EasyJet 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual report and accounts 200923 easyJet plc

q

Overview

Business review

Governance

Accounts

Other information

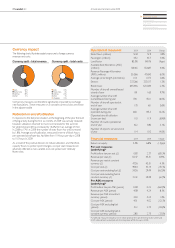

Ground handling

Ground handling cost per seat at constant currency was up £0.27 or 6.6%

compared to 2008. Approximately 61% of ground handling costs are now

denominated in euro, up 6ppt from 2008. The drivers of this increase include

airport mix, as presence continues to be increased in the top European

airports (estimated impact £0.14 per seat), the full year effect of PRM

(Passengers with Reduced Mobility) charges and increased adverse weather

related de-icing costs.

Airport charges

Airport cost per seat at constant currency was up £0.59 or 7.8% compared

to 2008. Approximately 58% of these costs are denominated in euro,

up 7 percentage points from 2008. The key driver of this increase has been

over-ination price rises in airport passenger related charges at a number of

locations across the network, increasing costs by approximately £30 million.

Signicant increases have occurred at Gatwick, Luton, Amsterdam and

at all Spanish and Italian airports. Mix continues to impact as we increase

our presence in the top European airports. In a specic response to the

uneconomic level of charges at Luton, easyJet announced in September

2009 that it would remove some ying for 2010 and redeploy aircraft

to more protable activity elsewhere.

Crew

Crew cost per seat at constant currency was up £0.44 or 8.7% compared

to 2008. An increasing proportion of these costs are denominated in

non-sterling currencies as more overseas contracts are introduced and

approximately 25% of these costs are now denominated in euro and 9% in

Swiss franc. The increase in unit costs has been driven by last year’s crew pay

deal which was linked to August 2008 RPI, the increased costs associated with

the introduction of overseas contracts (a necessary part of the expansion

strategy into continental Europe) and maintaining higher than required crew

numbers over the winter, whilst there was reduced aircraft utilisation, as these

crew were required for the summer activity.

Crew costs continue to be a key area of management focus with signicant

opportunities for efciency improvement in the medium term.

Maintenance

Maintenance cost per seat at constant currency was down £0.12 or 4.1%

compared to 2008. The net reduction in unit cost mainly reects the benet

of the reduction in the number of leased aircraft as the Boeing 737-700s

have started to leave the eet partly offset by the full year costs of the

new in-house maintenance planning function. During the year, 12 leased

Boeing 737-700s and four leased (ex GB) A320s were returned to lessors.

Approximately 35% of maintenance costs are denominated in US dollar

and 21% in euro.

At the end of the year, negotiations were completed with SR Technics

on a new maintenance contract which will deliver savings of around

£175 million over the 11 year life of the contract.

Insurance and other costs

Other costs per seat at constant currency were up £0.17 or 9.3% compared

to 2008. The main drivers of this per seat increase were reduced utilisation

and an increase in disruption costs (driven by bad weather in the winter)

partially offset by the prot on the Boeing spares optimisation project,

as reported in the rst half of the nancial year.