EasyJet 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 easyJet plc Annual report and accounts 2009

q

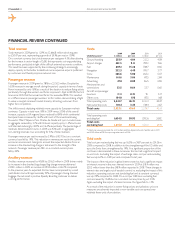

easyJet has also leveraged its scale and the recession to renegotiate some key

contracts with suppliers. Overall capacity in the European short-haul market

is shrinking and as one of the few carriers in Europe growing capacity, easyJet

is well placed to secure better terms at airports.

Following a global tendering process, easyJet has selected Zurich-based SR

Technics for airframe maintenance support of easyJet’s core Airbus eet for a

period of 11 years. The agreement, valued at more than $1.6 billion, provides

easyJet with a reduction in maintenance costs (excluding engines) of around

£175 million over the life of the contract. SR Technics will provide a range of

services including aircraft maintenance, component repair and overhaul, and

logistics management for easyJet’s core Airbus eet.

A signicant portion of our cost base is determined by governments and

regulatory bodies, in particular, navigation costs and charges at regulated

airports. We have increased our focus on these costs by constructively

engaging the governments and regulators that set them. Alongside our work

at Gatwick and Stansted, areas of particular focus have been the regulatory

charges at the Paris airports and Amsterdam, UK navigation charges and the

wider European approach to navigation costs. Looking forward, we will sustain

this involvement and seek to further develop our inuence across Europe.

Management of cash, capital expenditure and fleet

Fleet plan

easyJet is making good progress towards its goal of operating a common

aircraft eet. Eliminating the Boeing and GB Airways sub-eets will take

cost out of the business and simplify our operations.

The intention is to exit all aircraft in the two sub-eets by 2012 to complete

the realisation of ownership cost savings of around £40 million per annum.

12 Boeing 737s and four GB Airways A320s were returned to lessors in the

past year. The sale of the seven A321s from the GB Airways sub-eet continues

to progress with three A321s disposed of in the year with an associated prot

on disposal of £11 million. It is anticipated that the remaining A321s will leave

the eet by September 2010. The ve A319s previously held for sale have

been returned to the eet and will be used to support our mainland

European expansion plans in 2010.

In the past year, easyJet took delivery of 15 A320 aircraft and 20 A319 aircraft

under the terms of the Airbus easyJet agreement. Congured with 180 seats,

the A320 will enable us to increase our capacity at peak times at slot

constrained airports. Also, the aircraft operates with a cost per seat that is

around 6% lower than the A319.

The total eet at 30 September 2009 comprised 181 aircraft. A further 70

easyJet specication aircraft deliveries are currently planned for arrival over the

next three years, a net increase of 26 aircraft over this period giving an expected

total number of aircraft of 207 by 2012. easyJet has a high degree of exibility in

its eet planning arrangements and thus is able to manage the total number of

aircraft in the eet through a combination of deferrals and lease extensions.

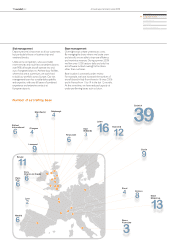

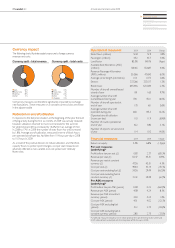

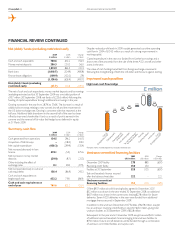

Owned

Under

operating

lease

Under

nance

lease Total

Changes in

year

Future

deliveries

(including

exercised

purchase

rights)

(note 1)

Un-

exercised

purchase

rights

(note 2)

easyJet

A320 family 103 46 6155 35 72 88

Boeing

737-700 –17 –17 (12) – –

GB Airways

A320 family 4 5 – 9 (7) 2 –

107 68 6181 16 74 88

Note 1: The 72 future easyJet deliveries are anticipated to be delivered over the next four

nancial years, 27 in 2010, 22 in 2011, 21 in 2012 and 2 in 2013.

Note 2: Purchase rights may be taken on any A320 family aircraft and are valid until 2015.

CHIEF EXECUTIVE’S STATEMENT CONTINUED

Northern Europe

In Germany, we improved the schedule during the year. Additional additional

capacity has been added on routes to Milan, Copenhagen and Brussels from

our Berlin base, which has improved our appeal to business travellers.

We closed the base at Dortmund but protable routes were retained.

easyJet celebrated its tenth birthday in Switzerland in the past year where

we have 12 aircraft based. easyJet’s position improved as competitors came

off key routes and we expanded ying between Switzerland and the French

regions and Scandinavia.

Southern Europe

easyJet has 13 based aircraft at Milan and we continue to outperform the

competition, with signicantly stronger load factors. easyJet has opened

a base at Rome Fiumicino with three aircraft based there operating on both

intra-European and Italian domestic routes. Madrid delivered improvements

in load and protability in the year as competitors continued to retreat and

we optimised our schedule. easyJet now has 14 aircraft based in France and

is France’s second largest airline with a 10% market share. France continues to

be an attractive market for easyJet as low cost carrier penetration is half the

European average and the market consequently has structurally higher fares.

Focus on margins through driving revenue

and managing costs

easyJet’s strategy is growth with margin improvement and therefore the

management team continually focuses its efforts on all three drivers of

margin, namely yield, ancillaries and costs.

Margins in the past two years have been severely impacted by higher fuel

prices with an aggregate £5.71 (£1.63 in 2009) increase in unit fuel costs,

albeit prot per seat has only declined by £3.47 due to the strength of the

revenue performance.

In the past year, easyJet’s industry leading revenue performance, has been

driven by proactive aircraft allocation into stronger markets such as Gatwick

and Milan, and good commercial management especially in pricing, promotion

and route selection.

In addition, easyJet is beneting from its efforts to target the business travel

market with around 15% of business passengers now originating through

business orientated distribution channels. Business customers tend to book

later, paying around 20% more than the average fare for their easyJet ights.

Ancillary revenue income grew by 38% to £9.77 per seat. The checked bag

charge averaged £4.51 per seat, an increase of £1.73 per seat in the year and

other ancillary revenues grew by £0.97 to £5.26 per seat. Going forward,

easyJet’s in-ight revenues will benet from the introduction of electronic

point of sale equipment onboard and food offerings tailored by market and

designed to appeal to a broader range of consumers. Improvements in

website presentation should also result in improved conversion rates for

car hire and hotels.

It is vital that easyJet aggressively manages its cost base so that it can continue

to offer competitive fares protably. Operating costs excluding fuel6, per seat

rose 3.9% at constant currency in the year principally due to increased sector

length, the planned lower aircraft utilisation over the winter as we mitigated

margin dilution due to higher fuel costs and price increases at Gatwick which

have cost around £10 million this year.

In the second half of the year, we saw improvements in aircraft ownership and

maintenance costs. easyJet also delivered improvements in its operations

information technology infrastructure in the year and key systems to support

the crew efciency programme have now been implemented. We have now

reviewed our progress against the £125 million cost savings target identied in

2008 and believe there is greater potential to take cost out of the business.

Based on the nancial results for the year ended 30 September 2009, we have

updated our targets and now expect to deliver cost savings of £190 million by

the end of nancial year 2012. After ination and increases in regulated airport

charges this will equate to approximately £1 per seat prot improvement.