EasyJet 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 easyJet plc Annual report and accounts 2009

q

FINANCIAL REVIEW CONTINUED

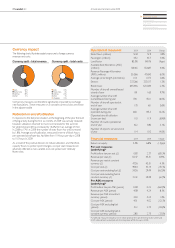

Ownership costs

Net ownership costs, on a per seat basis at constant currency, were up

£0.52 or 19.4% compared to 2008. The average number of aircraft during

the year was 174.1, up 16.0% compared to the previous year. The number

of non-operational aircraft increased by nine compared to last year principally

due to aircraft held for sale and an increase in aircraft in maintenance as

easyJet prepared aircraft for return to lessors. There were 35 additions

during the year, 31 debt nanced and four cash nanced; 12 Boeing 737-700s

and four ex-GB A320s were returned to lessors and three ex-GB A321s

were sold.

Net ownership costs include interest income which has fallen from

£48.9 million in 2008 to £18.4 million in 2009, a fall of £30.5 million due to

the dramatic drop in market interest rates and despite cash balances and

money market deposits rising from £863 million at 30 September 2008 to

£1,075 million at 30 September 2009. Gross ownership costs i.e. excluding

the impact of interest income, on a constant currency basis, improved by

£0.13 per seat or 3.5%. This benet is driven by the exit of higher cost leased

Boeing 737-700 aircraft and replacement by lower cost owned Airbus aircraft

and lower interest rates feeding into interest payable as rates are re-priced

to market.

Unit costs have been impacted by the reduced winter ying activity with costs

of the eet that is, on average, 16.0% larger being spread over a similar amount

of seats own as last year.

The exit of higher cost 737-700 aircraft is well under way and this, together

with the exit of higher cost aircraft acquired as part of the acquisition of GB

Airways, is expected to deliver the targeted benets in aircraft ownership.

*Underlying number; excludes an £11 million prot on the sale of three aircraft in 2009 and

£12.9 million of one-off integration costs for GB Airways in 2008.

Headline prot before tax for 2009 was £54.7 million; after excluding the

one-off benet of the prot on sale of three ex-GB A321s, underlying prot

before tax was £43.7 million. This is a fall of £79.4 million in underlying prot

before tax compared to 2008, despite the fuel bill rising £98.5 million. With

total revenue per seat increasing by 10.9% and total cost per seat increasing

by 15.1%, prot margin dropped by 3.6 percentage points to 1.6%.

Profit after tax and return on equity

At the end of 2009, favourable resolution was reached with HMRC on a

prior year tax matter resulting in the release of a provision. This release has

contributed to an effective tax credit rate for the year of 30.2% compared to

an effective tax charge rate of 24.5% in 2008. For 2010 the effective tax rate is

expected to be a charge of 25%.

The tax provision release also had a signicant impact on the return on

equity in 2009. For the year it was 5.5% compared to 6.8% in 2008, a fall of

1.3 percentage points. Although underlying prot before tax fell by 64.5%,

retained prot, signicantly impacted by the tax provision release, fell by only

14.4%. With shareholders’ funds broadly at year on year, the resultant return

on equity is therefore only down by 1.3 percentage points.

Basic earnings per share, at 16.9 pence, is down 14.6% compared to 2008,

reecting the signicant drop in retained prot, being offset, to a large extent,

by the tax provision release.

In line with established policy, no dividends have been paid or proposed in the

year ended 30 September 2009 or during the comparative accounting period.

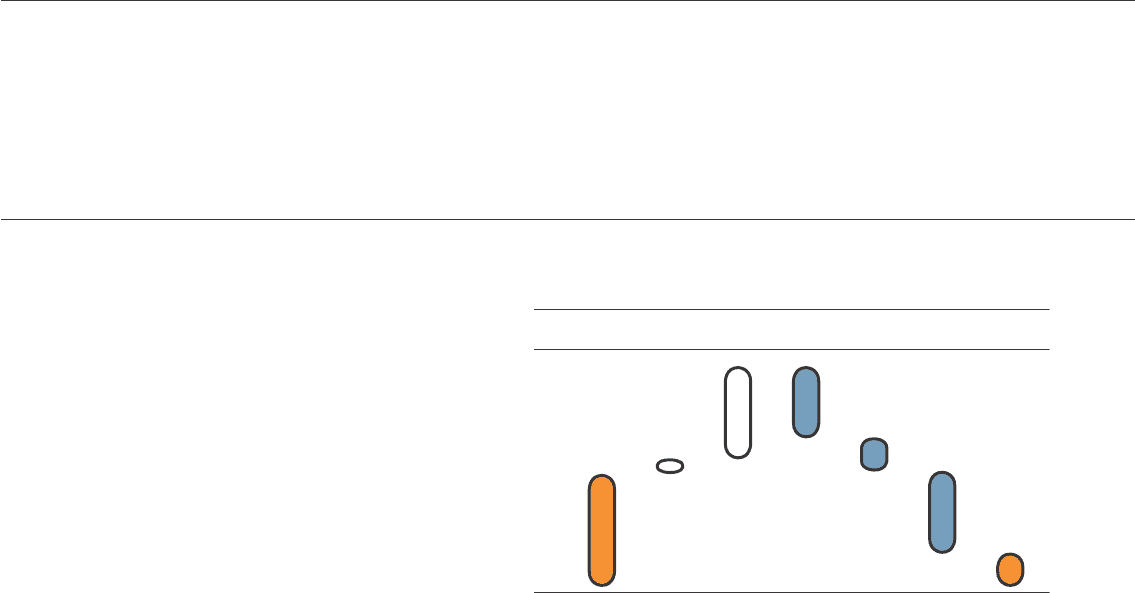

Changes in pre-tax profit per seat build up

£ per seat

High level profit per seat bridge

£0.83

£2.37 £1.63

£0.07

£1.85 £1.19

£0.64

2008 prot

before tax

per seat

Foreign

exchange

impact

Total

revenue

Costs

excl. fuel

excl. interest

Interest Fuel

inc. foreign

exchange

impact

2009 prot

before tax

per seat