Energizer 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENERGIZER HOLDINGS, INC.

(Dollars in millions, except per share data)

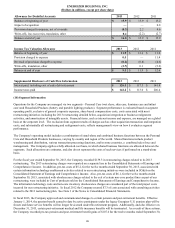

(10) Defined Contribution Plan

The Company sponsors a defined contribution plan, which extends participation eligibility to the vast majority of U.S.

employees. The Company matches 50% of participant’s before-tax contributions up to 6% of eligible compensation. As a

result of the freezing of the U.S. pension plan, effective January 1, 2014 the Company will match 100% of participant’s before-

tax contributions up to 6% of eligible compensation. Amounts charged to expense during fiscal 2013, 2012, and 2011 were

$9.3, $9.3, and $9.2, respectively, and are reflected in SG&A and Cost of products sold in the Consolidated Statements of

Earnings and Comprehensive Income.

(11) Debt

Notes payable at September 30, 2013 and 2012 consisted of notes payable to financial institutions with original maturities of

less than one year of $99.0 and $162.4, respectively, and had a weighted-average interest rate of 2.5% and 2.2%, respectively.

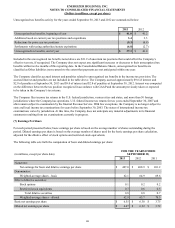

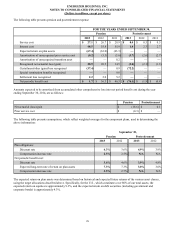

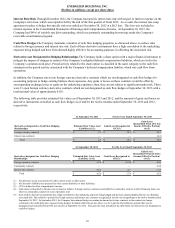

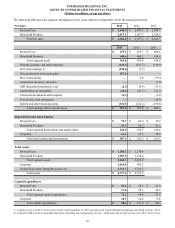

The detail of long-term debt at September 30 for the year indicated is as follows:

2013 2012

Private Placement, fixed interest rates ranging from 5.2% to 6.6%, due 2013 to 2017 $ 1,040.0 $ 1,165.0

Senior Notes, fixed interest rate of 4.7%, due 2021 600.0 600.0

Senior Notes, fixed interest rate of 4.7%, due 2022, net of discount 498.8 498.6

Term Loan, repaid in December 2012 —106.5

Total long-term debt, including current maturities 2,138.8 2,370.1

Less current portion 140.0 231.5

Total long-term debt $ 1,998.8 $ 2,138.6

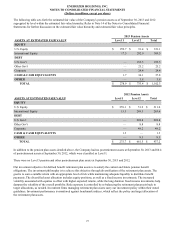

The Company’s total borrowings were $2,237.8 at September 30, 2013, including $99.0 tied to variable interest rates. The

Company maintains total debt facilities of $2,687.8. The Company's Amended and Restated Revolving Credit Agreement,

which matures in 2016, currently provides for revolving credit loans and the issuance of letters of credit in an aggregate amount

of up to $450 at September 30, 2013. We had no outstanding borrowings under our revolving credit facility, and $438.5

remains available as of September 30, 2013, taking into account outstanding borrowings and $11.5 of outstanding letters of

credit.

Under the terms of the Company’s credit agreement, the ratio of the Company’s indebtedness to its earnings before interest

taxes depreciation and amortization (EBITDA), as defined in the agreements and detailed below, cannot be greater than 4.0 to

1, and may not remain above 3.5 to 1 for more than four consecutive quarters. If and so long as the ratio is above 3.5 to 1 for

any period, the Company is required to pay additional interest expense for the period in which the ratio exceeds 3.5 to 1. The

interest rate margin and certain fees vary depending on the indebtedness to EBITDA ratio. Under the Company’s private

placement note agreements, indebtedness to EBITDA may not be greater than 4.0 to 1; if the ratio is above 3.5 to 1, for any

quarter, the Company is required to pay additional interest on the private placement notes of 0.75% per annum for each quarter

until the ratio is reduced to not more than 3.5 to 1. In addition, under the credit agreement, the ratio of its current year earnings

before interest and taxes (EBIT), as defined in the agreement, to total interest expense must exceed 3.0 to 1. The Company’s

ratio of indebtedness to its EBITDA was 2.3 to 1, and the ratio of its EBIT to total interest expense was 5.7 to 1, as of

September 30, 2013. These ratios are impacted by pre-tax cash charges associated with restructuring activities as such charges

reduce both EBITDA and EBIT as defined in the agreement. The ratios at September 30, 2013 were somewhat negatively

impacted by a portion of the pre-tax charges associated with the 2013 restructuring as such charges, exclusive of those

considered non-cash, reduced EBITDA as defined in the agreement. We expect the ratios to be somewhat negatively impacted

in the near term due to anticipated cash restructuring charges, but we expect to remain in full compliance with the debt

covenant ratios. In addition to the financial covenants described above, the credit agreement and the note purchase agreements

contain customary representations and affirmative and negative covenants, including limitations on liens, sales of assets,

subsidiary indebtedness, mergers and similar transactions, changes in the nature of the business of the Company and

transactions with affiliates. If the Company fails to comply with the financial covenants referred to above or with other

requirements of the credit agreement or private placement note agreements, the lenders would have the right to accelerate the

maturity of the debt. Acceleration under one of these facilities would trigger cross defaults on other borrowings.

Under the credit agreement, EBITDA is defined as net earnings, as adjusted to add-back interest expense, income taxes,

depreciation and amortization, all of which are determined in accordance with GAAP. In addition, the credit agreement allows

78