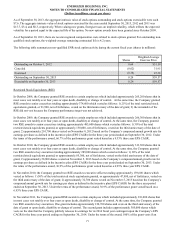

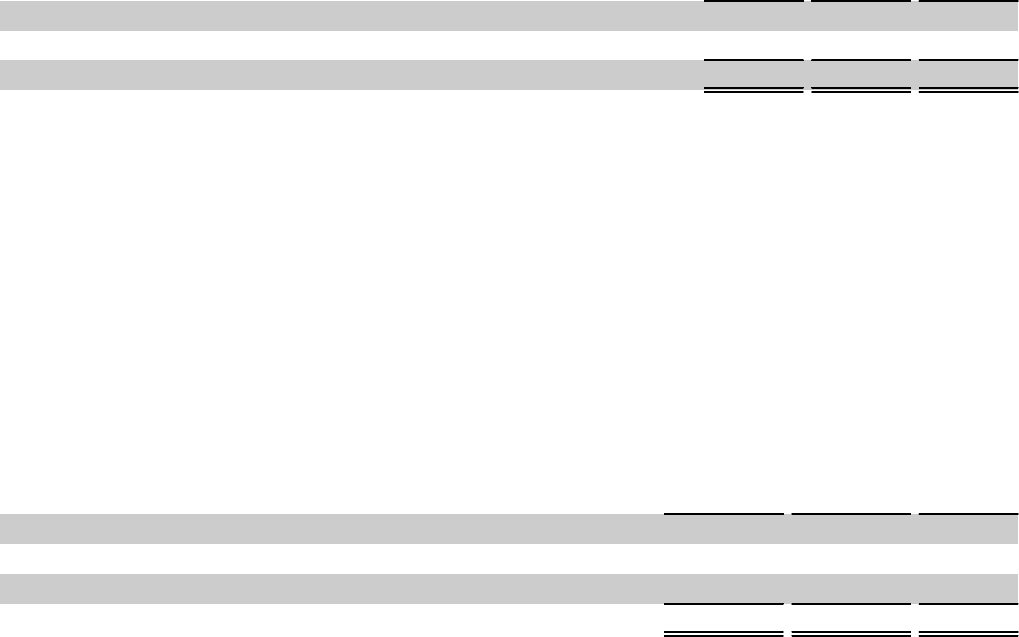

The following table represents the carrying amount of goodwill by segment at September 30, 2013:

Household

Products

Personal

Care Total

Balance at October 1, 2012 $ 37.3 $ 1,432.2 $ 1,469.5

Cumulative translation adjustment (0.1) 6.4 6.3

Balance at September 30, 2013 $ 37.2 $ 1,438.6 $ 1,475.8

The Company had indefinite-lived intangible assets of $1,703.9 ($1,622.4 in Personal Care and $81.5 in Household Products)

at September 30, 2013 and $1,701.9 at September 30, 2012. Changes in indefinite-lived intangible assets are due to changes in

foreign currency translation.

In addition, we completed impairment testing on indefinite-lived intangible assets other than goodwill, which are trademarks/

brand names used in our various product categories. No impairment was indicated as a result of this testing. However, the

indicated fair values resulting from our discounted cash flow analysis for two brands, Playtex and Wet Ones, were relatively

close to the carrying value at approximately 107% of the carrying value (approximately $650) for the Playtex brand and

approximately 109% of the carrying value (approximately $200) for the Wet Ones brand. Key assumptions included in the

testing of these brand values were a discount rate of 7.5% and a terminal growth rate of 2.0%.

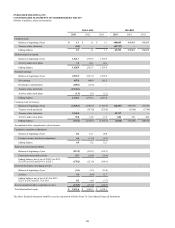

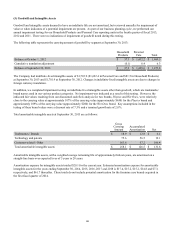

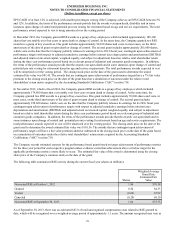

Total amortizable intangible assets at September 30, 2013 are as follows:

Gross

Carrying

Amount

Accumulated

Amortization Net

Tradenames / Brands $ 18.9 $ 12.8 $ 6.1

Technology and patents 75.6 56.5 19.1

Customer-related / Other 163.6 57.2 106.4

Total amortizable intangible assets $ 258.1 $ 126.5 $ 131.6

Amortizable intangible assets, with a weighted average remaining life of approximately thirteen years, are amortized on a

straight-line basis over expected lives of 5 years to 20 years.

Amortization expense for intangible assets totaled $20.1 for the current year. Estimated amortization expense for amortizable

intangible assets for the years ending September 30, 2014, 2015, 2016, 2017 and 2018 is $17.4, $15.2, $15.2, $14.8 and $7.3,

respectively, and $61.7 thereafter. These totals do not include potential amortization for the feminine care brands acquired in

the first fiscal quarter of 2014.

66