EasyJet 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 easyJet plc Annual report and accounts 2009

NOTES TO THE ACCOUNTS CONTINUED

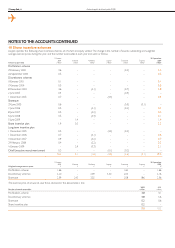

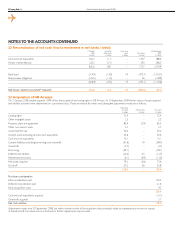

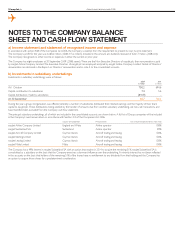

25 Financial risk and capital management (continued)

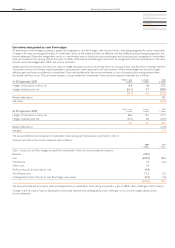

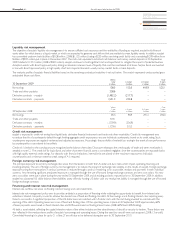

Fuel price risk management

easyJet is exposed to fuel price risk. The objective of the fuel price risk management policy is to provide protection against sudden and significant increases

in jet fuel prices thus mitigating volatility in the income statement in the short term. In order to manage the risk exposure, forward contracts are used in line

with Board approved policy to hedge between 50% and 80% of estimated exposures up to 12 months in advance, and to hedge a smaller percentage of

estimated usage up to 24 months in advance. In exceptional market conditions, the Board may accelerate or limit the implementation of the hedging policy.

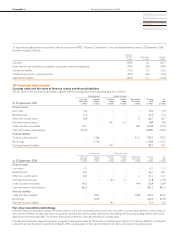

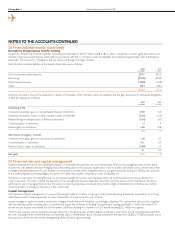

Market risk sensitivity analysis

Financial instruments affected by market risks include borrowings, deposits, trade receivables, trade payables and derivative financial instruments. The

following sensitivity analysis illustrates the sensitivity of such financial instruments to changes in relevant foreign exchange rates, interest rates and fuel prices.

It should be noted that the sensitivity analysis reflects the impact on profit or loss after tax for the year and shareholders’ funds on financial instruments held

at the reporting date. It does not reflect changes in revenue or costs that may result from changing currency rates, interest rates or fuel prices. Each sensitivity

is calculated based on all other variables remaining constant. The analysis below is considered representative of easyJet’s exposure over the 12 month period.

The currency sensitivity analysis is based on easyJet’s foreign currency financial instruments held at each balance sheet date taking into account forward

exchange contracts and zero cost collars that offset effects from changes in currency exchange rates. The increased sensitivity in the US dollar and euro rate

represents sterling weakening against each variable currency with the –10% sensitivity showing a stronger sterling sensitivity. The interest rate analysis assumes

a 1% change in interest rates over the reporting year applied to end of year financial instruments. The fuel price sensitivity analysis is based on easyJet’s fuel-

related derivative financial instruments held at the end of each reporting period. The sensitivity applied to both currency rates and the fuel price is based

on a reasonably possible change in the rate applied to the value of financial instruments at the balance sheet date.

Currency rates

At 30 September 2009 US dollar +10%

£ million

US dollar –10%

£ million

Euro +10%

£ million

Euro –10%

£ million

Interest rates

1% increase

£ million

Fuel price

10% increase

£ million

Income statement impact: gain/(loss) 17.9 (13.8) (1.1) 0.9 0.4 –

Impact on shareholders’ funds: increase/(decrease) 44.9 (37.6) (14.5) 12.0 –31.4

Currency rates

At 30 September 2008 US dollar +10%

£ million

US dollar –10%

£ million

Euro +10%

£ million

Euro –10%

£ million

Interest rates

1% increase

£ million

Fuel price

10% increase

£ million

Income statement impact: gain/(loss) (3.6) 2.9 2.3 (1.9) 2.4 –

Impact on shareholders’ funds: increase/(decrease) 86.8 (70.5) (27.1) 22.1 – 27.6

The impact of a 1% increase in interest rates and a 10% increase in the fuel price is disclosed above. A corresponding decrease in each of the rates results in

an equal and opposite impact on the income statement and shareholders’ funds in both reporting periods.

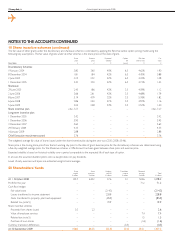

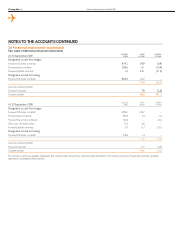

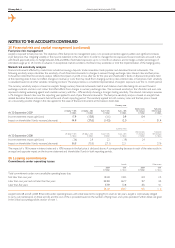

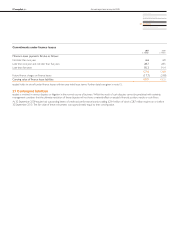

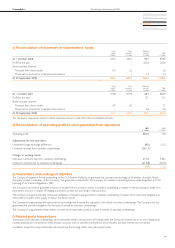

26 Leasing commitments

Commitments under operating leases

Aircraft Other assets

2009

£ million

2008

£ million

2009

£ million

2008

£ million

Total commitments under non-cancellable operating leases due:

Not later than one year 101.0 118.2 2.3 2.5

Later than one year and not later than five years 223.0 267.7 3.7 4.4

Later than five years 37.9 72.8 3.5 4.1

361.9 458.7 9.5 11.0

easyJet holds 68 aircraft (2008: 84 aircraft) under operating leases, with initial lease terms ranging from seven to ten years. easyJet is contractually obliged

to carry out maintenance on these aircraft, and the cost of this is provided based on the number of flying hours and cycles operated. Further details are given

in the critical accounting policies section of note 1.