Energizer 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 2

ENERGIZER HOLDINGS, INC. 2013 ANNUAL REPORT

Fiscal 2013 was another very successful year for Energizer Holdings. Adjusted earnings

per share hit a record $6.96, increasing 12% over the previous scal year. In addition, this

marked the second consecutive year of double-digit adjusted earnings per share growth.

Furthermore, free cash ow from operations also set a record, totaling $659 million, up

an impressive 27% over the prior-year level. ese performance records were achieved in

spite of major challenges such as unprecedented competitive activity, soft category volume

dynamics and currency headwinds.

Our continued strong nancial performance is attributable, in large part, to our focus

on enhancing shareholder value. We believe four key pillars serve as the foundation for

our continued success:

• Investing in Successful Innovation

• Broadening our Personal Care Product Portfolio

• Optimizing our Cost and Operating Structure

• Maximizing Free Cash Flow

Innovation is vital to achieving our mission of delivering solutions to our consumers and

trade customers better than anyone else. is is perhaps best exemplied by our continued

expansion and growth of the Schick Hydro® razor and blade shaving platform. Fiscal 2013

saw the continued build-out of this innovation with the introduction of Hydro® disposable

razors in the U.S. and Western Europe, as well as with the continued rollout of Schick

Hydro Silk® razors and blades for women. e Hydro® franchise grew more than 20% in

scal year 2013, approaching a quarter of a billion dollars in global annual net sales. We

continue to seek innovation across our portfolio.

Broadening our Personal Care Product Portfolio is achieved through the acquisition of

new businesses and strategically entering new categories. On the acquisition front, we

entered the Personal Care space in 2003 with our acquisition of Schick Wilkinson Sword.

And then in 2008, we more than doubled our presence with the acquisition of Playtex,

To Our Shareholders,

Ward M. Klein Chief Executive Ofcer

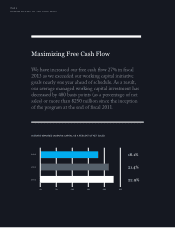

2013

2012

2011

2010

2009

2013

2012

2011

2010

2009

$659

$6.96

$521

$6.20

$315

$5.20

$544

$5.60

$350

$5.06

FREE CASH FLOW

in millions

DILUTED EARNINGS PER

SHARE – ADJUSTED (NON-GAAP)