EasyJet 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65 easyJet plc Annual report and accounts 2009

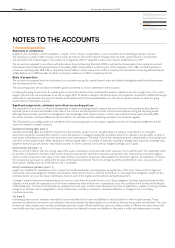

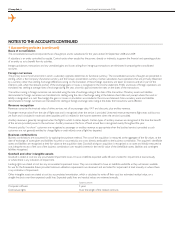

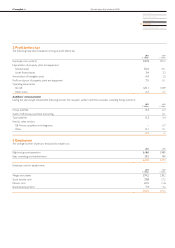

Aircraft maintenance provisions

The accounting for the cost of providing major airframe and certain engine maintenance checks for owned and finance leased aircraft is described in the

accounting policy for property, plant and equipment.

easyJet has contractual obligations to maintain aircraft held under operating leases. Provisions are created over the term of the lease based on the estimated

future costs of major airframe checks, engine shop visits and end of lease liabilities. These costs are discounted to present value where the amount of the

discount is considered material.

A number of leases also require easyJet to pay supplemental rent to the lessor. Payments may be either a fixed monthly sum up to a cap or are based

on usage. The purpose of these payments is to provide the lessor with collateral should an aircraft be returned in a condition that does not meet the

requirements of the lease. Supplemental rent is either refunded when qualifying maintenance is performed, or is offset against end of lease liabilities. Where

the amount of supplemental rent paid exceeds the estimated amount recoverable from the lessor, provision is made for the non-recoverable amount.

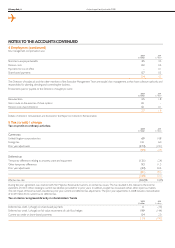

Employee benefits

easyJet contributes to defined contribution pension schemes for the benefit of employees. The assets of the schemes are held separately from those

of easyJet in independently administered funds. easyJet’s contributions are charged to the income statement in the year in which they are incurred.

The expected cost of compensated holidays is recognised at the time that the related employees’ services are provided.

Share-based payments

easyJet has a number of equity settled share incentive schemes. The fair value of share options is measured at the date of grant using the Binomial Lattice

option pricing model. The fair value of awards under the Long Term Incentive Plan and awards of free shares is the share price at the date of grant. The fair

value of the estimated number of options and awards that are expected to vest is expensed to the income statement on a straight-line basis over the period

that employees’ services are rendered, with a corresponding increase in shareholders’ funds. Where performance criteria attached to the share options and

awards are not met, any cumulative expense previously recognised is reversed.

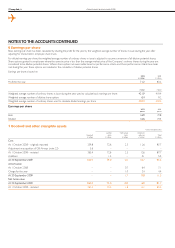

Segmental disclosures

easyJet has one business segment: the provision of a low cost airline service. easyJet has one geographical segment relating to the origin of its turnover which

is Europe.

Investments in subsidiaries

Investments in subsidiaries are stated at cost, less any provision for impairment, in the entity accounts.

Assets held for sale

Where assets are available for sale in their current condition, and their disposal is highly probable, they are reclassified as held for sale and are measured

at the lower of their carrying value and the fair value less costs to sell. Depreciation ceases at the point of their reclassification from non-current assets.

Impact of new International Financial Reporting Standards

The following interpretations are required to be implemented for the year ended 30 September 2009:

IFRIC 12 Service Concession Arrangements

IFRIC 13 Customer Loyalty Programmes (IAS 18)

IFRIC 14 The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction (IAS 19)

IFRIC 16 Hedges of a Net Investment in a Foreign Operation

The adoption of these interpretations has had no impact on these accounts.