EasyJet 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 easyJet plc Annual report and accounts 2009

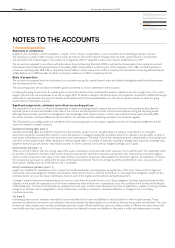

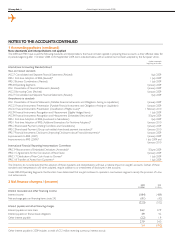

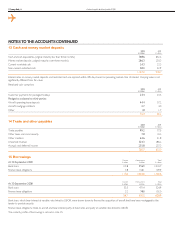

NOTES TO THE ACCOUNTS CONTINUED

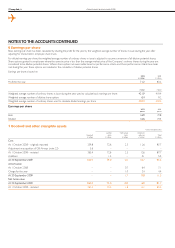

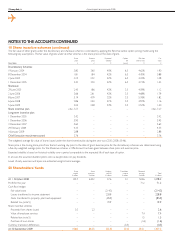

4 Employees (continued)

Key management compensation was:

2009

£ million

2008

£ million

Short-term employee benefits 4.5 3.5

Pension costs 0.2 0.4

Payments for loss of office –0.1

Share-based payments 0.7 0.5

5.4 4.5

The Directors of easyJet plc and the other members of the Executive Management Team are easyJet’s key management as they have collective authority and

responsibility for planning, directing and controlling the business.

Emoluments paid or payable to the Directors of easyJet plc were:

2009

£ million

2008

£ million

Remuneration 2.5 1.8

Gains made on the exercise of share options 0.1 –

Pension costs (two Directors) 0.1 0.1

2.7 1.9

Details of directors’ remuneration are disclosed in the Report on Directors’ Remuneration.

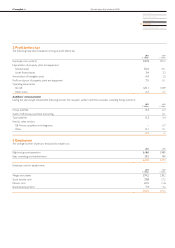

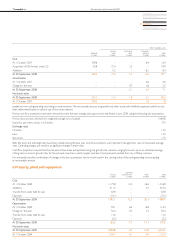

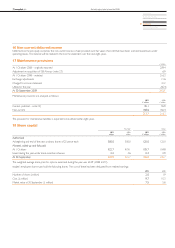

5 Tax (credit) / charge

Tax on profit on ordinary activities

2009

£ million

2008

£ million

Current tax

United Kingdom corporation tax 6.9 14.8

Foreign tax 12.1 6.0

Prior year adjustments (27.4) (23.1)

(8.4) (2.3)

Deferred tax

Temporary differences relating to property, plant and equipment (13.1) (2.4)

Other temporary differences 9.3 11.3

Prior year adjustments (4.3) 20.4

(8.1) 29.3

(16.5) 27.0

Effective tax rate (30.2)% 24.5%

During the year, agreement was reached with Her Majesty’s Revenue & Customs on certain tax issues. This has resulted in the release to the income

statement of £30.7 million relating to current tax liabilities provided for in prior years. In addition, easyJet has reassessed certain other open tax matters.

The net impact of these has been classified as prior year current and deferred tax adjustments. The prior year adjustments in 2008 include a reclassification

of £16.9 million from current tax to deferred tax.

Tax on items recognised directly in shareholders’ funds

2009

£ million

2008

£ million

Deferred tax credit / (charge) on share-based payments 1.1 (7.3)

Deferred tax credit / (charge) on fair value movements of cash flow hedges 19.9 (14.4)

Current tax credit on share-based payments 0.4 2.0

21.4 (19.7)