Energizer 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

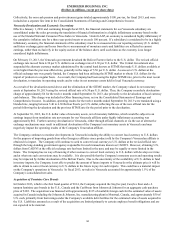

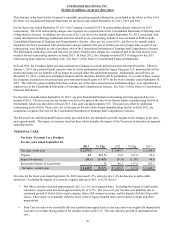

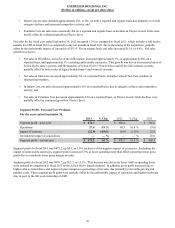

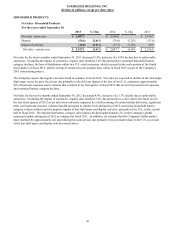

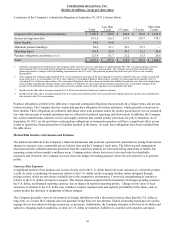

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

Collectively, the non-cash pension and post-retirement gains totaled approximately $108, pre-tax, for fiscal 2013, and were

included on a separate line item in the Consolidated Statements of Earnings and Comprehensive Income.

Venezuela Devaluation and Economic Uncertainty

Effective January 1, 2010 and continuing through fiscal 2013, the financial statements for our Venezuela subsidiary are

consolidated under the rules governing the translation of financial information in a highly inflationary economy based on the

use of the blended National Consumer Price Index in Venezuela. Under GAAP, an economy is considered highly inflationary if

the cumulative inflation rate for a three year period meets or exceeds 100 percent. If a subsidiary is considered to be in a highly

inflationary economy, the financial statements of the subsidiary must be re-measured into our reporting currency (U.S. dollar)

and future exchange gains and losses from the re-measurement of monetary assets and liabilities are reflected in current

earnings, rather than exclusively in the equity section of the balance sheet, until such times as the economy is no longer

considered highly inflationary.

On February 13, 2013, the Venezuela government devalued the Bolivar Fuerte relative to the U.S. dollar. The revised official

exchange rate moved from 4.30 per U.S. dollar to an exchange rate of 6.30 per U.S. dollar. The Central Government also

suspended the alternate currency market administered by the central bank known as SITME that made U.S. dollars available at

a rate higher than the previous official rate, generally in the range of 5.50 per U.S. dollar. As access to U.S. dollars at the

official exchange rate was greatly limited, the Company had been utilizing the SITME market to obtain U.S. dollars for the

import of product on a regular basis. As a result, the Company had been using the higher SITME rate, prior to the most recent

devaluation, to translate its operating results and to value its net monetary assets held in local Venezuela currency.

As a result of the devaluation noted above and the elimination of the SITME market, the Company valued its net monetary

assets at September 30, 2013 using the revised official rate of 6.30 per U.S. dollar. Thus, the Company recorded a devaluation

charge of approximately $6 for the twelve months ended September 30, 2013, due primarily to the devaluation of local currency

cash balances. This charge was included in Other financing items, net on the Consolidated Statements of Earnings and

Comprehensive Income. In addition, operating results for the twelve months ended September 30, 2013 were translated using a

blended rate, ranging between 5.40 to 6.30 Bolivar Fuerte per U.S. dollar, reflecting the use of the new official rate for the

period following the devaluation and the previous SITME rate for the period prior to the devaluation.

At September 30, 2013, the U.S. dollar value of monetary assets, net of monetary liabilities, which would be subject to an

earnings impact from translation rate movements for our Venezuela affiliate under highly inflationary accounting was

approximately $62. Further currency devaluation in Venezuela, either through official channels or via the use of alternative

exchange mechanisms may result in additional devaluation of the Company's net monetary assets in Venezuela and may

negatively impact the operating results of the Company's Venezuelan affiliate.

The Company continues to monitor developments in Venezuela including the ability to convert local currency to U.S. dollars

for the purpose of importing goods from other Energizer affiliates since product sold by the Company's Venezuelan affiliate is

obtained via import. The Company will continue to seek to convert local currency to U.S. dollars at the revised official rate

through the long-standing government agency responsible for such transactions known as CADIVI. However, obtaining U.S.

dollars from CADIVI at the official exchange rate has been limited in the past, and may be equally or more limited in the

future. The Company has no way of knowing if other avenues to convert local currency to U.S. dollars will develop over time

and at what rate such conversions may be available. It is also possible that the Company's monetary assets and operating results

may be impacted by further devaluation of the Bolivar Fuerte. Due to the uncertainty of the availability of U.S. dollars to fund

inventory imports, the Company is not able to predict the amount of future imports to Venezuela or the ultimate price it will be

able to obtain to convert local currency to U.S. dollars in the future to pay for such imports. This could have a material impact

on the Company's operations in Venezuela. In fiscal 2013, net sales in Venezuela accounted for approximately 1.5% of the

Company's consolidated net sales.

Acquisition of Feminine Care Brands

In October 2013, which is the first fiscal quarter of 2014, the Company acquired the Stayfree pad, Carefree liner and o.b.

tampon feminine care brands in the U.S., Canada and the Caribbean from Johnson & Johnson for an aggregate cash purchase

price of $185. The acquisition was financed with approximately $135 of available foreign cash for the estimated value of assets

acquired in Canada including the Johnson & Johnson, Inc. manufacturing plant in Montreal, Canada, and approximately $50 of

U.S. cash, primarily from borrowings under the Company's available debt facilities for the estimated value of assets acquired in

the U.S. Liabilities assumed as a result of the acquisition are limited primarily to certain employee benefit obligations and are

not expected to be material.

34