Energizer 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per share)

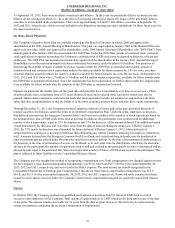

The Company uses raw materials that are subject to price volatility. The Company may use hedging instruments as it desires to

reduce exposure to variability in cash flows associated with future purchases of commodities. In September 2012, the Company

discontinued hedge accounting treatment for its then-existing zinc contracts as these contracts no longer met the accounting

requirements for classification as cash flow hedges because of an ineffective correlation to the underlying zinc exposure being

hedged. There were no outstanding derivative contracts for the future purchases of commodities as of September 30, 2013.

Through December 2012, the Company had specific interest rate risk with respect to interest expense on the Company's term

loan, which was fully repaid by the end of the first quarter of fiscal 2013. As a result, the then-existing interest rate swap

agreement in place to hedge this specific risk was settled on November 30, 2012 for a $0.3 loss. This loss was included in

interest expense in the Consolidated Statements of Earnings and Comprehensive Income. At September 30, 2013, the

Company had $99.0 of variable rate debt outstanding.

For further discussion see Notes 11 and 14 of the Notes to Consolidated Financial Statements.

Cash Equivalents – Cash equivalents are all considered to be highly liquid investments with a maturity of three months or less

when purchased. At September 30, 2013, the Company had $998.3 in available cash, substantially all of which was outside of

the U.S. The Company has extensive operations, including a significant manufacturing footprint outside of the U.S. At

September 30, 2013, substantially all of the Company's cash is denominated in foreign currencies. We manage our worldwide

cash requirements by reviewing available funds among the many subsidiaries through which we conduct our business and the

cost effectiveness with which those funds can be accessed. The repatriation of cash balances from certain of our subsidiaries

could have adverse tax consequences or be subject to regulatory capital requirements; however, those balances are generally

available without legal restrictions to fund ordinary business operations. U.S. income taxes have not been provided on a

significant portion of undistributed earnings of international subsidiaries. Our intention is to reinvest these earnings indefinitely.

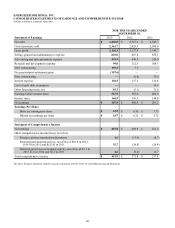

Cash Flow Presentation – The Consolidated Statements of Cash Flows are prepared using the indirect method, which

reconciles net earnings to cash flow from operating activities. The reconciliation adjustments include the removal of timing

differences between the occurrence of operating receipts and payments and their recognition in net earnings. The adjustments

also remove cash flows arising from investing and financing activities, which are presented separately from operating activities.

Cash flows from foreign currency transactions and operations are translated at an average exchange rate for the period. Cash

flows from hedging activities are included in the same category as the items being hedged, which is primarily operating

activities. Cash payments related to income taxes are classified as operating activities.

Accounts Receivable Valuation – Accounts receivable are stated at their net realizable value. The allowance for doubtful

accounts reflects the Company’s best estimate of probable losses inherent in the receivables portfolio determined on the basis

of historical experience, specific allowances for known troubled accounts and other currently available information. Bad debt

expense is included in Selling, general and administrative expense (SG&A) in the Consolidated Statements of Earnings and

Comprehensive Income.

Inventories – Inventories are valued at the lower of cost or market, with cost generally being determined using average cost or

the first-in, first-out (FIFO) method.

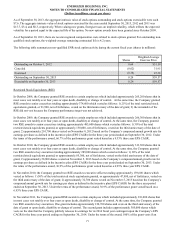

As part of the American Safety Razor (ASR) acquisition in fiscal 2011, the Company recorded an increase in the estimated fair

value of inventory acquired of $7.0, to bring the carrying value of the inventory purchased to an amount which approximated

the estimated selling price of the finished goods on hand at the acquisition closing date less the sum of (a) costs to sell and

distribute and (b) a reasonable profit allowance for these efforts by the acquiring entity. As the inventory was sold during the

first and second quarter of fiscal 2011 the adjustments were charged to cost of products sold in those respective periods.

Capitalized Software Costs – Capitalized software costs are included in other assets. These costs are amortized using the

straight-line method over periods of related benefit ranging from three to seven years. Expenditures related to capitalized

software are included in the Capital expenditures caption in the Consolidated Statements of Cash Flows. Amortization expense

was $2.0, $2.7, and $5.2 in fiscal 2013, 2012 and 2011, respectively.

Property, Plant and Equipment, net – Property, plant and equipment, net is stated at historical costs. Property, plant and

equipment acquired as part of a business combination is recorded at estimated fair value. Expenditures for new facilities and

expenditures that substantially increase the useful life of property, including interest during construction, are capitalized and

reported in the Capital expenditures caption in the Consolidated Statements of Cash Flows. Maintenance, repairs and minor

renewals are expensed as incurred. When property is retired or otherwise disposed of, the related cost and accumulated

61