EasyJet 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87 easyJet plc Annual report and accounts 2009

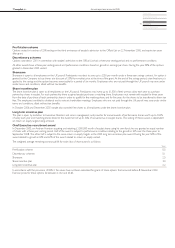

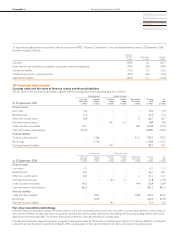

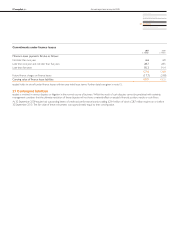

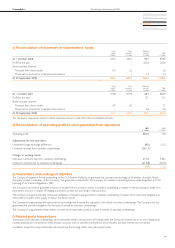

Commitments under finance leases

2009

£ million

2008

£ million

Minimum lease payments fall due as follows:

Not later than one year 6.6 6.9

Later than one year and not later than five years 28.7 28.5

Later than five years 92.3 91.4

127.6 126.8

Future finance charges on finance leases (17.7) (24.8)

Carrying value of finance lease liabilities 109.9 102.0

easyJet holds six aircraft under finance leases with ten year initial lease terms. Further details are given in note 15.

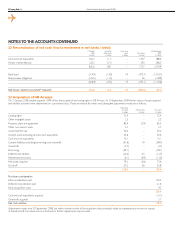

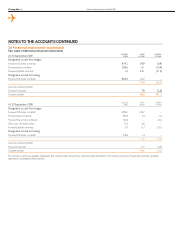

27 Contingent liabilities

easyJet is involved in various disputes or litigation in the normal course of business. Whilst the result of such disputes cannot be predicted with certainty,

management considers that the ultimate resolution of these disputes will not have a material effect on easyJet’s financial position, results or cash flows.

At 30 September 2009 easyJet had outstanding letters of credit and performance bonds totalling £29.4 million of which £28.7 million expires on or before

30 September 2010. The fair value of these instruments was approximately equal to their carrying value.