EasyJet 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85 easyJet plc Annual report and accounts 2009

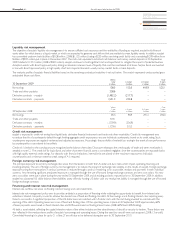

Liquidity risk management

The objective of easyJet’s liquidity risk management is to ensure sufficient cash resources and the availability of funding as required. easyJet holds financial

assets either for which there is a liquid market or which are expected to generate cash inflows that are available to meet liquidity needs. In addition, easyJet

has committed undrawn bank facilities of $528 million (2008: $1,135 million), being a $250 million revolving credit facility and a remaining $278 million from

facilities of $937 million put in place in December 2007. The cash, cash equivalent, restricted cash balances and money market deposits at 30 September

2009 totalled £1,147.2 million (2008: £928.7 million). easyJet continues to hold significant cash and liquid funds to mitigate the impact of potential business

disruption events with Board approved policy stating an absolute minimum level of liquidity that must be maintained at all times. Surplus funds are invested,

in line with Board approved policy, in high quality short-term liquid instruments, usually money market funds or bank deposits.

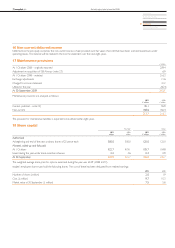

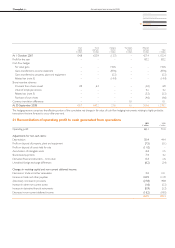

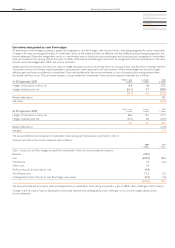

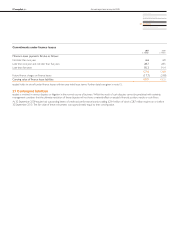

The maturity profile of easyJet’s financial liabilities based on the remaining contractual maturities is set out below. The analysis represents undiscounted gross

anticipated future cash flows.

30 September 2009

Within

1 year

£ million

1–2 years

£ million

2–5 years

£ million

Over

5 years

£ million

Borrowings 138.5 150.5 418.9 525.1

Trade and other payables 338.6 – – –

Derivative contracts – receipts (1,482.2) (217.7) – –

Derivative contracts – payments 1,541.3 232.8 – –

30 September 2008

Within

1 year

£ million

1–2 years

£ million

2–5 years

£ million

Over

5 years

£ million

Borrowings 85.5 96.9 291.2 296.0

Trade and other payables 304.1 – – –

Derivative contracts – receipts (1,759.9) (336.9) – –

Derivative contracts – payments 1,729.6 310.3 – –

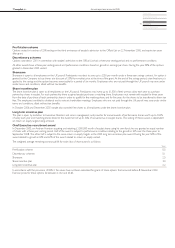

Credit risk management

easyJet is exposed to credit risk arising from liquid funds, derivative financial instruments and trade and other receivables. Credit risk management aims

to reduce the risk of counterparty default through limiting aggregate credit exposure to any one individual counterparty, based on its credit rating. Such

counterparty exposures are regularly reviewed and adjusted as necessary. Accordingly, the possibility of material loss arising in the event of non-performance

by counterparties is considered to be unlikely.

Credit risk is limited to the carrying amount recognised at the balance sheet date. Disclosure relating to the credit quality of trade and other receivables is

detailed in note 12. The credit risk for liquid funds and other short-term financial assets is considered negligible, since the counterparties are reputable banks

with high quality external credit ratings. For deposits with financial institutions, internal limits are placed on the maximum exposure to individual

counterparties and a minimum external credit rating of A is required.

Foreign currency risk management

The principal exposure to currency exchange rates arises from fluctuations in both the US dollar and euro rates which impact operating, financing and

investing activities. The aim of foreign currency risk management is to reduce the impact of exchange rate volatility on the results of easyJet. Foreign exchange

exposure arising from transactions in various currencies is reduced through a policy of matching, as far as possible, receipts and payments in each individual

currency. Any remaining significant anticipated exposure is managed through the use of forward foreign exchange contracts and zero cost collars. No new

zero cost collars were put in place during the year ended 30 September 2009, and all existing positions matured prior to 30 September 2009. In addition,

easyJet has substantial US dollar balance sheet liabilities, partly offset by holding US dollar cash; any residual net liability is managed through the use of forward

foreign exchange contracts.

Financing and interest rate risk management

Interest rate cashflow risk arises on floating rate borrowings and cash investments.

Interest rate risk management policy aims to provide certainty in a proportion of financing while retaining the opportunity to benefit from interest rate

reductions. Interest rate policy is used to achieve the desired mix of fixed and floating rate debt. All borrowings are at floating interest rates repricing every

three to six months. A significant proportion of the US dollar loans are matched with US dollar cash, with the cash being invested to coincide with the

repricing of the debt. Operating leases are a mix of fixed and floating rates. Of the operating leases in place at 30 September 2009 approximately 60%

of lease payments were based on fixed interest rates and 40% were based on floating interest rates (2008: 60% fixed, 40% floating).

All debt is asset related, reflecting the capital intensive nature of the airline industry and the attractiveness of aircraft as security to lenders. These factors are

also reflected in the medium-term profile of easyJet’s borrowings and operating leases. During the year four aircraft were cash acquired (2008: 13 aircraft).

Committed financing is in place for up to 21 of the 27 aircraft due to be delivered during the year to 30 September 2010.