Energizer 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

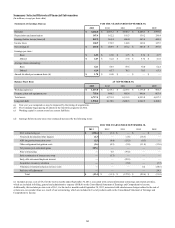

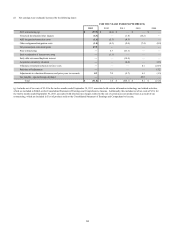

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

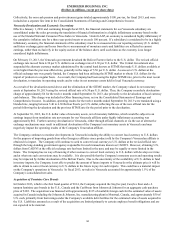

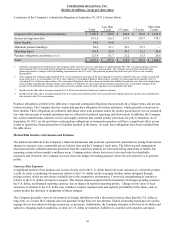

A summary of the Company’s contractual obligations at September 30, 2013 is shown below:

Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

Long-term debt, including current maturities $ 2,140.0 $ 140.0 $ 440.0 $ 150.0 $ 1,410.0

Interest on long-term debt 631.6 116.3 197.9 138.7 178.7

Notes Payable 99.0 99.0———

Minimum pension funding(1) 84.9 31.1 30.1 23.7 —

Operating leases 130.0 28.9 39.3 31.2 30.6

Purchase obligations and other(2) (3) (4) 121.8 61.7 21.2 13.3 25.6

Total $ 3,207.3 $ 477.0 $ 728.5 $ 356.9 $ 1,644.9

1 Globally, total pension contributions for the Company in the next five years are estimated to be approximately $85. The U.S. pension plans constitute

approximately 80% of the total benefit obligations and plan assets for the Company’s pension plans. The estimates beyond 2014 represent future

pension payments to comply with local funding requirements in the U.S. only. The projected payments beyond fiscal year 2018 are not currently

determinable.

2The Company has estimated approximately $6.9 of cash settlements associated with unrecognized tax benefits within the next year, which are included

in the table above. As of September 30, 2013, the Company’s Consolidated Balance Sheet reflects a liability for unrecognized tax benefits of $37.3,

excluding $12.4 of interest and penalties. The contractual obligations table above does not include this liability beyond one year. Due to the high degree

of uncertainty regarding the timing of future cash outflows of liabilities for unrecognized tax benefits beyond one year, a reasonable estimate of the

period of cash settlement for periods beyond the next twelve months cannot be made, and thus is not included in this table.

3Included in the table above are approximately $67 of fixed costs related to third party logistics contracts.

4 Included in the table above are approximately $16 of severance and related benefit costs associated with staffing reductions that have been identified to

date related to the 2013 restructuring.

Purchase obligations set forth in the table above represent contractual obligations that generally have longer terms, and are non-

routine in nature. The Company also has contractual purchase obligations for future purchases, which generally extend one to

three months. These obligations are primarily individual, short-term purchase orders for routine goods and services at estimated

fair value that are part of normal operations and are reflected in historical operating cash flow trends. In addition, the Company

has various commitments related to service and supply contracts that contain penalty provisions for early termination. As of

September 30, 2013, we do not believe such purchase obligations or termination penalties will have a significant effect on our

results of operations, financial position or liquidity position in the future. As such, these obligations have been excluded from

the table above.

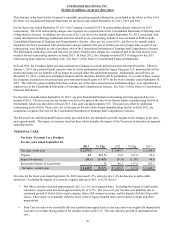

Market Risk Sensitive Instruments and Positions

The market risk inherent in the Company’s financial instruments and positions represents the potential loss arising from adverse

changes in currency rates, commodity prices, interest rates and the Company’s stock price. The following risk management

discussion and the estimated amounts generated from the sensitivity analysis are forward-looking statements of market risk

assuming certain adverse market conditions occur. Company policy allows derivatives to be used only for identifiable

exposures and, therefore, the Company does not enter into hedges for trading purposes where the sole objective is to generate

profits.

Currency Rate Exposure

A significant portion of our product cost is more closely tied to the U.S. dollar than to the local currencies in which the product

is sold. As such, a weakening of currencies relative to the U.S. dollar results in margin declines unless mitigated through

pricing actions, which are not always available due to the competitive environment. Conversely, strengthening of currencies

relative to the U.S. dollar can improve margins. This margin impact coupled with the translation of foreign operating results to

the U.S. dollar, our financial reporting currency, has an impact on reported operating profits. Changes in the value of local

currencies in relation to the U.S. dollar may continue to impact reported sales and segment profitability in the future, and we

cannot predict the direction or magnitude of future changes.

The Company generally views its investments in foreign subsidiaries with a functional currency other than the U.S. dollar as

long-term. As a result, the Company does not generally hedge these net investments. Capital structuring techniques are used to

manage the net investment in foreign currencies, as necessary. Additionally, the Company attempts, to the best of its ability and

subject to changing market conditions, to limit its U.S. dollar net monetary liabilities in countries with unstable currencies.

44