EasyJet 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual report and accounts 200925 easyJet plc

q

Overview

Business review

Governance

Accounts

Other information

Balance sheet and cash flow

As discussed in the Business Review, the industry has faced challenging

economic conditions in 2009. However, easyJet continued to generate

a strong operating cash ow and ended the year with over £1 billion in

cash and short-term liquid deposits, a strong balance sheet and signicant

undrawn committed nancing to fund future aircraft deliveries.

A clear focus on working capital and balance sheet management has

put easyJet in a strong position to withstand the current economic

climate and to emerge stronger.

Despite a signicant tightening of credit in capital markets, easyJet

has capitalised on the strength of its business model and nancial position

to secure additional debt and lease nancing to add to that agreed in

December 2007.

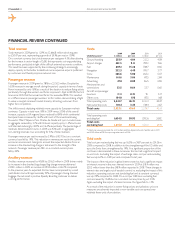

Summary balance sheet

2009

£ million

2008

(restated)*

£ million

Change

£ million

Goodwill 365.4 365.4 –

Property, plant and equipment 1,612.2 1,102.6 509.6

Other non-current assets 213.2 218.4 (5.2)

2,190.8 1,686.4 504.4

Net working capital (537.3) (306.5) (230.8)

Cash and cash equivalents 788.6 632.2 156.4

Money market deposits 286.3 230.3 56.0

Borrowings (1,120.6) (626.9) (493.7)

Other non-current liabilities (300.5) (337.3) 36.8

Net assets 1,307.3 1,278.2 29.1

Share capital and premium 748.5 745.9 2.6

Reserves 558.8 532.3 26.5

Shareholders’ funds 1,307.3 1,278.2 29.1

*Fair value adjustments in respect of GB Airways, see note 23 to the accounts.

Shareholders’ funds increased by £29.1 million in the year, the prot after tax

being offset by a reduction in the fair value of the Group’s cash ow hedges

net of deferred tax. The strengthening of the US dollar and the euro against

sterling in the year has caused a signicant reduction in the fair value of the

Group’s currency derivative portfolio; this was partially offset by a decrease

in the value of the jet fuel derivative liability as fuel prices fell. These fair value

gains and losses are deferred in equity and recycled to the income statement

in line with the underlying hedged transaction.

Goodwill was £365.4 million at 30 September 2009. Provisional fair values of

assets and liabilities acquired through a business combination may be adjusted

for 12 months following the acquisition date; for GB Airways this period ended

on 31 January 2009. Since 30 September 2008, the fair value of maintenance

provisions has been increased reecting additional liabilities relating to

engines on aircraft held under operating leases. After allowing for tax relief,

goodwill relating to the GB Airways acquisition increased by £5.6 million

to £55.8 million. Comparative balances have been adjusted to reect that

these liabilities were extant at the acquisition date.

The net increase in property, plant and equipment in the year was £509.6

million. Additions in respect of new aircraft delivered, pre-delivery deposits

for future deliveries and non-aircraft xed assets totalled £515.0 million, this

was offset by depreciation charged in the year of £55.4 million and disposals

of £4.9 million. During the year, easyJet took delivery of an additional 20 A319

aircraft and the rst 15 easyJet specication A320 aircraft. Three ex-GB

Airways A321 aircraft were sold generating a prot of £11.0 million.

These assets had been transferred to assets held for sale in 2008. Four A321

aircraft remain as assets held for sale at 30 September 2009. The ve easyJet

specication A319 aircraft disclosed as assets held for sale at 30 September

2008 were taken off the market in the year and returned to property, plant

and equipment at their book value of £54.9 million. Potential purchasers have

found credit hard to obtain in the current market and the Board has agreed to

retain these owned aircraft to support the European expansion plans in 2010.

Net working capital improved by £230.8 million in the year. Assets held

for sale decreased by £121.7 million with three A321s sold and ve A319s

returned to property, plant and equipment. Trade and other payables

increased by £97.7 million as a result of additional unearned income, the

increase in the size of the business and efcient working capital management.

Unearned income increased due to the strength of the euro against sterling

and as a result of the schedule now being on sale out for up to 11 months.

In addition, the fair value of short-term derivative balances decreased

£43.6 million year-on-year as the US dollar and euro strengthened

against sterling.

The total of cash and cash equivalents and money market deposits was

£1,074.9 million at 30 September 2009 up £212.4 million compared to

30 September 2008. Net cash of £134.5 million was generated from

operations as a result of cash received in advance from customers and strong

working capital management. £90.2 million was received from the sale of

three ex-GB A321 aircraft and other xed assets in the year. The purchase

of aircraft in the year was funded predominantly by additional borrowings.

Of the 35 A320 family aircraft delivered in the year, 31 were mortgage

nanced. Money market deposits are held partially in US dollars to provide

a match against US dollar denominated borrowings.

Excluded from the above total is £72.3 million of restricted cash disclosed

in other non-current assets and net working capital. These amounts relate

principally to operating lease deposits and customer payments for holidays.

The total of cash and cash equivalents, money market deposits and restricted

cash at 30 September 2009 was £1,147.2 million (30 September 2008:

£928.7 million).

As detailed above, most aircraft deliveries were funded from additional

borrowings. Total borrowings increased by £493.7 million in the year to

£1,120.6 million as a result of £468.2 million of new draw downs net of

repayments and foreign exchange movements of £25.5 million on the

retranslation of debt. Most borrowings are denominated in US dollars;

however some facilities were drawn in euros for the rst time in the year.

The US dollar rate moved from 1.78 at 30 September 2008 to 1.60

at 30 September 2009.

Other non-current liabilities include maintenance provisions for work due

to be performed in more than one year of £168.6 million, deferred income

relating principally to the excess of sale price over fair value for aircraft subject

to sale and leaseback of £52.6 million, deferred tax liabilities of £76.7 million

and long-term nancial instrument liabilities of £2.6 million.

Maintenance provisions have been impacted by the movement in the

US dollar and euro exchange rates in the year. Deferred tax liabilities have

decreased by £31.1 million since 30 September 2008 as a result of the

reduction in the value of cash ow hedges, reduced accelerated capital

allowances and the recognition of a deferred tax asset on losses; offset

by a charge for increased short-term operating timing differences.